- Bill Bishop

“Don't gamble; take all your savings and buy some good stock and hold it till it goes up, then sell it. If it don't go up, don't buy it.”

- Will Rogers

There’s a lot to be said for both Mr. Bishop’s and Mr. Roger’s thinking - though I think good old Will would have been more successful if he had those seeing eyeglasses. And that’s the problem. Most of us might know a good company when we see one. We just don’t know whether it will be a great stock. My last article discussed in detail (perhaps too much!) about what type of knowledge is necessary to really grasp the issues facing a modern US-based healthcare company. In that article I used iRadimed (IRMD) - an MRI compliant pump manufacturer – that makes pumps that can safely operate in an MRI setting. In the article, I walked through some of the major knowledge requirements I recommend an investor have as they begin their investment journey into the healthcare markets.

The “Short and Shoddy” Healthcare Investment Process

Several readers have reached out to me since that article’s publication to see if it is absolutely essential that investors develop such a skill set. It’s not unreasonable to see if there is a “short and shoddy” way to quicken the process. Some readers may be surprised to hear me say absolutely yes. There are several ways to do this. First – and the most obvious and easiest – is to find a high quality ETF or focused fund in the industry you look to acquire assets. For instance, the Vanguard Health Care Fund (VGHCX) is an outstanding way to get some healthcare coverage without a lot of real grunt work. Another approach is to find very high quality companies with deep competitive moats and long runways of growth. Of course, you have to wait for the right price, but if you are patient it is possible to find a company that can give you exposure and provide your portfolio with a decades-long anchor that can drive substantial outperformance.

Since my article was on healthcare, I thought I’d use the same industry as an example of finding such a company. Let me start by saying that if there was an industry most suited for the “short and shoddy” approach, it would healthcare. Having made myself a complete hypocrite with this statement, let me explain my thinking. Healthcare - as an industry in the United States – is roughly one-half for profit and one-half not-for-profit. The for-profit part can be heavily regulated producing monopolies and duopolies. This can also create companies with extremely high returns and profitability. In a sense, there is no better market sector to stumble into diamonds without too much effort. There are three reasons for this.

First, a large portion of the healthcare industry is regulated by federal and state agencies. A lot of leg work such as product safety and good manufacturing processes (known as cGMP) are already inspected by industry regulators. Second, healthcare provides thousands of companies with exclusive rights to medicines or machines that save lives. This exclusivity can range from 7 - 20 years. Third, the healthcare industry is a steady marketplace. The life cycle of birth, life, sickness, and death is immutable. People need healthcare regardless of market conditions. For these reasons, healthcare can allow value investors to sometimes shorten (dare I say slightly cheat) their research process. This doesn’t take away from the fact that healthcare really is an incredibly complex ecosystem. It just means that if one knows what to look for, sometimes the diamonds are lying in plain sight.

So what should an investor look for in their “short and shoddy” investment research process? It isn’t much different than my existing approach, but might be slightly different than most other investors’. The key is looking or smaller companies with high returns on equity and capital along with strong balance sheets. This doesn’t always indicate a company with a wide competitive moat, but I’ve never found such a company without these type of numbers. Another thing to look for is announcements about FDA approvals for their products. Last, it should be in a segment of healthcare with steady revenue and growth. Think along the lines of something like lab testing or saline solution which is constantly used in a clinical setting.

An example of this type of company is Nintai Investments’ holding Masimo (MASI). With a market cap of $8.2B, MASI is in the mid-cap range with ample opportunity to grow over the next few decades. Masi is a medical device company focusing on noninvasive patient monitoring. It began by creating a device that nearly any hospital patient will recognize – an oxygen and pulse reader that clamps at the end of your finger tip and allows doctors to see your oxygen and pulse levels. Every emergency department and primary care physician uses these devices on a daily basis.

Masimo’s Financial Story

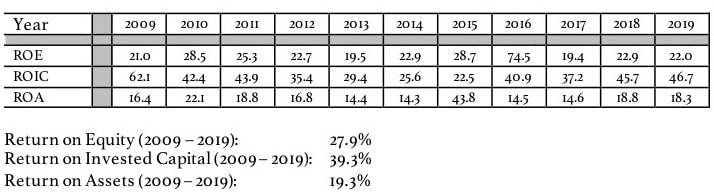

We can start by reviewing Masimo’s financials. These should tell a story of high returns based on a deep competitive moat combined with a company product in a steadily growing marketplace. First, the company as a long history of generating above average return on equity, return on invested capital, and return on assets.

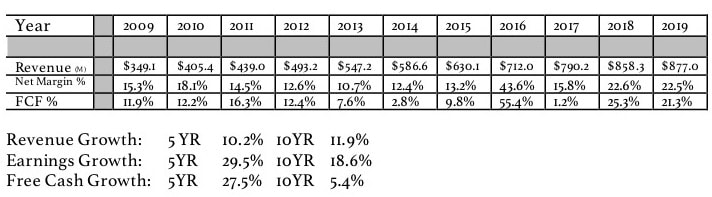

From another angle, the company has done an outstanding job growing both earnings and revenue. While free cash flow has grown at a slower rate, it has picked up considerably and should continue to increase with Masimo’s recent deal with Phillips as well as leveraging its installed base.

Masimo’s Moat

Sometimes being able to ascertain the strength of a moat in healthcare can be difficult. Everything from the microbiology and chemistry behind a biopharmaceutical patent to understanding the technology, professional acceptance, and clinical outcomes of robotic surgery, can demand enormous industry knowledge. But there are some companies like Masimo that don’t require technological, industry, or clinical expertise. For instance, read Morningstar’s description of Masimo’s moat. In two paragraphs, a savvy investor can understand that the company has a strong competitive position.

