- The list consists of the current holdings of the Nintai Charitable Trust as of Jan. 1. Changes may be made in the portfolio without notification to the public at any time.

- Information in this article, including forecast financial information, should not be considered as advice or a recommendation to investors or potential investors in relation to holding, purchasing or selling securities or other financial products or instruments and does not take into account your particular investment objectives.

- Past performance is not a reliable indication of future performance.

- The description of each holding is my opinion as Chief Investment Officer of the Nintai Charitable Trust. In no way does it reflect the views of either GuruFocus or Dorfman Value Investments.

After a year of heavy turnover, we find ourselves quite pleased with the 22 companies we currently hold in the Nintai Charitable Trust portfolio. We simply couldn’t be more happy partnering with Jeff Musser at Expeditors, Lothar Maier at Linear, or Ken Dedeluk at Computer Modelling Group along with our other investment partners.

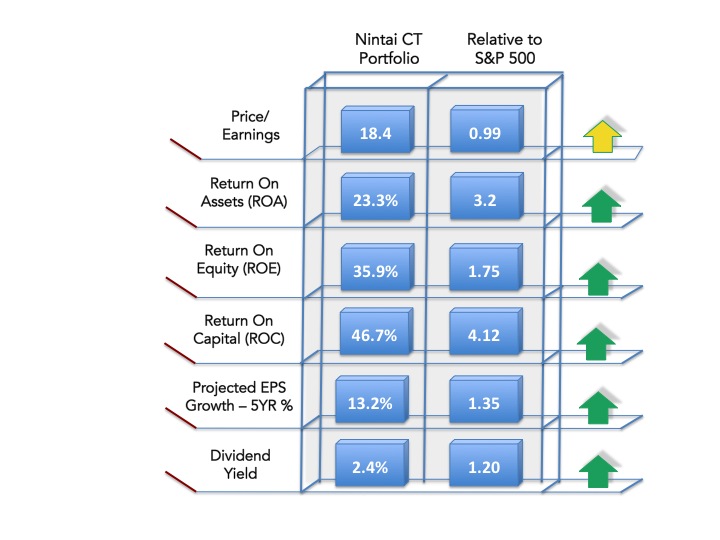

In general we like to maintain a portfolio that has a PE ratio equal or less than the S&P 500. In addition we look to have return on assets, return on equity, and return on capital be significantly higher than the general markets. Finally we look to have projected five-year earnings growth as well as the dividend yield be at least 20% above the S&P 500. Finding companies that can assist the portfolio in meeting these objectives is not easy. We have roughly 125 companies on our watch list that can do this. When we invest in one of these, we have a tendency to own it for an extended period of time.

As seen in the Nintai Abacus report below the portfolio currently meets our investment criteria.

The portfolio currently consists of 22 companies. Each is led by a shareholder-friendly management team, achieves extraordinary returns on assets, equity, and capital, carries no short or long term debt (with several exceptions), and converts a high amount of revenue into free cash. The following are holdings in the Nintai Charitable Trust as of Jan. 1.

1. F5 Networks (FFIV)

F5 Networks is a developer and provider of software-defined application services designed to ensure that applications delivered over Internet Protocol (IP) networks are available to any user, anywhere, anytime, on any device and on any network. F5’s products embed themselves deeply into their customer’s technology infrastructure making a transition to a new vendor a difficult decision. FFIV has established itself as a leader in the mature Application Delivery Controller, or ADC, field, with 50% market share and considerable brand strength. We think the UMT market will grow at single higher digits over the next decade.

FFIV has generated an average ROE of 23%, FCF/Revenue of 32%, and net margins of 19% over the past five years. Management has generated a return on capital of 37% over the same period. The company currently has $400 million in cash on the balance sheet with no short or long-term debt. FFIV generates roughly $620 million in cash annually.

2. MasterCard (NYSE:MA)

MasterCard runs one of the duopoly-based closed network credit and debit card networks. They allow consumers, financial institutions, merchants, governments and businesses to use electronic forms of payment instead of cash and checks. MasterCard (along with fellow holding Visa) has one of the deepest moats in our portfolio. Their network functions as a tollbooth on financial transactions, generating a small amount of revenue from every transaction that runs through its network, and every dollar of payments made using the MasterCard brand.

MasterCard has generated an average ROE of 43%, FCF/Revenue of 36%, and net margins of 35% over the past five years. Management has generated a return on capital of 62% over the same period. The company currently has $4.3 billion in cash on the balance sheet with $1.5 billion of long-term debt. MasterCard generates roughly $3.4 billion in cash annually and yields 0.6%.

