Having fought cancer for five years, I simply don’t have the energy to be on the road 250 days of the year traveling to see clients and answering phone calls at all hours of the night. Also, I have focused on my passion for value investing. Working with the Charitable Trust as well as consulting with Dorfman Value Investments has been a pure joy. I simply couldn’t work with more pleasant and knowledgeable people.

On a personal note, I tried rock climbing for the first time and – after several stunning demonstrations of ineptitude – began to see a connection with investing. Putting aside the all-too-easy similarities of plunging falls, bruised egos and soaring heights, I learned there are several major rules that apply to both.

Don’t hug the wall: As counterintuitive as this may seem, the more unsure of yourself you are the farther you should be from the wall. As fear naturally takes hold, I found myself pinned against the rock. This took away any vision I had limiting my options. Investing is no different. By focusing too much on details, sometimes it’s impossible to get a good picture of what steps to take next. As fear builds, it is critical that as an investor you lean out and get a clear vision of the terrain.

Don’t rush others or yourself: It’s considered impolitic to rush others on the wall. By forcing others to move before they are confident or ready, we can create errors. I learned the same goes for me. Every time I made a move where I felt time constraints, I usually made a mistake. In investing, time is your ally not your enemy. Unforced errors – made with the ticking clock in mind – usually mean investing outside your selection criteria.

More eyes mean better routes: I was fascinated by the more successful climbers and how they discussed potential routes. They were remarkably open about their thoughts, suggestions and questions. They never considered it an option to hold their information and focus on their own sight. I think investing is similar. Sharing thoughts with other investors or writers on GuruFocus makes me a better investor.

Be prepared to help others: One thing I learned climbing was that everyone is linked together – literally and figuratively. You don’t get extra points by racing ahead of everyone else, and you sure as hell need to be thinking about your climbing partners. We think investing is quite similar. We are tethered to the success or failure of our investment partners. Our research is only as good as the team that produces it. Finally, we think it's of huge value to share our learnings and lend a hand when it's needed.

The year in review: Why do we do this?

At the beginning of each year, we take a look back and see how the portfolio performed over the past 12 months and also see how we are doing over the long term. Each year we include three questions that both we as management and you as investors should look to answer.

1. Does our philosophy and process work?

There really isn't any better way to analyze whether our investment process works than measuring our returns against our proxies. It's our goal to significantly outperform the markets in the long term. To prove that, we need to demonstrate an ability to beat our benchmark and explain why we have or haven't done so in the short and long term.

2. Is it worth it for our investors to remain invested with us?

Every day we go to work knowing it is extraordinarily difficult to beat a low-cost index fund over time. To make it worthwhile for our investors we need to both outperform the indices and do it in a way that our investors can sleep well at night. If we meet these conditions we are confident our investors will remain long-term partners on our journey.

3. How do we improve our process and returns?

No investment process we've designed – or seen – has been perfect for its entire lifetime. We like to use our annual reports to discuss what we've learned and what steps we are taking to improve our professional knowledge as well as investment process.

2015 review

2015 was certainly a year to remember. The Nintai Charitable Trust had its highest turnover since the 2008 market crash. Total turnover was 91% with the Trust exiting eight positions and taking profits in an additional four stocks. Additionally, we took initial positions in 11 new companies. In essence we almost turned over the entire portfolio during the calendar year.

Starting with our exits, FactSet Research (NYSE:FDS) and Manhattan Associates(NASDAQ:MANH) were sold based on valuation. These were long-term holdings (both were purchased in 2006) that we would have preferred to hold, but the markets had priced beyond perfection. Additionally we sold out of our positions in Hermés (HESAY), Coach (COH) and New Oriental (EDU) based on reductions in both competitive moats and valuation reductions. Baxter(BAX) was sold after the announcement of the break up of the company. We exited Blackrock (BLK) based on our assessment on the financial industry and the fact we already own T Rowe Price (TROW). We also took profits with Synaptics (SYNA) but still hold a considerable position.

We welcomed a host of new companies to the portfolio in 2015. The mini-crash of the summer allowed us to purchase positions in two truly outstanding companies – Paychex (PAYX) and Linear Technology (NASDAQ:LLTC). A swoon in price allowed us to welcome back Intuitive Surgical(ISRG). During the course of the year, dramatic mispricing relative to value allowed us to purchase CBOE Holdings (NASDAQ:CBOE), Computer Programs and Services (NASDAQ:CPSI), Computer Modelling Group (CMDXF) and Collectors Universe (NASDAQ:CLCT). We expect each of these to be long-term holdings in the Charitable Trust portfolio. We added F5 Networks(FFIV) and SolarWinds (NYSE:SWI) after the companies had disappointing quarters, and we felt the shares were significantly undervalued. Late last year it was announced Silver Lake Partners and Thomas Bravo would acquire SolarWinds. We expect to net a roughly 90% annualized return when the transaction closes in March.