“The pulse oximetry market is an effective duopoly between Masimo and Covidien (now Medtronic), with Philips and GE Healthcare representing a minority 10%-15% share. Masimo’s share of shipped units has grown from 30% at the beginning of the decade to nearly 50% today thanks to superior products that are more accurate and reliable than the competition. The company is agnostic about how its units get to market, whether directly in Masimo-branded monitors or through OEM devices using Masimo SET. Of the company’s approximately 1.5 million installed units, only a fourth are Masimo devices; the remaining three fourths are OEM multiparameter monitors containing a Masimo circuit board. This strategy has driven returns on capital substantially ahead of our estimate of WACC each year since the company’s 2007 IPO, which to us signals the existence of a moat.

Masimo has left the lumpy and sales-intensive capital equipment business largely to its OEM partners, while retaining the asset-light, high-margin sensor sales business. The company relies on razor-and-blade effects to establish the installed base from which it can drive repeat sales of its disposable and reusable sensors, generally under five- to six-year purchase contracts. Masimo sensors can be used across competing systems through universal adapters, but Masimo oximetry units use a closed architecture, creating a captive sales base. Further, the company has demonstrated its ability to successfully retain customers after an initial contract win; renewal rates have remained near 98% over time, which we believe illustrates the company’s superior value proposition.”

By now, we’ve learned relatively quickly that Masimo is a medical device company that achieves outstanding financial results driven by a duopoly in a healthcare market that has shown steady growth rates with predictions of more of the same over the next decade or two. All of this without going into the technology behind it, the science for which it is employed, and without knowing much about the end-customer, its competition, or its supply chain.

We’ve reached this conclusion by coming from the nearly opposite direction that Nintai Investments employs. In healthcare, we utilize deep industry knowledge to look for players that might be overlooked due to size, complexity, or flat-out “unsexiness”. We do this – as I discussed in “Industry Knowledge” – by looking at connections or business processes missed by many with less experience in the industry. But as I’ve often said, in value investing there are many ways to skin a cat.

Some Takeaways

I believe that deep industry knowledge can give investors a leg up in finding investment opportunities. Some of the most successful investments over my investing career have been found that way. But not all. Sometimes you can find a diamond in the rough - not by knowing where to dig - but simply by knowing what a diamond looks like. Many investment diamonds - meaning companies that you can hold for decades - have common characteristics that can help you create a shortcut in your investment research. Here are a few that I’ve found over the years that can help them shine brightly as you sift through investment dirt.

Duopolies: Most companies that are monopolies are well known and hard to find at the right price. Duopolies have many advantages of a monopoly but often fly below the radar. A company like FactSet Research (FDS) is a great example. Remember: It doesn’t matter whether your holding is #1 or #2 position. Just make sure there is only two.

ROIC Far Exceeds WACC: Companies with strong competitive moats have their return on invested capital always exceed their weighted average cost of capital. Simply looking on GuruFocus’ 30 Year Financial tab under “Ratios” can give you both numbers.

Their Advantage is Locked In: You are looking for a company where their advantage is secure – whether by patent (like Masimo) or by switching costs combined with technological excellence (also Masimo). Their competitive advantage should be secure for the next 10 -20 years. There aren’t many companies that can say that. Whether it be Coke or Wrigley or Masimo, as an investor you shouldn’t be able to find any major reason why the moat could be filled in or outflanked.

The Balance Sheet Should Be Rock Solid: If a company has a strong competitive advantage, it shouldn’t be loading up on debt or issuing convertible debt. You want management to reinvest capital back into operations when ROIC exceeds WACC. Any profits they don’t need can be retained as cash on the balance sheet, used to repurchase shares (hopefully not overpaying), or sent back to investors in the form of dividends. Running an outstanding company should not be financial rocket science.

Finding a company with these types of attributes isn’t that hard. In today’s world, investors can create screens on GuruFocus or Morningstar in a matter of seconds.

One Last Thing

One thing I haven’t touched on in this article has been price. In the past few pages, I’ve shown you how to create a “short and shoddy” investment approach. It can help you find diamonds in any type of industry. But it doesn’t tell you what to pay for that diamond. At Nintai Investments we use a discounted free cash flow model to ascertain value. What approach you use is entirely up to you. I should warn you up front - the lack of industry knowledge abandoned in the “short and shoddy” approach will hurt in calculating valuation. A lot of assumptions that are used in calculating value come from deep industry expertise. But if you are committed to the “short and shoddy” method, then attempt whatever is your preferred way to calculate value and come up with a number. If the price is right, then congratulate yourself for find a truly affordable diamond in the rough.

Conclusions

It’s unlikely you will find us employing the “short and shoddy” approach to finding investment opportunities in Nintai portfolios. As a professional investment manager I will use every piece of data and run as many spreadsheets as possible to increase my chances at outperforming the markets. I employ researchers or buy industry research to try to make the most informed and knowledgeable decision I can. If pressed, I would probably still rank an industry focused index fund over the “short and shoddy” approach. That said, I encourage investors to create a few search screens and find out what shows up. This isn’t an investment recommendation in any way, but more a research recommendation. It may not be exactly to Will Roger’s methodology, but I can’t help but think you wouldn’t get a nod or a wink when you told him you invested in the “short and shoddy” way.

As always I look forward to your thoughts and comments.

DISCLOSURE: Masimo (MASI) is a holding in some of our personal and institutional accounts.

RSS Feed

RSS Feed