- Ron Hart

One of the goals of any value investor is finding that Shangri-La known as the 10-bagger or more formally known as decupling your investment. This idea of seeing your investments snowball was the title of the most recent Warren Buffett (Trades, Portfolio) biography. At the Nintai Charitable Trust, we are as eager as any other investor to invest in a 10-bagger. Sloth and indolence, however, are two predominant features of our corporate culture. In our investment process, we recognize we simply aren’t smart enough to time markets. Correspondingly, we rarely like to do the heavy lifting to grow a business (we’ve already done that) and now look for management teams who know how to compound value.

In essence, we outsource our snowballs. It sounds easy, but interestingly there simply aren’t that many management teams that year after year create value for shareholders. Inevitably, management seems to develop some form of clinical psychosis and begin believing in their omnipotence and guru status. Engaging in empire building, these individuals will begin to cast about for acquisitions – that for no better way to describe – destroy shareholder value. These events usually happen when you least expect it – during long summer vacations or winter holidays where you have limited communication access. Rather than a snowball, you end up with a large puddle of water. To avoid these all too common results, when looking at a potential investment at the Nintai Charitable Trust, we utilize a measure of returns that management achieve with retained capital.

Return on allocated capital

Nothing tells us more about the financial stewardship of corporate management than how they allocate capital. One of the measures we use on any potential investment is the return management achieves on retained capital. This formula is simply taking the increase in earnings from Year 1 to Year 5 and dividing by the sum of all five years earnings less any dividends paid out to investors. The formula would look like this:

(Increase in earnings Year 1 – Year 5)

(Sum of five-year earnings) – (Dividends paid out)

This formula gives the return on allocated capital achieved by management over the past five years. At the Nintai Charitable Trust, we look for management teams that have achieved at least 20%+ over that period of time. As we’ve previously stated, there simply aren’t that many corporate managements that achieve such results. We currently have a list of roughly 125 companies that meet such criteria and are constantly on the lookout for new additions to the list.

A Working Example

An example of such a company is CBOE Holdings (NASDAQ:CBOE), a current holding of the Nintai Charitable Trust. CBOE Holdings is engaged in trading of listed or exchange-traded, derivatives contracts on four categories: index options, futures on VIX, options on the stocks of individual equity, on the other exchange-traded funds and exchange traded notes. We have traditionally loved the business model of exchanges – deep competitive moats, high returns, and steady growth. CBOE is one of the best with a near monopoly on the derivatives market and a management team focused on shareholder return. CBOE has generated an average ROE of 69%, FCF/Revenue of 32%, and net margins of 28% over the past five years. The company currently has $122 million in cash on the balance sheet with no short or long-term debt. CBOE generates roughly $235 million in cash annually and yields 1.2%.

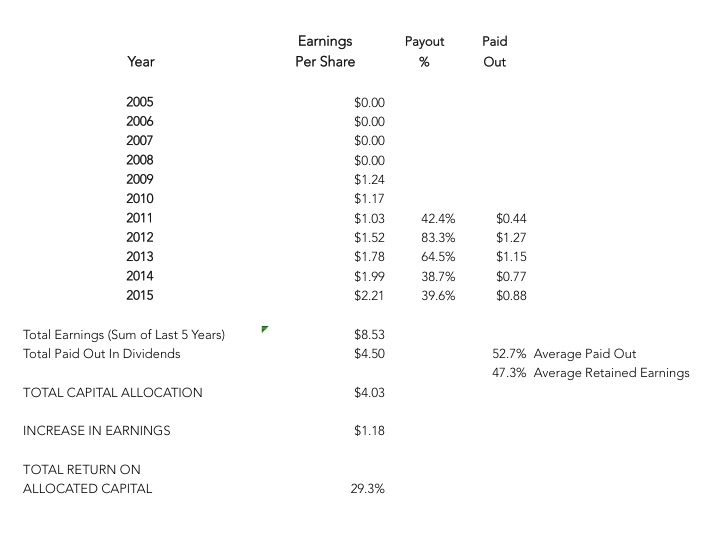

Calculating management’s return on allocated capital, we start in the year 2011 when the company had earnings of $1.03 per share (see calculations below). By 2015 earnings had increased to $2.21 per share. For the five-year period, the company had increased earnings by $1.18 per share. During that same period, the company had a total of $8.53 per share in earnings of which 53% was paid out in dividends. This means that management retained $4.03 per share of earnings that they allocated towards the business. By dividing the total earnings allocated by the increase in earnings, we can see that management achieved a 29% return on allocated capital. We think this is an impressive performance over the measured time frame.

Achieving high returns on allocated capital doesn't assure us the company is a great investment opportunity. It does allow us to rule out management teams that – over time – simply don’t compound value for investors. By combining this measure with other factors such as valuation, intrinsic value, balance sheet strength, returns on equity/assets, and others, we can begin to develop a portrait of management who wisely allocate capital. As we mentioned earlier, why not let your investment’s managers do the heavy lifting for your portfolio? By outsourcing your snowball building, you can focus on the more important aspects of life – like getting into an actual snowball fight with your kids.

As always, I look forward to your thoughts and comments.

RSS Feed

RSS Feed