What exactly is a "Compounding Machine"?

Compounding machines are simply companies that consistently grow free cash flow at substantial rates over a decade or two creating long-term value. This can be achieved through competitive advantages gained through internal and externally-facing moats. Additionally, these companies often generate high returns on capital and maintain fortress-like balance sheets. These attributes drive steady growth in the intrinsic value of the business. When I describe it like that, it seems like a pretty straightforward process. You simply have to find these types of companies, back up the truck, purchase a significant number of shares, and merely wait ten to twenty years as management and the company work their magic. What an easy world value investing would be if it was so simple. But, of course, we all know it doesn't work quite like that.

Finding compounding machines requires several major buckets of data. Some are easier to find, while others are more difficult. Overall, it requires a significant effort to create a process, identify opportunities, research candidates, and track holdings. The primary information and process requirements can include the following.

Quantifiable Data

In some ways, this is the easiest part of the process. A single search query can identify some (but certainly not all!) compounding machines on a search platform such as Gurufocus' All-in-One Screener. Search criteria might include the following.

Return on Equity (10 Year Average) > 15%

Return on Assets (10 Year Average) > 15%

Return on Capital (10 Year Average) > 15%

Free Cash Flow Margins (10 Year Average) > 25%

Free Cash Flow Growth (10 Year Average) > 10%

Debt/Equity Ratio (1, 3, 5, and 10 Year) < or = 0

This search on Gurufocus will likely generate less than 100 companies, and we haven't even begun to screen on valuation. An investor could probably do fine simply by investing in a broad bucket of such companies trading near their 52-week lows.

Non-Quantifiable Data

A simple query in a database can't discover some characteristics. While such searches can sometimes be good starting places, many compounding machines can only be found through the hard work achieved by rolling up the sleeves and better understanding specific industries or verticals. This includes a lot of time researching individual companies, their operations, competitors, product development, regulatory challenges, etc. In the course of this research, an investor should be looking for four broad themes.

Outstanding Capital Allocation

This is a multi-faceted attribute. It includes management that can identify great capital investment opportunities. It also requires management to say no to opportunities that might not reflect their core competence or provide adequate margins. Finally, it includes creating a business that operates in an environment where opportunities exist for allocating capital in existing business lines that can generate long-term runways for growth.

Deep and Wide Inward/Outward-Looking Moats

In last month's presentation to the Gurufocus's "Value Investing Live" series, I discussed in depth the idea of inward and outward-looking moats. In summary, outward-facing moats keep competitors at bay through a series of strategic and operational advantages. Inward-facing moats keep customers locked in by having products or services essential to their customer's business model, strategy, and operations. Capital compounders must have strengths in both of these, not just one.

Expanding Market Opportunities

This, too, is multi-faceted in that opportunities must be both in existing customers (by selling deeper into the organization) and new customers in either existing markets or new markets (this can be demographically and functionally). Compounding machines are generally strong in both of these but lean towards the former (broadening existing bases) and aim for the latter. Most avoid costly acquisitions as a means to growing market share or revenue.

Self-Fund Growth with Existing Internal Capital

Compounding machines tend to require very little capital to achieve growth. Because of this, nearly all new opportunities can be funded with either free cash flow or cash on the balance sheet. Most of these companies have extremely strong balance sheets with little or no debt and very high free cash flow margins (meaning the percentage of revenue converted into free cash). With extremely low weighted average cost of capital (WACC), compounding machines can achieve high returns on even lower margin growth.

An Example: Veeva (VEEV)

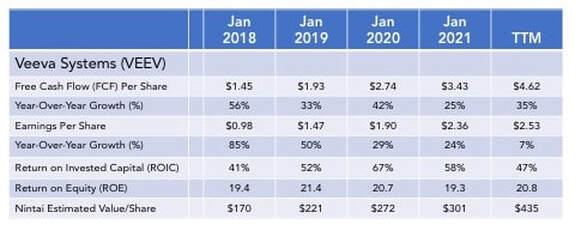

I have written about Veeva extensively over the last two years (including a recent presentation on Gurufocus' Value Investing Live), so I won't spend a lot of time rehashing previous content. Instead, I wanted to show a graphic that demonstrates the compounding nature of the company. Seen below is a quick overview of the growth in the company's free cash flow, earnings, returns, and valuation. The reader can see strong growth combined with consistent profitability and high returns. In combination, these drive an ever-increasing estimated intrinsic value.

Conclusions

The goal of every value investor - indeed every investor - is to create value over the long term that outperforms the general markets. Compounding machines can play a huge role in achieving those results. Finding companies with wide moats run by great capital allocators in growing markets is the holy grail at Nintai Investments. When we can find a company with these attributes (and the price is right), we will generally invest a substantial portion of our capital in the stock. We will then try to sit quietly and let management do the heavy lifting and perform their wonders. A successful investor once said that it isn't the investment manager that produces excellent returns but rather the management and companies in the portfolio. That individual understood the concept of compounding machines. It would behoove all investors to follow her lead.

RSS Feed

RSS Feed