Thinking differently

At the highest level, running Nintai Partners was similar to value investing because our strategy and operations were set up to be distinctly different than the consulting industry. Just as we know you cannot beat the markets by imitating them, neither could we compete with the McKinseys of the world by being the same. We did this in three broad ways. First, we wanted to make sure our incentives were aligned with our consulting clients. Second, we looked to build the company along the lines of Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) where we aimed to grow book value. Last, we decided we would focus on one area where we had real expertise (healthcare informatics).

Incentives

All too often consulting firms are rewarded for project scope creep and billable hours. At Nintai Partners, we turned this on its head when we designed compensation in the following manner: Twenty-five percent of salary was paid on a monthly basis. The remaining 75% was paid out after six-month, one-year, three-year, five-year and 10-year client reviews. In this model our pay was directly tied to the long-term value we added to each client. There was considerable upside for outstandingly consistent reviews. We felt this tied our incentives to what was most important to our clients – making a positive and sustainable impact to the organization.

Similarities

This is similar to the views of a value investor. In the consulting industry we find that companies that align their incentives with their clients are few and far between. On Wall Street, you won’t find many companies – whether they are brokers, mutual fund companies, or financial advisers – that truly align themselves with their clients either. Companies such as Vanguard partner with their clients by keeping costs to a minimum, retaining a true mutual fund structure, and reducing trading to a minimum (particularly in their index funds). Another example is Warren Buffett (Trades, Portfolio)’s partnerships that were designed to specifically align his interests with his partners through performance hurdles and compensation.

Long-term outlook and compound growth

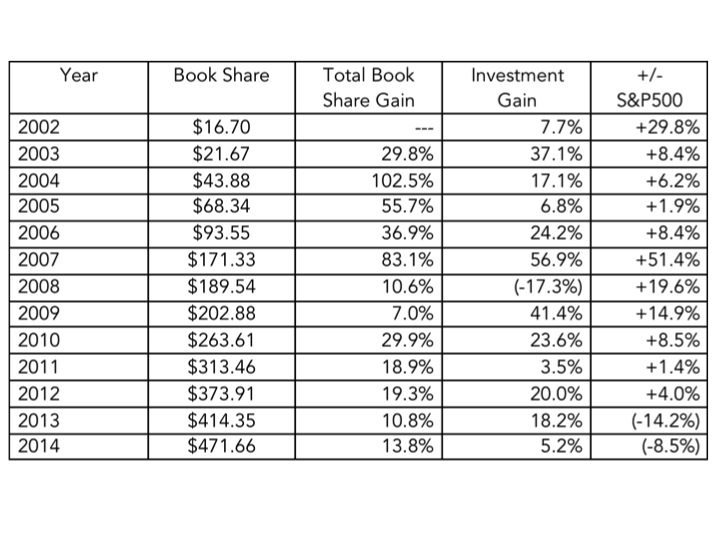

In conjunction with long-term value measures for our clients, Nintai also took a long-term outlook on value creation for our own investors. All retained earnings were invested into our internal fund that invested with a traditional value-based approach (the progenitor of the Nintai Charitable Trust). All employees and consultants were owners in the firm and once a month received an update on their holdings. This model meant we looked to use time, investment growth and compounding to be the value driver for our investors.

From its inception Nintai Partners focused exclusively on healthcare informatics. We recognized our circle of competence was limited and finite. Any time we thought of expanding our services or taking on a project outside this circle we immediately recognized we were setting up the firm and our clients for disappointing results. It wasn’t easy – we turned away a great deal of projects that could have fattened the portfolio significantly. In the final analysis we decided any short-term gains would be offset by long-term losses in our reputation and quality.

Similarities

It is remarkably easy to wander from your circle of competence when trying to grow a company. It is no different when trying to grow your portfolio. Sticking to your knitting – investing in companies you can understand and value with some certainty – will in the long run serve you in good stead. How many investors have paid the price for investing in BDCs with arcane financials, energy companies with enormous off-balance sheet liabilities or biotechnology firms with incredibly complex scientific barriers to overcome? Recognizing the limits of your circle – and the ability to go no further – is critical in investing and corporate strategy alike.

Conclusions

Whether you are a value investor or CEO of a growing business, the ability to allocate capital will be one of your greatest challenges. By creating some core values – demanding alignment of management with shareholders, keeping a long-term outlook and staying within your circle of competence – you can increase your chances for success. It doesn’t work every time. A vast majority of businesses fail, and most investors underperform the broader markets. But running a business can give you some unique insights into your investment management skills. It certainly made me a better investor, and I wouldn’t have missed it for the world.

RSS Feed

RSS Feed