We first purchased LLTC in August 2015. Since then (and including the rise in price after ADI’s offer), the stock has returned 65% including dividends. We will be selling the entire position over the next few days. With this sale, the Nintai Charitable Trust’s cash position will be roughly 13%.

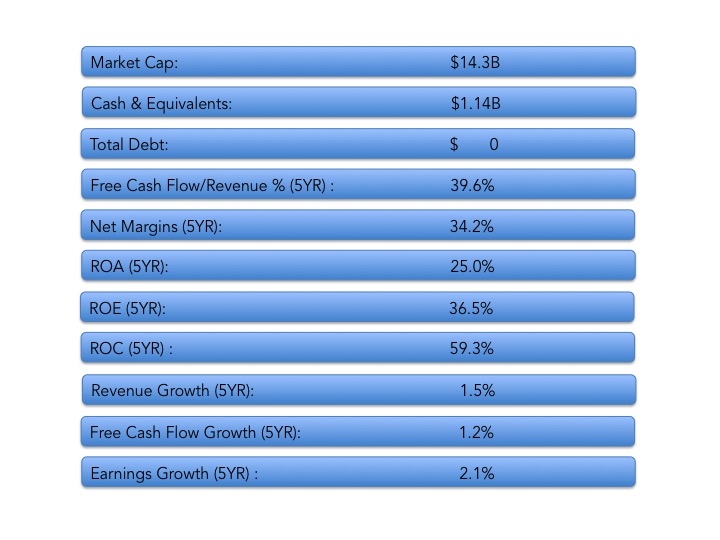

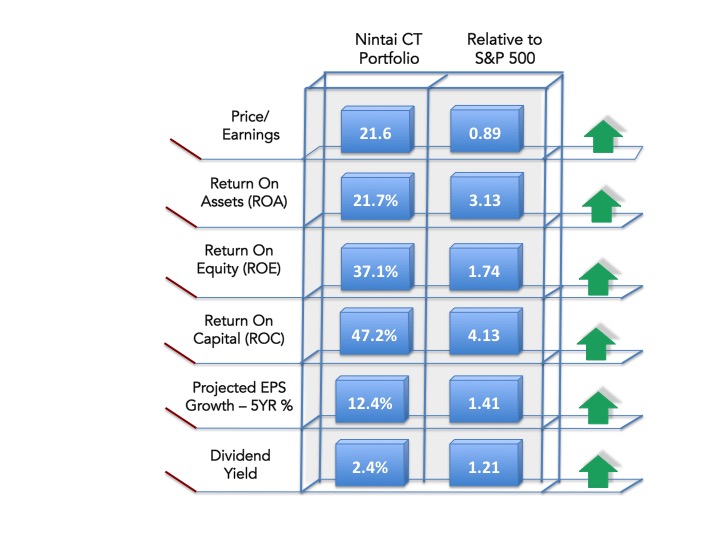

Because this holding produced a good profit in a relatively short time, I would like to describe my rationale for purchasing it. Linear specializes in high performance analog (HPA) chips. There is simply no other chip maker that generates LLTC’s free cash flow as a percent of revenue, returns of assets/equity/capital and fortress-like balance sheet. As with our discussion about ARM Holdings (NASDAQ:ARMH) (acquired several weeks ago), the acquisition of LLTC is a long-term bet on the Internet of Things (IoT). There was one stark difference, however. LLTC's growth was far slower than ARM. We listened to management and felt growth was about to rise significantly and felt comfortable holding the shares into the future. Also similar to ARM, Linear is the type of company we would have been happy to hold for decades.

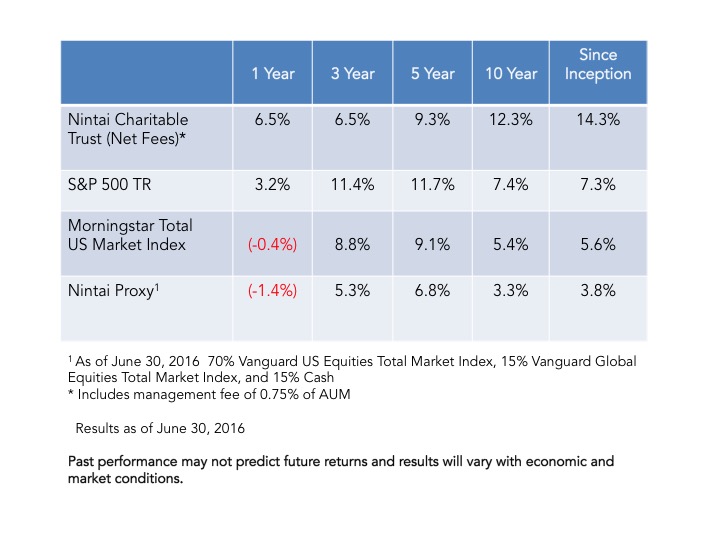

As mentioned previously, I don’t know where the markets are headed, what logic will be employed for mergers and acquisitions, or whether the Internet of Things will drive double digit growth over the next several decades. At the Nintai Charitable Trust and Dorfman Value Investments, I look for great companies with deep competitive moats generating high returns, generous free cash flow, fortress-like balance sheets, and selling at a significant discount to their estimated fair value. It is my intention to let management compound value over the long term. While I’m somewhat sad to see two holdings be acquired over the past several weeks, if the markets see fit to provide outsized performance in the short term, then I am happy to play along with their tune.

RSS Feed

RSS Feed