- David J. Greer

“Investment managers think their professional life centers around beating their respective index. No doubt this has a lot to do with the long-term success of their fund or role with the investment firm. Surprisingly though, that isn’t the most important thing when working with their clients. How they deal with their investors, what level of trust they enjoy, or how much they listen can have twice the impact as to how they perform against their index. Twice as much! That’s something you never hear about from the investment profession.”

- Alan Hurd

I’ve often talked about our investment philosophy, our investment process, and our investment returns. I thought I’d share with readers some interesting aspects of being an investment manager beyond those. I wanted to talk about the side of investment management that rarely gets discussed - the client - or as Nintai Investments calls them - our investment partners.

As with any service industry, investment managers focus on outcomes that are the most obvious and measurable - in this case their own portfolio performance versus their respective benchmark such as the S&P 500 or the Russell 2000. I certainly lie awake at night running my fund performances against my benchmark. However, there is a secondary part of being an investment manager that rarely comes up in discussions, but one I think is vital in maintain and growing our assets under management - client support and communication. After reading the latest update to the “Advisor Alpha” report, I was surprised by the level of importance that clients put on their advisor’s client communication and support functions.

Poor Returns Don't Always Create Unhappy Clients

Each year, Vanguard publishes its annual update to “Vanguard’s Advisor Alpha” report. In creating the original “Adviser’s Alpha” concept and report in 2001 (US-only), the company outlined how advisers could add value - or alpha - through relationship-oriented services such as financial planning and behavioral training (among others) rather than by trying to simply outperform the market. Vanguard believes that implementing their “Adviser’s Alpha” framework may add roughly 3% in net returns for an advisor’s clients. All this while differentiating their soft-skills and their investment practice. For those with greater interest in the Vanguard’s “Advisor Alpha” program, feel free to visit the site here.

It’s the 2018 update[1] that I wanted to focus on in this article. In this report was a section that discussed the major reasons why investors terminated their contract with their advisors. Their research divided the reasons into three buckets: personality/service levels, performance/portfolio, and advisor left for new firm. The researchers also broke the respondents into three categories: mass affluent, high net worth, and ultra-high net worth. Reading through the results, several findings really jumped out.

Personality/Service Outweighs Performance

64% of mass affluent, 65% of high net worth, and 70% of ultra-high net worth (a blended rate of 65%) clients left their advisor because of personality and/or services. This compares to 38% of mass affluent, 41% of high net worth, and 53% of ultra-high net worth (a blended rate of 39%)[2] who left due to performance or the structure of their portfolio. In general, an advisor’s inability to communicate well and build trust caused more clients - and sometimes nearly double the number - to leave their advisors versus those who left due to performance or the make up of their portfolio. For advisors who think the numbers speak for themselves, they should think again.

The Perception of Bad Investment Choices was Most Painful

Investors were more likely to leave their advisor after perceiving they were poor stock pickers (18%) versus if they felt their advisor had a poor response to a market downturn (12%) or if they were underperforming their peers (10%). In this case, the advisor violated the investors’ first principles (“don’t lose my money”) versus the analogous model of peer-based performance or more general market themes (“well, we’re all losing money in such a down market”).

I should note that while it’s surprising how important the relationship is between the advisor and the investor, in no ways should this diminish the importance of achieving adequate results in the eyes of the investor. For instance, for ultra-high net worth investors, 53% stated that performance was a reason for leaving their advisor versus 70% stating it was due to their relationship or level of service. What these numbers show is that an advisor needs to keep an eye on both service and performance for the ultra-high net worth.

What This Means

We have frequently taken a (good-natured) ribbing at Nintai Investments for the amount of communication that takes place between our investment partners and our staff. We make a strong commitment - from our Statement of Investment Partnership to our weekly musings on Gurufocus - to communicate with our investment partners on anything that might interest the Nintai team. We love to learn and we love to share our learnings. We try to make an effort to establish great communication and a strong sense of trust before we even sign a contract.

Establishing the Relationship

Before we partner with any investor, we think there is knowledge we should convey and a significant of learning we can get back from the prospect. Outgoing knowledge is conveyed in two documents and any number of phone calls. The “Nintai Capabilities” presentation and “Statement of Investment Partnership” convey to any prospective partner our investment strategy, our portfolio theory, and our expectations of how Nintai will communicate and support each investment partner. Equally important is the incoming learning we get from our “Client Profile Form” combined with several lengthy conversations to discuss anything of importance to the partner we may have missed. All these forms can be found on our website.

This process hopefully ensures our new investment “partner” feels just that - an equal in the process with the rights to open, clear two-way communication. We want our partners to feel free to call anytime - with questions about their individual goals, their portfolio, or to simply to discuss their thoughts on value investing. It is essential from the beginning that we as the advisor become intimately aware of our partners goals, fears, past experiences, and expectations going forward. We hope to learn as much from them as they learn from us.

An Open and Honest Dialogue

When he have a new investment partner, its important we establish an open and honest relationship. This involves developing a deep trust that - as an advisor - we will do everything in our power to meet our fiduciary responsibilities. Not just to the letter of the law, but in the best spirit of it as well. Vanguard Adviser Alpha describes trust in three major buckets - functional (does the advisor do what she says she will), emotional (I sleep better at night), and ethical (she act in my best interest all the time). I have found over time that any advisor who can build such a trust construct with their investment partners will have a great long-term relationship.

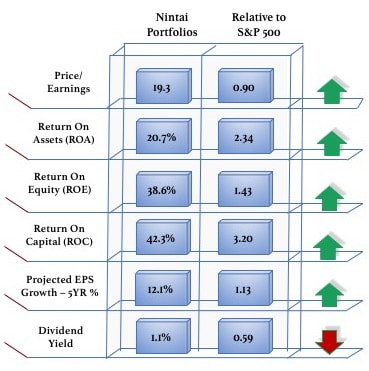

In support of building such trust, at Nintai we provide our investment partners with a detailed business case and valuation spreadsheet of each prospective holding in their portfolio. This allows our partner to see that we invest in companies that faithfully meet our criteria (functional), that these companies have rock-solid financials, deep competitive moats, and trade at a significant margin of safety (emotional), and will likely purchase the same shares in our personal accounts. Our investment partners get to see we eat our own cooking (ethical). Our quarterly and annual reports discuss our winners and losers with a discussion on what we learned and how we will try to implement this new knowledge.

Finally, we treat our investment partners as we would our family. We share food, rare wine, and even rarer whisky with our partners - not because it’s good business - but because it’s what friends do. While we understand our role is to be exceptional allocators of capital, we enjoy celebrating life as much as seeing stocks double in price. Who better to share the fine things in life than with those you trust and respect?

Conclusions

The latest Vanguard “Advisor Alpha” reinforces the message that trust and service play an equal – if not more important role – than historical portfolio performance. Establishing a personal support process, having respect and trust for your clients, and using each point of contact as a chance to learn more about them can create real value over time. Only an advisor who feels this sincerely will make this work. If there’s anything worse than no service, it’s bad service with fake sincerity. So the next time you think of yourself as the next Seth Klarman of value investing, remember that the ability to create open and trusting relationships will see you through the difficult investing times. It’s something we aspire to every day at Nintai Investing.

[1] “The Evolution of Vanguard Advisor’s Alpha”: From Portfolios to People”, Donald G. Bennyhoff, CFA; Francis M. Kinniry Jr., CFA; and Michael A. DiJoseph, CFA January 2018

[2] Some individuals left for multiple reasons thus creating numbers that don’t add up to 100%.

RSS Feed

RSS Feed