- Alan Sugar

“Arguing with idiots is like playing chess with a pigeon. No matter how good you are, the bird will crap on the board and strut around like it won anyway”.

- Anonymous

Over the years I’ve taken to task money managers who charge egregious fees, underperform the markets, or flagrantly violate their own investment strategies. In general, I try to stay positive in my writing as most readers like to hear about solutions rather than problems. But much like the articles I just cited, occasionally a case comes along that practically begs for a little criticism.

In the past couple of weeks, the South Carolina Government Pension Plan has exploded into the news with an analysis revealing a stunning ineptitude and truly amazing greed. The state’s pension fund is overseen by a six-person board and an Executive Director. It was reported on December 4th, that the pension plan is currently funded to meet only 47% of its obligations. In addition, the general public was outraged to see that total investment management fees had jumped from $27M in the early 2000s to peak at $454M in 2014 . Even with this type of compensation, the plan grossly underperformed against a simple blend of equity and bond index funds.

Almost none of this should have been a surprise. In July, 2015, the Maryland Public Policy Institute published its “Wall Street Fees and Investment Returns for 33 State Pension Funds” . The report discussed several findings.

High Fees Gain You…..Net Negative?

Pension plans have paid an extraordinary amount of fees for underperformance. Indexing fees cost a state pension fund about 3 basis points yearly on invested capital versus 66 basis points for active management fees (or a savings of roughly 96.7%). The report goes on to state, “For the five years ending June 30, 2014, we were unable to find a positive correlation between high fees and high returns. In fact, we found a negative correlation.” The difference between 3 basis points and 66 basis points might not seem like much (it never does!) but the latter could have saved tens of billions of dollars for state pensions. As an example, a state pension fund of $50B would have an additional $6.8B after five years if indexed rather than using higher cost investments, assuming performance remained equal. For many underfunded plans, these numbers might be the difference between cuts in pension plans or meeting their current obligations.

No Proof that Higher Risk Means Higher Returns

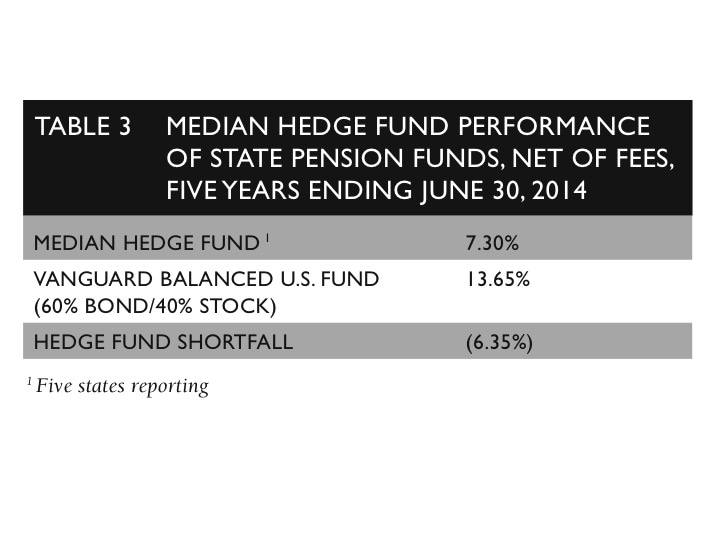

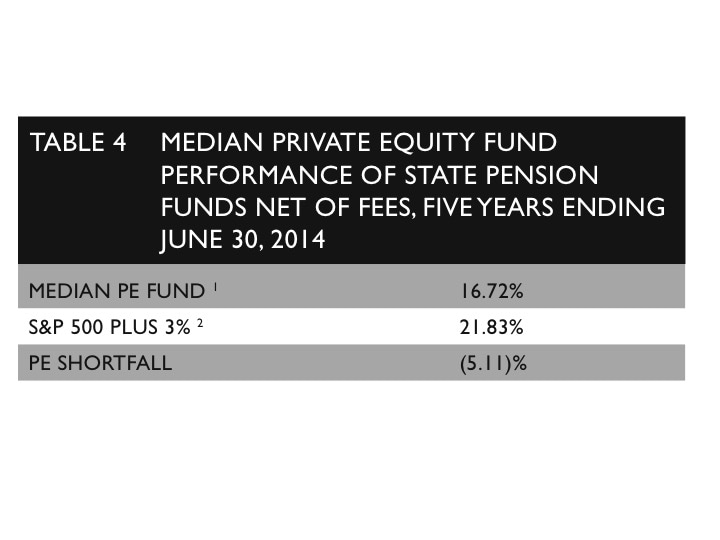

According to the S&P Dow Jones Indices/SPIVA Scorecard YE 2014, over the five years ending December 31st, 2014, 84 percent of domestic equity funds failed to beat the S&P benchmark. I must be honest in saying the Nintai Charitable Trust also underperformed for this period. It is for this reason pensions plans have begun to diversify into the higher risk/higher reward investments such as hedge funds and private equity. The report showed both of these are a poor choice for increasing investment returns. Hedge funds used by state pension funds underperformed a blended 60/40 equity and bond portfolio by roughly 6.4 percentage points from 2009-2014. All of this at twice the rate of beta.

Several years ago I wrote about Sir William Occam’s theory on the simplicity of solutions. Many times the simplest solution can also be the incorrect one. Think of the first Italian who mounted fake wings on his arms and hurled himself off the tallest building in Siena. A remarkably simple solution with remarkably bad results. Yet there is something to be said for good Sir Bill in some cases. Investing is one of those areas. Many of the worse cases of crash and burn (to continue in the vein of our poor human-avian example) have been systems created with such complexity even their designers couldn’t understand or quantify systemic risk. Returns such as those achieved by pension funds around the country have shown the best advice is to stick with Sir William and leave attempts to defy gravity to those with a much larger appetite for costs and thicker wallets.

Conclusions

All too often marketing beats results in investing. Much like the old Arab folk saying (trust your neighbor, but tie up your camel), investors simply must look at the record of their investment managers. I certainly don’t mean this in a trigger-happy manner but over a longer term (5-10 year). Not many investors have duration and size like that of large pension funds. South Carolina State Treasurer Curtis Loftis - one of the few heroes in this sordid story - summed it up best when he said, “Our attitude from 2006 to 2013 was, we wanted to be on the cutting edge of (investment) diversification and financial theory, but we were on the bleeding edge. We have lost so much money the state will be lucky to get out of it." The story of South Carolina’s pension debacle is a classic case of poor investment decision making, ignorance of marketing fables versus actual results, and a doubling down on mistakes. If investors keep an eye on costs and turn off the marketing channel known as CNBC, it is likely (but not certain) they can outperform the so-called Wizards of Wall Street. And that’s something that can really help your investment portfolio take flight.

RSS Feed

RSS Feed