- Grant Hammond[1]

In 1961, Colonel John Boyd – working with Thomas Christie – wrote an article named “Aerial Attack Study.” Boyd trained as a fighter pilot, but his mind quickly developed beyond the cockpit. Aerial Attack Study introduced the military to the concept of “Energy-Maneuverability Theory” (E-MT). Boyd’s and Christie’s work was vital in understanding the various tradeoffs when working on aircraft design. E-MT was a breakthrough of immense value because it gave engineers a process to calculate how any design can be superior or inferior when measured against another. E-MT analyzed how swiftly and efficiently an aircraft could change its energy use, speed, and acceleration or potential versus kinetic energy. This analysis could then be converted to a numerical value of how well a plane maneuvers under various conditions. This process enabled fighter pilots to “converse” with engineers in their language by describing dogfighting jargon in mathematical terms. E-MT had a significant impact in creating the leading fighter aircraft over the next generation, including the F-15 Eagle and F-16 Fighting Falcon.

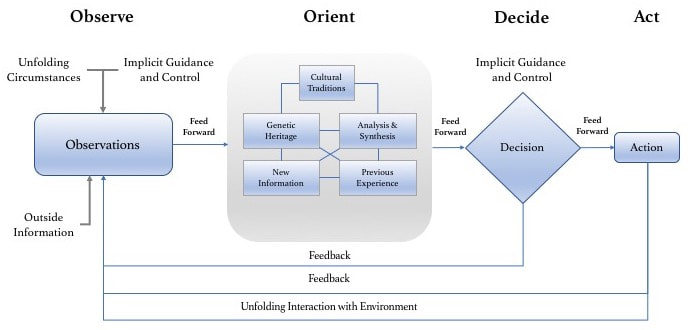

Boyd’s next project brought him even greater fame – in terms of both name recognition and scope of impact. It also is where his thinking can best be applied to value investing theory and practice. Thinking at a higher level than his E-MT work, Boyd began analyzing what systems could be put in place to improve a fighter pilot’s speed/effectiveness in thinking processes and decision-making skills. From this, he developed the OODA (Observation, Orientation, Decision, and Act) Loop.

The OODA Loop begins by making two assumptions. First, Boyd contends that all intelligent life and human-developed organizations continuously interact with their respective operating environment. Second, all of these interactions can be broken into four major groups or functions.

- Observe: The utilization of all major senses in the collection of data. Boyd made it clear that data was a snapshot of what was happening within a complex environment at any one time. Observation information becomes obsolete relatively quickly. Therefore, observation requires constantly updating your data.

- Orient: After collecting data through observation, comes the synthesis and analysis of the data. The orientation phase is about reflecting on the critical data captured during observation and considering the next steps. Above-average orientation skills require great situational awareness and a process that uses multiple mental models. Boyd saw this as the most essential function.

- Decide: The decision phase develops a series of suggestions taking into account all potential outcomes. A key component in the decision process is creating a strategy that screens out extraneous inputs and allows management or the individual to focus on the best possible choices, not all choices.

- Act: The steps and actions necessary to carry out the decision. In Boyd’s final presentation on the OODA Loop, he placed “Test” directly next to “Act” (this was changed to “Unfolding Interaction with Environment” and “Feedback” in his later presentations). In doing so, he clarified that he saw the Loop not just as a decision-making process but as an individual or organization-learning process. Thus, not only should we be constantly updating inputs, but we should constantly test our mental models throughout the Loop.

“The Tao of Boyd: How to Master the OODA Loop,” AoM, November 2020

After developing the OODA Loop, Boyd developed several thoughts about its effectiveness and some caveats in its usage.

- The OODA Loop is a means to operating in a complex environment. Multiple inputs are constantly changing. The faster someone can obtain inputs, the quicker someone can produce decisions.

- The OODA loop is only as effective as the time it takes to execute a result.

- The person or organization that completes multiple OODA loops first derives the most value.

- The person or organization that adapts/updates their observation and mental models quickest, thereby evolving their OODA Loop, derives the most value.

- Limiting extraneous factors that can needlessly slow down getting to decision and action phases can significantly impact.

The OODA Loop and Value Investing

So what does all of this have to do with value investing? At their highest level, the description of the OODA Loop and value investing share many common attributes. For instance, the OODA Loop has been described as “a learning system, a method for dealing with uncertainty, and a strategy for winning head-to-head contests and competitions. Another description is “the OODA Loop is a means to a.) observing complex organisms, whether they be an enemy pilot or a competitive corporate threat, b.) developing possible counter-measures through situation awareness and mental models, and c.) acting on such chosen measures.”

