“FOR SALE: BABY SHOES, NEVER WORN”

What a remarkable effort. Utilizing six words, he told a story that has so many possibilities and an infinite amount of beginnings and endings. His friends admitted that while the story missed what many classic literature instructors would consider essential (such as those listed earlier), the reality was that the 6 words appeared to tell a story of particularly melancholy nature[1].

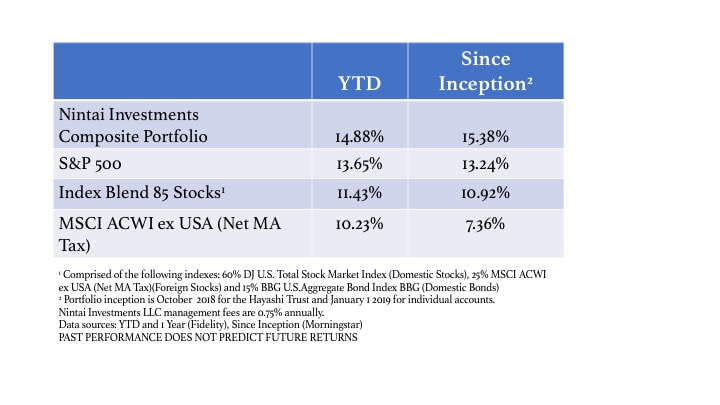

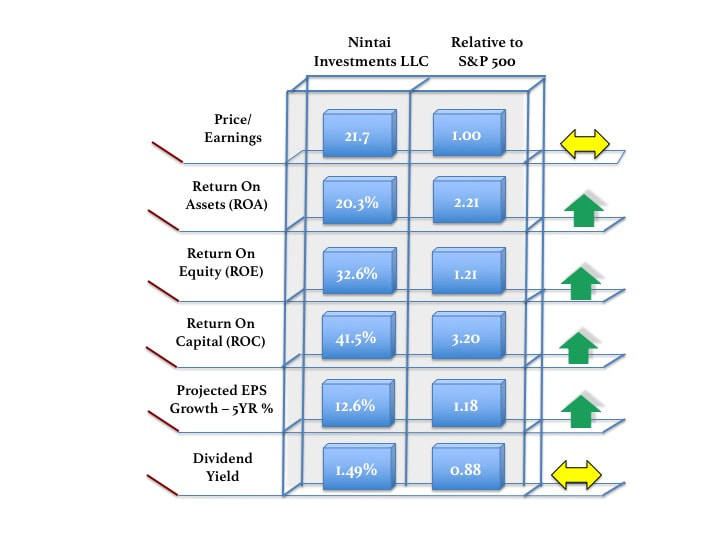

I bring this story up because I’m frequently asked why I run a focused portfolio of roughly 20 - 25 stocks. For me, the idea is similar to Hemingway - can I outperform the markets with portfolios having a limited beginning and end? It’s an interesting dilemma. Much like Hemingway, in my portfolio I have a tendency to miss what are considered essential components of modern portfolio theory. These include considerable diversification in both number of stocks and industries. I didn’t develop such an investment approach because of a bet to see whether I could consistently beat the markets with such a small group of holdings (though the approach has worked out quite well for my investors[2]). I developed the portfolio strategy over time simply because I found I couldn’t tell my portfolio “story” if I had too many “words” (stocks). I’m simply not smart enough to keep track of more than 25 stocks.

The Requirements for a Successful “Six Word” Portfolio

Much like summing up your life in 6 words, a very focused portfolio designed to - and capable of - beating the general markets year after year is a tough nut to crack. First, it requires a set of criteria that can choose stocks with the best chance to outperform the general markets in the long term. Second, it creates a process that gathers the greatest amount of relevant information yet weeds out vast amounts of inconsequential data. The ultimate goal is to have as much deep, proprietary knowledge as can be gathered for each portfolio holding. This allows you to have a clear competitive advantage on other investment managers who own 500 stocks with a turnover rate of 150% annually. With only 20 stocks, these are the major areas of knowledge I use to make sure I have the deepest level of knowledge possible and increase my chances to outperform the S&P500 over the long term.

