The second quarter saw some dramatic movement at the end of June as Britain voted to exit the European Union. The reaction to this left the markets down during the quarter. The S&P 500TR was down by (0.38%), the Morningstar Total US Equity Index was down (0.8%) and the Nintai Proxy (70% Vanguard US Equities Total Market Index, 15% Vanguard Global Equities Total Market Index, and 15% Cash) was down (1.3%). The Nintai Charitable Trust Portfolio was down (2.1%) net fees. For this year through June 30th, 2016, (YTD) the S&P 500TR is up 3.8%, the Morningstar Total US Equity Index is up 2.6%, and the Nintai Proxy is down (0.6%). The Nintai Charitable Trust Portfolio is up 7.4% YTD net all fees.

Several stocks have driven outperformance YTD. Collectors Universe (CLCT) is up 33%, Dolby Labs (DLB) is up 43%, and SEI Investments (SEIC) is up 30%. Several companies have produced significant drag YTD including Computer Programs and Systems (CPSI) down (-18%), Novo Nordisk (NVO) down (-6%), and Mastercard (MA) down (-9%).

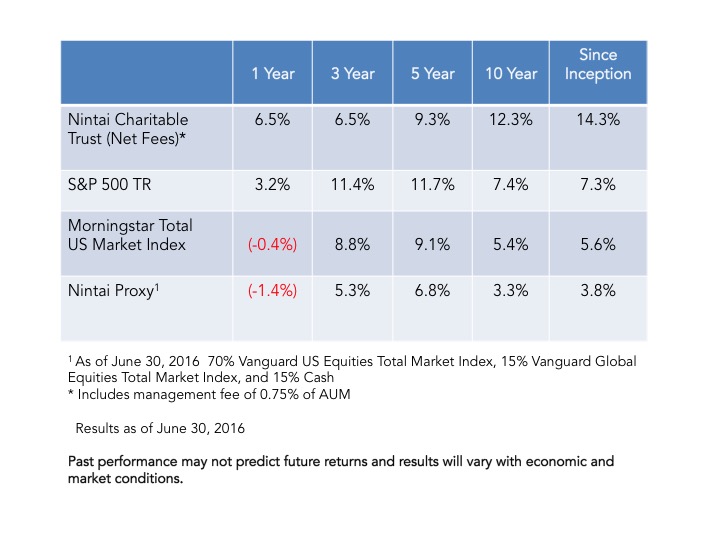

The following is the breakdown of annualized returns by 1YR, 3YR, 5YR, 10YR and since inception.

I made only one (1) change in the portfolio during the quarter. The Trust purchased Hargreaves Lansdown PLC (LSE: HL.). The purchase was made at the end of the quarter when UK financial stocks dropped significantly after the Brexit vote. Hargreaves Lansdown is one of the UK’s larger investment management services firms. It acts as a fund supermarket, a fund manager, a discount broker, a stockbroker, a pension specialist, an annuity specialist, a wealth manager and a financial adviser. It offers investment products, investment services, financial planning and advice to private investors and advisory services to companies in respect of group pension plans. The stock price dropped roughly 35% in two days and I purchased shares at a roughly 30% discount to my estimated intrinsic value.

Portfolio Positioning

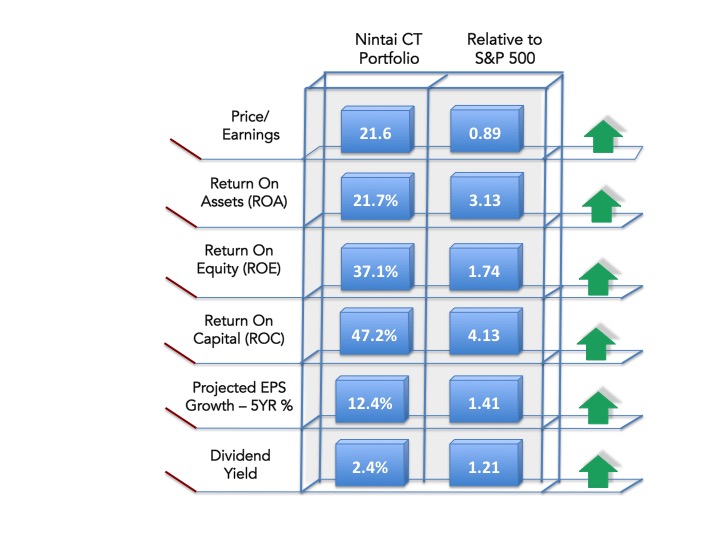

The current P/E ratio of the portfolio is 21 or roughly 16% above the current S&P 500 ratio. Projected earnings growth over the next 5 years is 12.4%, or roughly 40% greater than the S&P 500. Additional measures can be seen here on the Nintai Abacus report:

While disappointed with the portfolio performance on a three (3) and five (5) year basis, I am pleased with YTD results (beating the S&P 500 TR by roughly 3%) and its long-term ten (10) and since inception performance. The fact that we made only one transaction during the quarter shows that we view the opportunities in the market as limited right now. The benefits of holding cash became evident when we saw the UK markets swoon in in late June and we were able to put some capital to work purchasing outstanding assets at fair prices.

Notice I say fair prices. While the market has pretty much tread water in 2016, the vast majority of equities are trading at fair – or slightly above fair - values. There simply aren’t many opportunities out there right now. That said the Charitable Trust has partial ownership in a selection of outstanding companies I would love to own for an extended period of time. Management that wisely allocates capital combined with such a long time horizon should provide the Trust with more than adequate compounding investment returns.

As the investment manager of a charitable trust, the Board has charged me with making the trust grow so that it can better fund the Trust’s charitable activities. I am cognizant of the responsibility that places on me. I will continue to invest with that future in mind – keeping one eye on risk and the other on opportunity. I hope everyone has a happy and safe summer.

RSS Feed

RSS Feed