3. Fastenal (FAST)

Fastenal is engaged in the wholesale distribution of industrial and construction supplies in North America. The company offers bolts, nuts, screws, studs, and related washers; and miscellaneous supplies and hardware. Fastenal is a leader in the highly fragmented market of industrial distribution. With only $3 billion of the $140 billion maintenance and repair market, we believe there is a very long runway for growth. The company is known throughout the industry for its selection, customer service, and timeliness.

Fastenal has generated an average ROE of 26%, FCF/Revenue of 7%, and net margins of 13% over the past five years. Management has generated a return on capital of 26% over the same period. The company currently has $121 million in cash on the balance sheet with $125 million of short-term debt and no long-term debt. Fastenal generates roughly $336 million in cash annually and yields 2.6%.

4. T. Rowe Price (NASDAQ:TROW)

T. Rowe Price Group is a financial services holding company. It provides investment advisory services to individual and institutional investors in the sponsored T. Rowe Price mutual funds and other investment portfolios. With around 57% of its AUM held in retirement accounts and variable-annuity investment portfolios, the firm has a far stickier set of assets than its peers, and benefits from a nearly constant flow of capital into these funds. T Rowe Price has some of the best governance in the investment management space.

TROW has generated an average ROE of 23%, FCF/Revenue of 29%, and net margins of 29% over the past five years. Management has generated a return on capital of 23% over the same period. The company currently has $1.8 billion in cash on the balance sheet with no short or long-term debt. TROW generates roughly $1.2 billion in cash annually and yields 2.3%.

5. Computer Modelling Group (CMDXF)

Computer Modelling Group is a computer software technology company engaged in the development and licensing of reservoir simulation software. The stock dropped by nearly 40% with the crash of oil prices. With a large group of PhDs along with its patented technology, CMDXF would be hard to recreate in today’s world.

CMDXF has grown free cash flow and revenue at an average 26% and 18% over the past 10 years. CMDXF has generated an average ROE of 52%, FCF/Revenue of 39%, and net margins of 35% over the past five years. Management has generated a return on capital of 228% over the same period. The company currently has $55 million in cash on the balance sheet with no short or long-term debt. CMDXF generates roughly $30 million in cash annually and yields 4.0%.

6. CBOE Holdings (CBOE)

CBOE Holdings is engaged in trading of listed or exchange-traded, derivatives contracts on four categories; index options, futures on VIX, options on the stocks of individual equity, on the other exchange-traded funds and exchange traded notes. We have traditionally loved the business model of exchanges – deep competitive moats, high returns, and steady growth. CBOE is one of the best with a near monopoly on the derivatives market and a management team focused on shareholder return.

CBOE has generated an average ROE of 69%, FCF/Revenue of 32%, and net margins of 28% over the past five years. Management has generated a return on capital of 71% over the same period. The company currently has $122 million in cash on the balance sheet with no short or long-term debt. CBOE generates roughly $235 million in cash annually and yields 1.2%.

7. Terra Nitrogen (NYSE:TNH)

Terra Nitrogen produces and distributes nitrogen fertilizer products. Its products include anhydrous ammonia and urea ammonium nitrate solutions. TNH is a wonderful little business producing a product of increasing need – fertilizer. We believe the company will do great over the long term as countries around the world seek to make their land yield increasing crops per acreage.

TNH has generated an average ROE of 116%, FCF/Revenue of 55%, and net margins of 41% over the past five years. Management has generated a return on capital of 71% over the same period. The company currently has $113 million in cash on the balance sheet with no short or long-term debt. TNH generates roughly $338 million in cash annually and yields 7.2%.

8. Intuitive Surgical (NASDAQ:ISRG)

Intuitive Surgical designs, manufactures and markets da Vinci Surgical Systems and related instruments and accessories. A da Vinci Surgical System consists of a surgeon's console, a patient-side cart, and a high performance vision system. Da Vinci Surgery utilizes computational, robotic and imaging technologies to enable improves patient outcomes compared to other surgical and non-surgical therapies. As new therapeutic areas begin to utilize robotic technology, ISRG should see continued growth.

ISRG has generated an average ROE of 19%, FCF/Revenue of 31%, and net margins of 27% over the past five years. Management has generated a return on capital of 63% over the same period. The company currently has $1.8 billion in cash on the balance sheet with no short or long-term debt. ISRG generates roughly $506 million in cash annually and does not pay a dividend.

