We bring this up because this description isn’t much different than investing. There are things we can certainly control in our process such as selecting companies with certain financial criteria (investment returns), while there are things we simply have no control over such as the P/E ratio of our holdings (speculative return).

John Bogle had a great formula for describing total investment returns[1] -

Dividend yield + Investment Returns + Speculative Returns

He defined investment returns as earnings growth/contraction and speculative returns as the increase/decrease in the respective stock’s P/E ratio. The first two (DY+IR) are direct actions taken or achieved by your investment. The third (SR) is driven purely by the whims of the market. This combination of all three drive both the short and long term returns of your investment portfolio. To put it in the context of Benjamin Graham’s eponymous phrase, the speculative return is the voting machine while the dividend yield and earnings growth is the weighing machine. Or put in our boxer’s parlance, one happens in the ring and the other outside of it.

We strongly believe our investment selection process focused on companies with little/no debt, high free cash flow, high capital returns, and deep competitive moats will – over the long term – assure our investment returns. Theoretically, purchasing our investment at a discount to fair value will mitigate risk in the speculative return.

All of this seems quite reasonable until we recognize that a vast majority of our short-term returns and a substantial part of our long term returns are directly linked to Bogle’s speculative returns. John Maynard Keynes wrote[2], “In one of the greatest investment markets in the world, namely, New York, the influence of speculation is enormous. It is rare for an American to ‘invest for income,’ and he will not readily purchase an investment except in the hope of capital appreciation. This is only another way of saying that he is attaching his hopes to a favorable change in the conventional basis of valuation, i.e., that he is a speculator.” Things have changed very little since Keynes penned these words in the throes of the great Depression.

Investment Return Versus Speculation Return

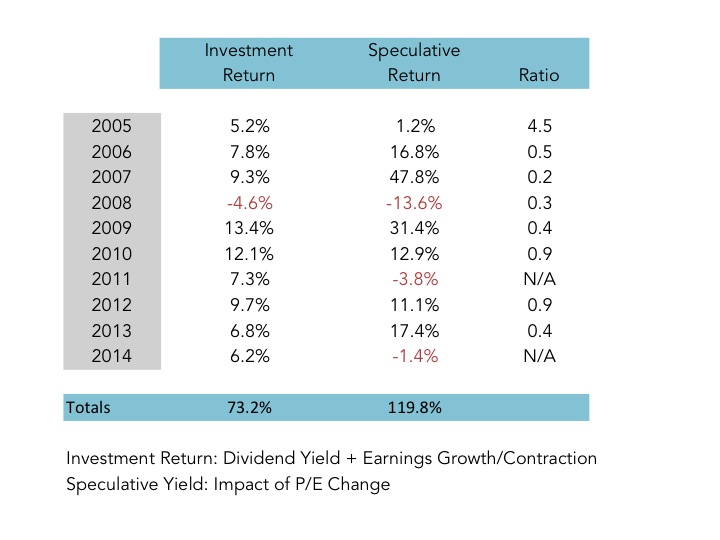

At Nintai we keep a close watch on both investment returns and speculative returns within our individual holdings and how that impacts the portfolio in total. As seen below, since 2005 over half of our returns have come from speculative returns – meaning over 50% of the returns of the Nintai portfolio have come from P/E expansion rather than dividend rates or earnings growth.

Much like a state of equilibrium in physics, this simply cannot go on in perpetuity. Over the next decade we would expect to see over all returns decrease in scope as P/E ratios return to a more normalized level. As the Nintai portfolio’s average P/E is roughly 28% below the S&P500, we would expect this correction to affect the portfolio significantly less than the general markets thereby leading to outperformance in the long term. We believe the financial strength of our portfolio holdings – in combination with lower P/E ratios – provides us significant protection in the case of a market correction similar to 2000 or 2008/2009.

Some Further Thoughts

This philosophy doesn't extend to just our portfolio. At Nintai we are perpetually on the lookout for stocks that might meet all our investment criteria including trading at a significant discount to fair value. Unfortunately some have never quite met these as the speculative return has vastly outrun the investment return over the past few years. One company – CBOE - is a classic case of this phenomenon.

Chicago Board of Exchange

CBOE is engaged in the trading of listed, or exchange-traded, derivatives contracts on four product categories; options on market indexes, futures on the VIX Index and other products, options on stock of individual corporations, options on other exchange-traded products such as exchange-traded funds and exchange traded notes. The Company owns and operates three stand-alone exchanges.

CBOE has generated an average ROE of 69%, FCF/Revenue of 32%, and net margins of 28% over the past five years. Management has generated a return on capital of 79% over the same period. The company currently has $138M in cash on the balance sheet with no short or long-term debt. CBOE generates roughly $207M in cash annually and pays no dividend.

So far this is a company we would love to own. The only fly in the ointment is that the P/E of the stock has gone from roughly 16.5 to 27.5 in the past five years while revenue has grown by roughly 10% during this same time. Here the expanding speculative return (the P/E ratio) has driven the price in excess of its investment return (dividend + earnings growth).

The solution here would be a sudden collapse in the speculative return and a significant decrease in the P/E ratio. Given that scenario - and dependent upon the impact on the business itself - we would be highly likely to back up the truck and make CBOE a new holding in the Nintai Portfolio.

Conclusions

People have been writing to us commenting that our recent musings have been touching a great deal on protection against the downside. Their emails have been asking whether we have any particular knowledge that would predict a future market correction. Our article published on May 27th (found here) touched on our inability to accurately predict almost any macro event including market corrections and/or crashes. That said, we are increasingly sensitive to the risk a downturn could play on our investors’ long-term returns. Any situation that could produce permanent capital impairment is – and must – always be a top concern. The increasing role of speculative returns in our total investment returns has us concerned about valuations and what is the wisest course of action going forward. By focusing on stocks with great investment characteristics (earnings growth + dividends) and low speculative returns (low P/E ratios) over the past several years, we feel investors are setting themselves up well for a future of dampened total returns.

[1] As I was writing this, Grahamites published a great article entitled “When Total Return Meets Chasing For Yield – A Reality Check On The Consumer Stable Sector”. I highly recommend reading it.

[2] “The General Theory of Employment, Interest, and Money”, John Maynard Keynes, 1936

RSS Feed

RSS Feed