We think this story is quite illustrative in today’s markets. We often hear about confirmation bias during bull markets, but we rarely hear about it in the context of buying stocks during market crashes. During days when the markets drop by 5+% and some stocks on your watch list drop in synch, do you often think bargains are to be had? Do you immediately see bargains where there were none just the day before? You wouldn't be alone. We all suffer from confirmation bias. But drops of 10% to 20% do not guarantee great investment opportunities. As usual, the drop in price must be put in the context of value. We believe the past few days have shown an enormous reaction based on confirmation bias.

To See and Not Believe

In Daniel Gilbert’s published article “How Mental Systems Believe [1]”, he wrote that understanding a statement begins with our attempt to believe it. Danny Kahneman is his “Thinking, Fast and Slow” stated that this attempt at believing is the basis for confirmation bias. He wrote, “You must first know what the idea would mean if it were true. Only then can you decide whether or not to unbelieve it. [2]” He went on to describe the attempt to believe is processed through System 1 (the more automatic and accepting process) while attempting to unbelieve (or test the idea) is processed through System 2 (more associated with critical thinking).

The past week has greatly activated many value investors’ System 1 thinking. Huge drops in the markets must mean there are significant values to be had if you only look close enough. On Monday, anchors on Bloomberg stated they heard investors were purchasing stocks “with both hands” and “hand over fist”.

But is it really the best time to buy shares in the market? We would propose that confirmation bias is as dangerous in market drops as it is in bull markets. Just because a stock has dropped suddenly by 10% does not make it an automatic value. Even though every emotion in our investing mind is telling us to buy, we must engage our System 2 and engage in critical thinking. More importantly we must focus on one specific question: What is the new price relative to the company’s value?

Confirmation Bias: A Working Example

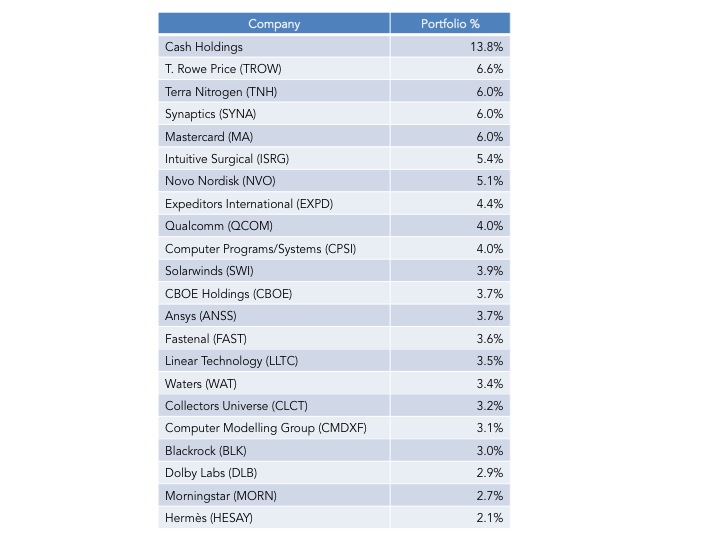

As an example of this we wanted to use one of our current holdings – Ansys (NASDAQ:ANSS). We first purchased its shares in December 2008 at $28.14/share. On Aug. 21, the shares peaked at roughly $97/share. Within the two trading days, the stock price had dropped to roughly $86/share. During trading on Aug. 24, the stock was briefly down 8%. By the end of that day several individuals had written to me asking if we would be purchasing additional shares.

I must admit out initial reaction was to salivate at the price drop. Over the next 24 hours we took a look at the history of our holding, its valuation, and price movement. On Oct. 24, 2014 the stock was priced at roughly $72/share. In January of this year we estimated an intrinsic value of $84/share. By August, when the stock was trading at $97/share we believed the stock was priced roughly 15% above fair value. The rapid drop of 10% during Aug. 21 to 24 had simply brought the shares in line with our estimates. It was still trading $12/share more than it was less than nine months before. If we didn’t purchase it in October 2014, then why would we purchase in August 2015? With our intrinsic value being static, the decision to pass was a not a hard choice. But getting to that decision certainly was difficult. Confirmation bias – processed by System 1 – instinctively informed us a large price drop in a short time should be a buying moment. Only upon using System 2 were we able to critically analyze these emotions and make a more reasoned decision.

Switching Systems: Mauboussin’s Checklist

In Michael Mauboussin’s great book “Think Twice: The Power of Counterintuition [3]”, he suggests a checklist of five steps to avoid focusing on only System 1 thinking. In regards to the questions of purchasing additional shares in ANSS, they provided significant value in the decision making process. These include:

Explicitly Consider Alternatives: By reviewing Ansys’ past price history, its valuation, and our investment thesis, we found that such a significant price drop was inconsequential to purchasing the stock or changing our valuation.

Seek Dissent: Within an hour of discussing the stock, several individuals pointed out that the price drop didn't offset the run up over the past nine months. This forced us to broaden our outlook.

Keep Track of Previous Decisions: Because we outlined our investment thesis and detailed our valuation methodology, we were able to see the price drop simply brought the stock in line with our current valuation model.

Avoid Making Decisions While at Emotional Extremes: Certainly when the Dow drops by over a 1000 points or the Nasdaq drops by 11%, the adrenaline starts to flow. It turns out that would have been exactly the wrong time to make the investment call.

Understand Incentives: We aren’t paid by the amount of trades. We are paid for performance with a risk incentive to protect to the downside. This form of incentive forced us to pause and reflect on both the risk and uncertainty of purchasing more shares in ANSS.

Conclusions

The ability to avoid confirmation bias – both on the upside and downside – becomes critical on days of extreme market gyrations. Sudden price movements can be incredibly tempting times. The emotional and intellectual pressure to act combined with our experiences make it vital to step back and allow our second systems time for critical thinking. In doing so, we can become far more successful in our decisions. Who knows, it might even prevent your own investing Waterloo.

[1] “How Mental Systems Believe” Daniel Gilbert, American Psychiatrist. Volume 46, Number 2, February 1991.

[2] “Thinking, Fast and Slow”, Daniel Kahneman, . Penguin Books Limited, 2011. p. 81.

[3] “Think Twice: The Power of Counterintuition”, Michael Mauboussin, Harvard Business Review Press, 2012

RSS Feed

RSS Feed