Financial Data and Updates

Accounting is the language of business so you’d better be fluent in all aspects – balance sheet, income statement, statement of cash flows, 10-Qs, 10-Ks, management notes, actual earnings, pro-forma earnings and EBITDA. The list is endless. Much like accents in certain geographic areas, every company and its management have their own take on reporting the numbers. It’s amazing how many shenanigans can go on in federally mandated reports or filings. Every year a portfolio holding releases one 10-K and annual report, 4 10-Qs, any number of unplanned updates announced in 8-Ks, S-4s for mergers and acquisitions or exchange offerings (better look that one up!), and 11-Ks for employee stock purchases or plans. Everyone of these filings can hold a critical piece of information that might confirm – or far worse – deny a basic assumption in your investment thesis. In my portfolio of 20 – 25 holdings I will generally read roughly 200-300 pages of filings per holding annually or nearly 6,000 – 7,000 pages of filings each year. Think about the work required if you had 200 holdings and 100% annual turnover.

In reading all these pages I focus on three buckets of information that will help me understand the issues within the portfolio holding. First is any change in the capital structure. As a common stock, preferred stock, or bond holder, I want to know about any changes such as drawdown on the company credit line, issuance of new stock or debt instruments, or issuance of stock options and/or warrants. All of these will have an impact on the estimated valuation of the company and my holdings. Second, I want to know about any major strategic efforts or changes that might require a shift in company assets, changes in capital allocation, or large increases in research and development. Changes in strategy can be expensive in terms of time and money. As a log-term value investor, I look to partner with executives who make as few changes as I do in the portfolio. Last, I want to know about any changes in how the company operates. This includes everything from decreasing margins to increased CAPEX that might require more spending. For instance, new hires in the sales force might be a clue that market dynamics are shifting or the economy might be slowing.

Marketplace Developments

The latter changes (such as hiring new sales reps) is information that not only tells me about potential changes in the company’s financials, but changes in the marketplace. Sources of this type of information include trade journals, proprietary research, trade events, competitive reports, etc. In this area, I look more outside the company for information. Subjects in this area include the following.

Product and Service Development

Companies work in ecosystems that are always changing and evolving. New products and services are constantly being developed and launched. It is essential that as a value investor, you know these dangers to each of your holdings. Press releases and trade journals are great sources of new product announcements. Masimo (MASI)[3] - a medical device company - is constantly looking to expand its product range or product functionality. For instance, Masimo looks at improving its oximeter (the little clip that goes on your finger tip to measure your oxygen saturation rate) by integrating it deeper into the patient care platform. Reading up on trade journals or attending conferences can give you a great idea on how and where competition is making its move. Your understanding of both the product and your portfolio holding’s competitors can pay huge dividends in the long run.

Micro-Economics

Another area of interest are micro-economic developments and pressures. Examples of this are changes in interest rates, localized employment numbers, and raw materials cost pressures in a specific suburban area like Scottsdale if you own a homebuilder. An example of this was research we conducted on the long-term capital allocation decisions in for-profit versus not-for-profit hospitals when it comes to magnetic resonance imaging (MRI) machines. In areas with large university health care systems (think Boston) versus mostly private (think Dallas), sales and growth can be greatly impacted at iRadimed (IRMD) a Nintai Investments holding. Understanding these local environments allowed us to test management’s growth estimates.

Competitive Strategy

Changes in competitive strategies is another area of huge interest. Reading competitive documents/filings and talking to customers is a great way to get a sense of any impending shifts in how competition thinks. An example of this was reading Fidelity’s internal presentations and talking to mutual fund investors to get a feel on how Fidelity’s shift in pricing affected T. Rowe Price (TROW)[4]. Understanding the major components of the mutual fund industry – ranging from the 1940 Investment Company Act to the mutual fund, its independent advisor, the fund’s directors, were all vital in understanding how and why Fidelity can create “free” index funds. After an extensive review it was clear Vanguard was Fidelity’s target and there would be minimal impact on T. Rowe Price.

New Technologies and Delivery Models

Last is understanding what new technologies and delivery models might be occurring out there that can cause real grief to one of your holdings’ business model. One needs to look no further than Amazon to see this at work. An example is drug distribution. Since the 1980s and the creation of drug wholesalers and pharmacy benefit managers (PBMs), there have been three waves of mergers and acquisitions (pharmaceuticals buying PBMs, pharmaceuticals divesting PBMs, pharmacies buying PBMs), 28 specific pieces of federal legislation involving drug distribution (safety, fake drugs, illegal importation, rebates, etc.), and three major new delivery models (cold chain supply systems, supply hub, etc.). All of these transactions, regulations, and legislation are simply to deal with drug distribution. Imagine if you had to understand 150 more industry-specific technology and delivery model changes.

