- As a professional investment manager, I will not be providing a full list of portfolio holdings. My customers pay me to allocate their dollars in a specifically chosen portfolio – not announce their portfolio to website readers.

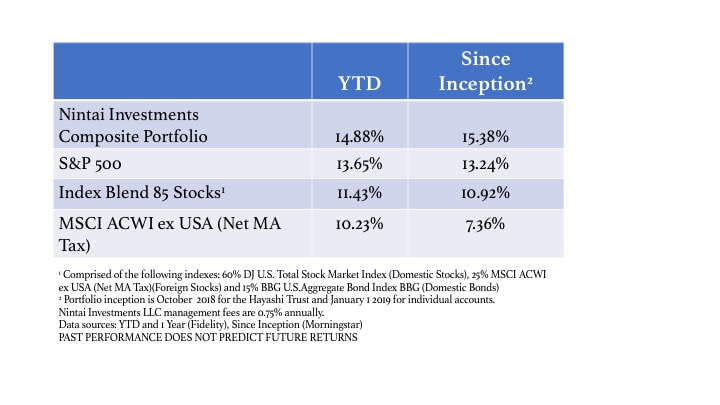

- Returns are a composite of the Hayashi Trust and individual investor portfolios.

- Inception date is October 15 2018 for the Hayashi Trust and January 1 2019 for individual portfolios.

- In my previous life, I was happy to discuss individual holdings and my rationale for their being in the portfolio. As a paid investment manager, I must necessarily be far more discreet in my answers to readers’ questions.

- Of course, past performance does not promise future returns. Any company discussed will be identified as a portfolio holding if in either an individual investment account, the Hayashi Trust, or in my personal brokerage account.

As many of you know, I ran the Nintai Partners Portfolio – and then the Charitable Trust – from 2002 - 2015. In addition, I was a portfolio manager from 2015 - 2018 at Dorfman Value Investments. While very proud of those returns, I believe the results of Nintai Investments LLC must stand on their own and develop their own unique history. Going forward, when I discuss the Nintai Investments LLC portfolio, I will be referring to a composite of individual portfolios managed by Nintai Investments LLC and the Hayashi Trust portfolio managed by Nintai Investments LLC.

I was pleased with Q1 performance of the composite portfolio outperforming its benchmark, the S&P 500. I have also been very pleased with performance since inception. Seen below are the numbers for periods ended March 31 2019.

Total Returns Net of Fees

This quarter I sold the entire stake in Allergan (AGN) after it was announced the company was charged with systematically overcharging the Centers for Medicare and Medicaid (CMS) by utilizing false data on average wholesale pricing (AWP). As I wrote at the time, this is a particularly egregious crime that steals money from the patients who can afford it the least and reduces government funding available for other treatments. I simply will not tolerate such behavior by a holding’s management.

During the quarter I also added to 4 existing positions. Each holding was trading at a significant discount to my estimated intrinsic value at the time I added to the position.

Winners and Losers

Two stocks led the way in Q1 - Veeva Systems (VEEV) and NIC (EGOV). Veeva was up 38% in the quarter while NIC increased by 34%. Veeva’s February quarterly earnings exceeded both top and bottom lines. Management upped guidance as well. Over the last year, VEEV has increased free cash flow by 33%, EPS by 60%, and revenue by 24%. I increased Veeva’s estimated intrinsic value by roughly 13% in February 2019 after the company raised guidance. The position is currently up 115% since it was purchased in February 2018.

NIC recovered nicely after the markets recognized the loss of part of the company’s Texas website contract was not going to have a significantly adverse effect on the firm. Free cash flow actually grew by 1% after analysts estimated a 15-20% drop in 2018. While the quarter’s results were gratifying, the position is currently only breaking even. While Veeva and NIC had great quarters, I should point out that roughly half the portfolio holdings were up 20% or greater during the quarter.

It wouldn’t be value investing if you didn’t have to report on stocks that were the inverse to those winners. The ones that get you all puffed up and make you feel like the smartest person in the room. For the second quarter in a row, the largest drag on the portfolio was Biosyent (BIOYF) down -5.2%. The company was a having a decent year until in the last days of Q1. Management announced they received two notice of deficiencies from Health Canada for their two new cardiovascular products. The company has exclusive distribution rights to these drugs in the Canadian markets. At the time of this report, I’m still in discussions with Biosyent management, Health Canada clinical reviewers, and market analysts to judge the impact on my estimated intrinsic value.

Portfolio Characteristics

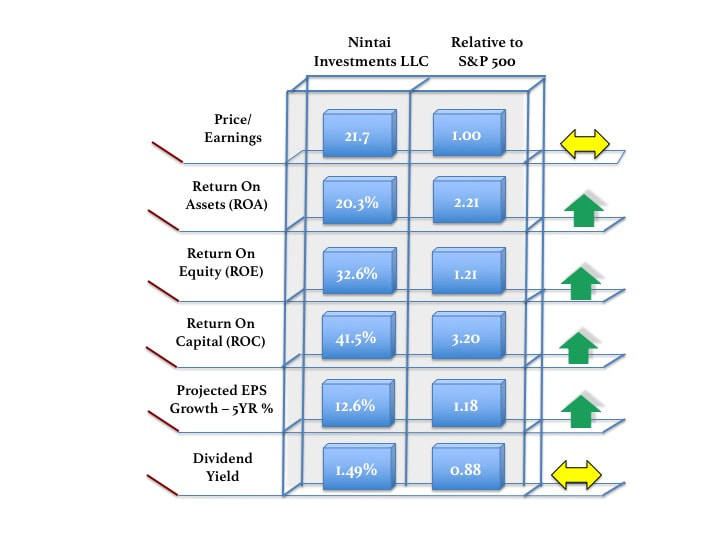

The current Abacus view as of March 31 2019 shows that the Nintai Portfolio holdings are slightly more expensive than the S&P500 and projected to grow earnings at a significantly greater rate than the S&P500 over the next five years.

