The day is quiet … really quiet

The one thing everyone seems to notice in a visit to our offices is how little noise and motion there is. An average day for us is one where we can spend a considerable amount of time reading, thinking and discussing current or proposed holdings. The ability to think (and here we mean truly think) is directly proportional to the activity that doesn’t take place in the portfolio. In a study published in 2011[1], researchers found that nearly 80% of their subject matter’s time was spent on trading (writing trading contracts, buying, selling, etc.). How someone can truly understand investment holdings when so much time is spent buying and selling is beyond us.

The day we can find an interesting prospect

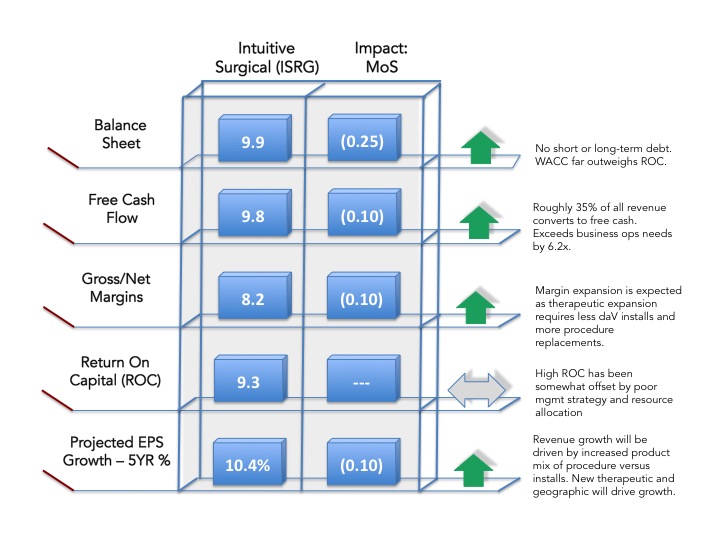

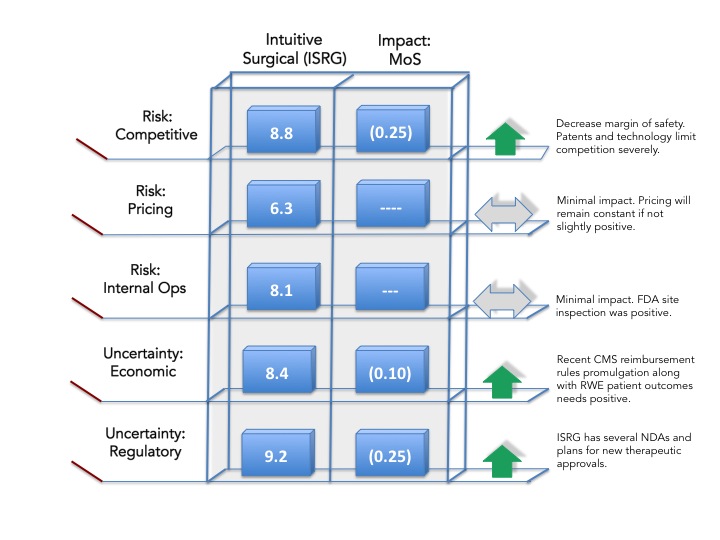

The past two weeks we have spent researching in great detail two stocks – CBOE Holdings (CBOE) and Collectors Universe (CLCT). The stocks have been on our watch list for four and two years, respectively. These past two weeks we have rolled up our sleeves and conducted rigorous analyses on each. For CBOE this includes interviewing roughly 35 individuals including senior management, regulatory officials, legislative aides and industry leaders. In addition, we’ve read each annual report from 2000 to 2014. We’ve hired several consultants to create reports including the future of market index options, the VIX as an investing option, corporate stock options, and exchange traded funds/notes. We have also commissioned a study on the technology (data, informatics, platforms, exchanges) related to CBOEs Hybrid Trading Model (HTM). Additionally we have spent the past several weeks conducting deep research on Collectors Universe. As part of a duopoly (along with NGC), we absolutely love the company and its business model. Our research has focused on the potential growth in the collectables markets, potential impact of tax code changes, growth of government collectables initiatives (such as the gold presidential first lady coins) and the latest technologies including RFID embedded track and trace systems. During this time roughly 75% of our research is conducted in the office utilizing the phone or iChat/Skype to conduct interviews. The remaining 25% is spent on the ground either at the customer’s headquarters/operations center or visiting competitive sites.

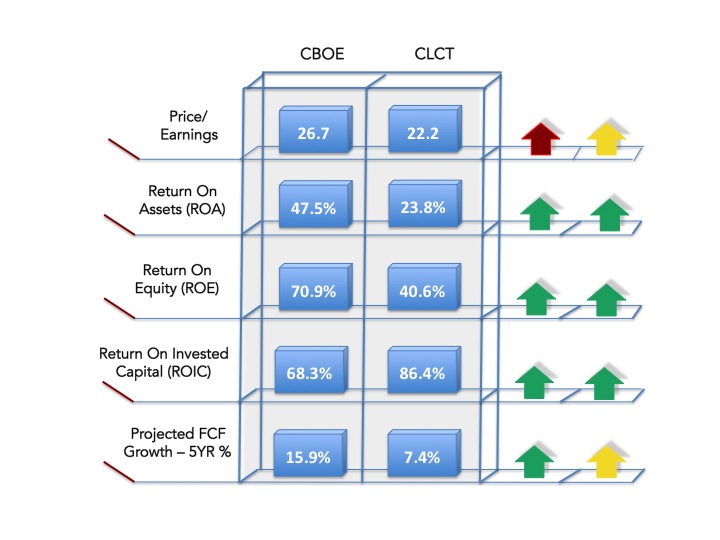

The following is a high level evaluation of some of our investment criteria on an Abacus screen:

The day the markets drop ... a lot

To answer the second part of our reader’s question, a most exciting day for us is when the markets drop. The greater the drop the more the excitement. We recognize people perceive it as very odd when we verbalize our frustration when the markets jump 3-4% on seemingly innocuous news. But nothing gets our competitive juices flowing more than a panicky sell off that impacts stock prices across the board. We think this represents the greatest predictor of whether an investor will be successful or not in the long term. The best possible culmination of such a day is the ability to purchase either a new stock from our watch list or to add to an existing position. Equally important is being ready when these days happen. In the case of CBOE or CLTC, we are comfortable pulling the trigger on any given day knowing we have prepared ourselves – intellectually and emotionally - in nearly every conceivable manner. Preparation is the oxygen of a successful investing environment.

Conclusions

The past several weeks in the office have been ideal for our team as we got the chance to delve into two watch list stocks. This research – along with the associated lack of noise and distractions – has allowed to build extensive data and mental models that will allow us to make well-educated, data-driven, value-based investment decisions. Over the next several days we will create the investment (price) based criteria that will drive our purchase decisions (if there are any). We hope this helps answer our reader’s question about our average day.

As always we look forward to hearing your thoughts and comments.

[1] “Individual Investors and Volatility”, Thierry Foucault, David Sraer, and David J. Thesmar, The Journal of Finance, Volume LXVI, No. 4, August, 2011

RSS Feed

RSS Feed