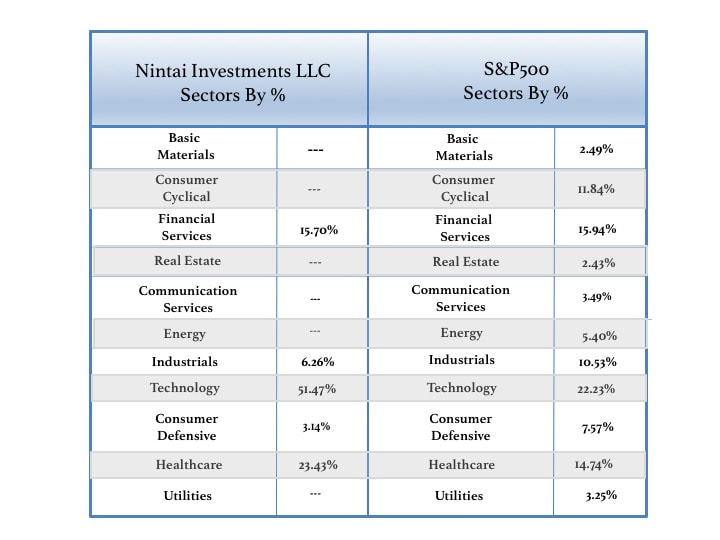

As you can imagine, understanding how each of these four areas can impact each of your investment holdings can be a real challenge and require a huge effort. In this research not only does the focused number of companies really help, but the industry focus (Nintai Investments only invests in 5 of 11 S&P’s industry groups) really allows us to focus in much greater detail than other investment managers.

Scuttlebutt

An enormous amount of trade and proprietary company information is disclosed and discussed everyday on our beloved interwebs. Scuttlebutt can be achieved through discussions with customers, suppliers, reading online customer reviews, or even using a web crawler for searching local papers (reports on layoffs or a new plant). But I’ve found the most cost-effective tool is finding a specific industry scuttlebutt site, saddling up to the virtual watercooler, and look interested. For instance, anybody who invests in the biopharmaceutical industry must join the website CafePharma. This site is packed with information on everything from how effective or incompetent management is to issues related to a new manufacturing plant in Romania. You can find out how likely that new product management assured investors about in the Annual Report will meet its numbers. You might find out which drug has hit a bottleneck due to a shortage of raw materials or which product launch date might be soft because a consulting physician was drunk at the FDA meeting (yes…that was an actual posting). Every tidbit of information that you can find in this fashion gives you a leg up on valuing or deciding to hold on to one of your investment holdings.

What I Don’t Waste Time On

Issues that add no competitive edge to my investment decisions or add no real insight into the value of a holding are areas I steer well clear of through the course of my research. Some of these include the debate on whether the fed will raise rates, whether GDP growth will be 3.2% or 3.4% in the next quarter, or whether a new tweet from the President will raise tariffs on sweet gherkin pickles. The advantage in being a focused value investor means I can spend an inordinate amount of time researching in areas where larger investors simply don’t have the time or resources. As much as you want your investment holdings’ managers to wisely allocate capital, it is imperative you wisely allocate your “time” capital as well.

Conclusions

Part of the genius of Ernest Hemingway was that he had a gift for not wasting words. He made every word count. By creating a story of only six words, he demonstrated that a few words could tell a whole story. Focused value investing can achieve the same end. I firmly believe that living within my intellectual means, I can - in the long term - outperform the general markets with a “six word” portfolio. Of course, past performance doesn’t assure future returns. But I recommend everyone try creating their own focused portfolio, put in the research legwork, and test your returns against the general markets. Who knows? You might walk away from the table a little bit richer like Hemingway.

As always I look forward to your thoughts and comments.

DISCLOSURE: I own TROW, MASI in both individual and institutional accounts.

[1] There is a great book that took the concept of the “six word” story and asked famous – and non-famous - individuals to create their own six-word memoirs. It is entitled “Not Quite What I Was Planning” by Larry Smith and Rachel Fershleiser. One of my favorites (other than the title) was Stephen Colbert’s “Well, I thought it was funny”.

[2] It goes without saying – though I’m required to say it! – that past performance is not an assurance of future returns.

[3] Masimo is a holding in both institutional and individual accounts at Nintai Investments LLC.

[4] T. Rowe Price is a holding in both institutional and individual accounts at Nintai Investments LLC.

RSS Feed

RSS Feed