Compare that with the following description of value investing as “a trading process based on uncertainty and risk in which a.) an investor looks to identify a discrepancy between price and value identified by b.) observation of corporate data and ecosystem characteristics and c.) observable investor behavior that leads to d.) a decision to allocate capital in the security.” At Nintai, we believe the major steps in value investing consist of these steps.

- The investor sets specific criteria by which they search for possible investments. This can be by financial, capital return, industry, or country/region. As value investors, we are constantly updating both corporate and market information. Therefore, what may not meet our criteria one week might be ringing alarm bells just one week later. Similar to OODA Loop, “Observe.”

- Research is conducted through which estimated growth, profitability, market size, regulatory issues are identified and quantified. Information can be specific to a certain date (such as the balance sheet), a defined period (one-quarter, one calendar year, year-to-date, five-year average). A series of mental models will develop cross-functional ways to observe historical, current, and future value trends. Similar to OODA Loop “Orient.”

- Research ascertains the estimated intrinsic value of the company shares and matches it against its current trading price, and develops a series of possible recommendations. These might be to purchase at a specific strike price, buy increasing shares at share prices further decrease in price, sell a position when certain conditions are met (such as the holding taking on debt), or sell on specific market conditions (a competitor successfully launches a new FDA-approved drug). Similar to OODA Loop, “Decide.”

- When certain conditions are met (% discount from estimated intrinsic value) and reasonable suggested actions are offered (purchasing X number of shares representing only 30% of one day’s total trading volume), then action should place. Following up on these actions, we will spend a considerable amount of time evaluating the success or failure of the process. Similar to OODA Loop “Act.”

If this sounds similar to the OODA Loop, it should. Long-term successful value investors are constantly reevaluating not just their holdings (including management performance, product development, competition, market factors, etc.) but their very selection process (what factors are most important? How do we gather and collect data? How do we evaluate trends in the data, etc.?). At Nintai, we see the investment process must be continually reviewed and adapted to the ever-changing investment universe.

The Importance of Orientation

John Boyd felt the most important of the four steps in the OODA Loop was orientation. In one of his presentations, he stated:

“Orientation isn’t just a state you’re in; it’s a process. You’re always orienting.”

As I pointed out in the last section, Nintai sees the process of orienting our thinking as a never-ending process. This is perhaps the greatest symmetry between Boyd’s work and value investing. One of the failings in nearly every value investor (this author included) is constantly failing to update our orientation. Too often, we get stuck in a pattern of thinking which locks us into a particular model or pattern of assumptions. For value investors, this can be costly. For fighter pilots, it can be fatal.

One method that Boyd suggests using is applying a set of mental models regularly until they become second nature in your thinking process. Boyd lists seven disciplines that are a must for any strategist. These include:

- Mathematical Logic

- Physics

- Thermodynamics

- Biology

- Psychology

- Anthropology

- Conflict Resolution (Game Theory)

These models are essential for any person or organization to orient themselves in their environment. Understanding these disciplines allows an individual to see their position from many disparate and unique viewpoints. In addition, constant orientation leads to the ability to act quickly and – most importantly – with the best chance of obtaining outstanding results from your decision-making.

Again, this sounds remarkably similar to Charlie Munger’s concept of a “Latticework of Mental Models,” which he believes creates a powerful method of objective – and evolving – thinking. Thus, while Charlie’s disciplines[1] may differ somewhat from Boyd’s, the concepts meld pretty easily.

Conclusions

One thing that has always interested me in value investing is the constant need to acquire knowledge. Whether improving or altering my thought processes to the knowledge of a specific industry or market verticals, roughly 80-85% of my day is spent thinking and researching. Does this mean we get everything right? Absolutely not. But it does mean that Nintai can hopefully gain the ever-so-slight edge over the marketplace, which allows for long-term outperformance. Investors can continually adapt their thinking and investment processes by studying such works as Boyd’s. The history of business – and nations – are replete with organizations that got caught in a cycle of actions that never considered changes in their operating environment. As a value investor, the OODA Loop can be a helpful tool to evolve your thinking from valuing a business to understanding changes in specific industry verticals. Next month I will use a specific case study that discusses how Nintai uses Boyd’s work in understanding changes within a specific portfolio holding.

Until then, I look forward to your thoughts or comments.

[1] Math and Inversion, Probability, Chemistry, Statistics, Economics, Evolutionary Biology, Psychology, and Engineering

RSS Feed

RSS Feed