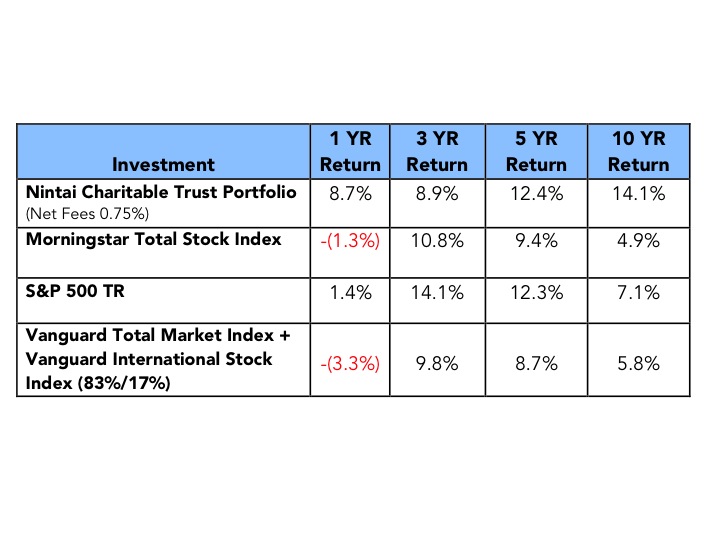

Last year saw the Charitable Trust outperform the markets for the first time in three years. The portfolio handily beat what we consider the most appropriate comparison – a blend of the Vanguard Total U.S. Stock Market Index, Vanguard Foreign Stock Market Index and money market returns. For 2015, the Nintai Portfolio returned 8.7% versus a -1.3% loss for the Morningstar U.S. Market Index and a 1.4% return for the Standard & Poor's 500 TR Index. The Charitable Trust Portfolio outperformed its recommended bogey's (80% Vanguard Total Market Index, 10% Vanguard International Stock Market Index and 10% cash) loss of -3.3%.

Historical returns

Since inception in 2004, the Nintai Charitable Trust (previously the Nintai Partners Holdings portfolio) has generated a 14.3% annual return (net fees of 0.75% annually) versus a 5.4% return for the Morningstar Total Stock Market Index and a 7.3% return for the S&P 500 TR. An investment of $100,000 in the Nintai portfolio in 2004 is currently worth (net fees) $435,000 versus $178,000 for the Morningstar Total Stock Index and $217,000 for the S&P 500 TR. A blend of Vanguard Total Market Index and Vanguard International Stock Index (rebalanced each year to reflect Nintai’s percentages) produced an annual return of 4.2% leaving an investor with $157,000 after the same period.

The following are comparative historic returns:

Conclusions

Even though the Nintai Charitable Trust portfolio has underperformed both the S&P 500 and Morningstar Stock Market Index on a three-year basis, we are quite comfortable with our holdings and positions. The current PE of our portfolio is 19.5, or roughly equal with the S&P 500. In addition the portfolio has an average ROA of 22.2% and an ROE of 34.9%. Respectively, these are roughly double and 70% higher than the S&P 500. Finally, projected earnings growth over the next five years is projected at 12.6% or roughly 30% greater than the S&P 500. In essence the Nintai Portfolio is equally priced to the index, but far more profitable than the broader markets and expected to grow considerably faster. This is a situation we are very comfortable to remain fully invested and quite patient.

Over the past 10 years, we have a turnover ratio of roughly 5% to 7% annually. Last year was certainly an anomaly in that record. However, we expect to return to that average in 2016. Each of the companies in the portfolio share common characteristics – excellent profitability signified by high ROA, ROE, and ROIC, little to no debt, management who are great allocators of capital, and they were purchased at a significant discount to fair value.

As the new year dawns, I have much to be thankful for professionally and personally. To the investors in the Nintai Charitable Trust and Nintai Partners, I owe an enormous debt of gratitude for having the patience to hang in there after three years of underperformance. To my readers at GuruFocus, I am indebted for all their comments, criticisms and questions. You never cease to help me grow. Last, to my family and friends, a grateful thank you for all their support and love that makes life such a pleasure in living. I wish everyone a very prosperous, happy and healthy New Year.

RSS Feed

RSS Feed