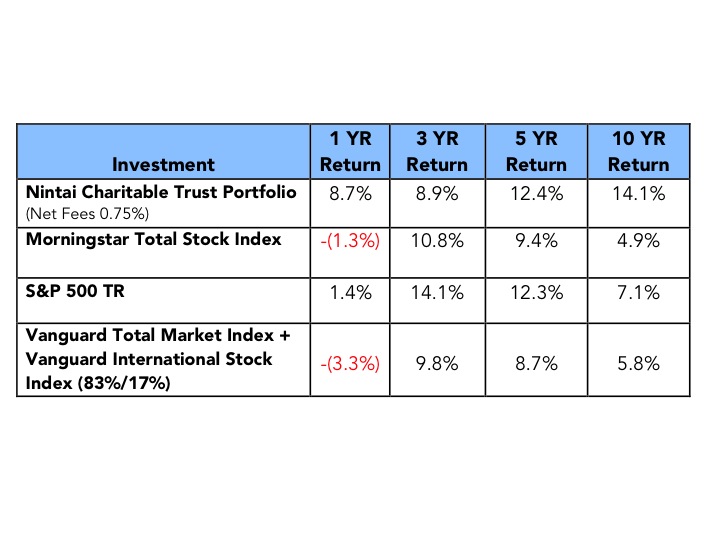

One can hardly imagine Ford’s thoughts as he watched his third pitch of the game sail out of the ballpark. I think we can safely say it wasn't entirely positive. I bring this up because 2016 has started out much like Whitey’s Chicago performance. The Morningstar US Market Index is down 8.0% YTD, the S&P 500 TR is down 7.2% YTD and the MSCI EAFE is down 7.9% YTD (all figures as of Jan. 28).

Pressing: Or the Art of Making Hasty Decisions

For many investors, this has led to a tremendous amount of angst about their portfolios and their associated risk. In a great study [2] published in December 2014, Daniel Folkinshteyn (Rowan University), Gulser Meric (Rowan University), and Ilhan Meric (Rider University) analyzed investor performance during and after market crashes from 1987 to 2008. Similar to de Bondt’s and Thaler’s research in 1985 [3], stocks that saw price drops in a crash greater than the general markets tended to see higher gains than the general markets post crash. This overreaction is what many sports players know as “pressing,” or the problem of trying too hard after a period of poor performance. Investors were selling for too little and buying too high based on emotion alone.

The study showed that during market crashes, a vast majority of buying and selling had absolutely nothing to do with fundamentals. This form of financial “pressing” led to serious underperformance in the long run. Most of these individuals (and fund managers) would have been wiser to take the advice of many professional athletes, step back from the markets, and focus their energies on evaluating their process.

Focus On Fundamentals

As with athletes, investors can use down markets like today’s to take steps in improving their investment process. There’s no reason to panic – but rather take the time to sit down and really apply yourself to process improvement. These are three steps I highly recommend.

Go back and check your fundamentals

Whenever a particular holding in the Nintai Charitable Trust drops by a significant percentage, the first thing I do is head into my office, put on some Mozart and methodically review each and every part of our investment case. Sam Snead once said that every time he performed poorly on the golf course, he would step back and check his fundamentals. It’s no different in investing. Market dips are an outstanding time to step back and evaluate your process. At the same time, it's a great opportunity to test the fundamentals of your investment case. You can always improve from where you are today.

Watch what’s important….not what’s the loudest

In a world filled with enormous noise pollution, we sometimes fall prey to extremely bad advice proffered in ridiculously loud volumes. Much like Opus in Bloom County accosted by the Ronco ads on television, the noise machine that is Jim Cramer should not play a role in your investment decisions. Yogi Berra said about the noise and pressure from the crowd, “That didn't bother me. The only guy you watch is the guy pitching.” The only things worth watching is the assumptions, business case, and valuation of your holdings. Anything else is just noise.

Invert the trend driving the market

During down markets it’s helpful to identify the trend driving them and invert the thinking. For instance, price increases drove the outperformance of many biopharma companies over the past several years. The recent crash in prices assumes these increases will end through federal legislative and policy actions. But what if they didn’t? What if Medicare and Medicaid never negotiated on price? What if pharmacy benefit managers (PBMs) could never gain leverage in pricing as it is assumed will happen over the next decade? Will the drop in share prices rebound? Who will be the winner? Down markets are a great time to invert the market’s emotional assumptions.

Conclusions

The ability to shut out the noise around you and focus on fundamentals is imperative in markets like those in the beginning of this year. Turn off your TVs, put on some great thinking music, and roll up your sleeves. Even if the markets have dropped significantly, it's critical to make sure your assumptions and valuation are current and realistic. In most cases the fundamentals have nothing in common with the overreaction of the markets. Whitey Ford ended up winning that game in Chicago. Buckling down, he retired 13 of the next 14 batters without a run being scored. By focusing on his fundamentals (“I didn’t have my best stuff, so I focused on getting the ball over the plate”) he turned a rather dire situation around into a winning performance. Give it a try. If it worked for Whitey, it might just work for you as well.

[1] This story is part of a wonderful interview that can be found here. I highly recommend checking it out.

[2] The full study can be found here.

[3] This was discussed in greater detail in an article I wrote in July 2015 entitled “The Overreaction Hypothesis”. It can be found here.

RSS Feed

RSS Feed