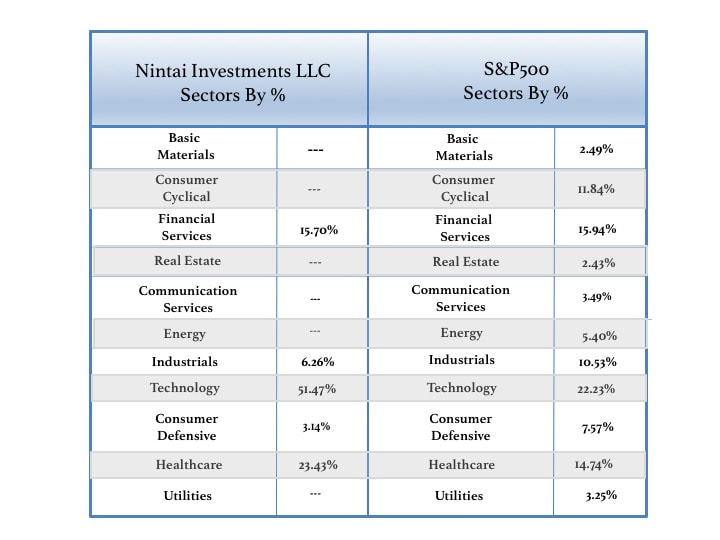

I remain highly focused in my industry and sector weightings. I currently have holdings in only 5 of the S&P500’s 11 categories - financial services, technology, industrials, consumer defensive, and healthcare. Industrials and consumer defensive are both extremely small holdings with roughly 90% of holdings in just three categories – financial services, technology, and healthcare. However, I should point out I see the categorization of the portfolio slightly differently. For instance, Computer Modelling Group (CMDXF) is categorized as a technology company by the index. However, with 100% of its revenue derived in the oil and gas discovery process, I consider the company a way to gain exposure in the energy industry.

Turnover for the quarter was roughly 14%. I expect this to drop as assets under management increase. I try to look for turnover of roughly 5-10% annually. This is dependent of course on factors such as overall market performance (steady increases over the past few years have allowed me to take profits but also increase turnover) or individual stock performance (a sudden price drop of 20% might make for a compelling buy scenario). I have reached the upper end of stocks I look to own in the portfolio. It’s likely that most trading going forward will be additions or subtractions from existing positions. Occasionally opportunities may arise where I swap out an entire position for one that is either trading at a steeper discount to my intrinsic value and represents a step up in quality and potential long-term gains.

In regards to cash, the portfolio currently maintains roughly 20% of its assets in cash. I have been fortunate that 80% of the portfolio has easily outperformed 100% of the S&P500. How long that can continue is anybody’s guess. With the Abacus report showing the portfolio’s estimated 5-year earnings growth at 18% greater than the S&P500 while being equally valued, the data suggest there is at least a moderate chance this could continue. But as always, I want to point out that past performance does not ensure future returns.

Eating Our Own Cooking

As many of my readers may remember from my GuruFocus presentation in April 2016, I have the “honor” of having an extremely rare genetic mutation (the TRNT1 gene for those keeping track). This disease – known by its acronym SIFD – is found in only 18 individuals in the world. While my parents always told me to be different, I’m not sure this is what they meant! I bring this up because over the past 8 years of treatments I spent my entire life’s savings seeking care that would keep me alive (the US is both a great place and a terrible place to have a rare disease). Now that we’ve isolated the disease through modern genetic clinical research, I’m in the position to begin rebuilding my individual investment portfolio. I want to assure my readers and investors that every dollar invested will be in the same stocks I own in the Nintai Investments portfolio. It is my intention that I will most certainly be eating my own cooking.

Making A Difference

At Nintai Investments, I take our social responsibility seriously. We (meaning myself and my shareholders) currently give 10% of net income to charitable causes that are making a difference in our communities. Each annual report I will highlight an organization that Nintai Investments has supported that year. As a corporate citizen, Nintai Investments has an equal – if not greater – responsibility to make a difference in our society. Having lived an immigrant life here in the United States, I have seen that capitalism produces enormous opportunities for all our citizens. But sometimes that isn’t enough - sometimes people need a helping hand. Having been blessed with a wonderful family, a great education, and a successful professional career, I feel Nintai Investments has a special responsibility to help provide that helping hand.

»»»»»»»»»»»»»

As Nintai Investments LLC begins its corporate journey, I take my responsibility seriously to wisely allocate capital, prudently manage risk, and attempt to generate adequate returns. Helping individuals and organizations achieve their life goals, support their corporate giving, or meet their retirement needs is a remarkable honor and mark of great trust. Every day we look to continue earning that trust. Should you have any questions, please do not hesitate to contact me by phone or email.

Thomas Macpherson

[email protected]

603.512.5358

My best wishes for a wonderful spring season.

RSS Feed

RSS Feed