9. Singapore Exchange Ltd. ADR (SPXCY)

Singapore Exchange is a full-service exchange operating trading platforms and clearing houses for both securities and derivative products. The company's business segments are Securities Market, Derivatives Market, and other operations. Singapore Exchange is a magnificent little business that churns out enormous amounts of cash and generously shares it with its co-owners. We believe there is a strong possibility of future roll up in this market though we’d hate to see this gem slip away.

SPXCY has generated an average ROE of 36%, FCF/Revenue of 46%, and net margins of 46% over the past five years. Management has generated a return on capital of 43% over the same period. The company currently has $623 million in cash on the balance sheet with no short or long-term debt. SPXCY generates roughly $254 million in cash annually and yields 3.9%.

10. Collectors Universe (CLCT)

Collectors Universe provides authentication and grading services to dealers and collectors of high-value coins, trading cards, event tickets, autographs and memorabilia. We are always seeking situations where two or three companies dominate a market. Collectors is part of a duopoly (along with NGC) that dominates the grading of collectables such as coins and baseball cards. A company that needs almost no capital and generates enormous cash flow, management is focused on wise allocation of capital (or in the absence of that, return of capital).

Collectors has generated an average ROE of 29%, FCF/Revenue of 18%, and net margins of 12% over the past five years. Management has generated a return on capital of 31% over the same period. The company currently has $15 million in cash on the balance sheet with no short or long-term debt. Collectors generates roughly $8 million in cash annually and yields 9.0%.

11. Linear Technology (LLTC)

Linear Technology is engaged in designing, manufacturing and marketing line of high performance analog integrated circuits for companies in diversified industries. Linear’s focus on HPA chips allows it to generate returns unlike any other chip maker. As the clear leader in the space, the company has carved out a very wide moat that we see continuing for the next decade or two.

Linear has generated an average ROE of 80%, FCF/Revenue of 40%, and net margins of 34% over the past five years. Management has generated a return on capital of 63% over the same period. The company currently has $217 million in cash on the balance sheet with no short or long-term debt. Linear generates roughly $593 million in cash annually and yields 2.7%.

12. Novo Nordisk (NYSE:NVO)

Novo-Nordisk is a healthcare company that is engaged in the discovery, development, manufacturing and marketing of pharmaceutical products. The company has two business segments: diabetes care and biopharmaceuticals. As the preeminent leader in diabetes, the company has captured roughly one-quarter of the market and has opportunities to sustain steady growth for the next decade. The company has consistently focused on returns and ignored the M&A craze maintaining a rock solid balance sheet.

NVO has generated an average ROE of 53%, FCF/Revenue of 27%, and net margins of 27% over the past five years. Management has generated a return on capital of 58% over the same period. The company currently has $2.2 billion in cash on the balance sheet with no short or long-term debt. NVO generates roughly $4.4 billion in cash annually and yields 1.3%.

13. Expeditors International (NASDAQ:EXPD)

Expeditors International is the most profitable among the top 10 global freight forwarders in a fragmented industry. It currently has operations around the world but has its strongest presence in the Asia-North America trade lanes. The company operates in an asset light business model producing high returns on capital. We think the company has one of the most shareholder friendly managements in the portfolio.

EXPD has generated an average ROE of 19%, FCF/Revenue of 6%, and net margins of 6% over the past five years. Management has generated a return on capital of 32% over the same period. The company currently has $970 million in cash on the balance sheet with no short or long-term debt. EXPD generates roughly $500 million in cash annually and yields 1.4%.

14. ARM Holdings (NASDAQ:ARMH)

ARM Holdings PLC designs microprocessors, physical IP and related technology and software, and sells development tools to enhance the performance and energy-efficiency of high-volume embedded applications. ARM’s technology and patents are at the heart of processers used in nearly every mobile device. Its IP is assured through an interlocking set of patents that assure a competitive moat for an extended period of time. We think the worldwide growth of mobile devices and interconnectivity provides the company with a very long runway for profitable growth.

ARM has generated an average ROE of 14%, FCF/Revenue of 36%, and net margins of 24% over the past five years. Management has generated a return on capital of 26% over the same period. The company currently has $113 million in cash on the balance sheet with no short or long-term debt. ARM generates roughly $500 million in cash annually and yields 0.9%.

15. Visa (NYSE:V)

Much like our sister holding MasterCard, Visa runs a duopoly-based closed network credit and debit card networks. They currently have roughly 50% of all credit card transactions and 75% of all debit card transactions. A wide moat indeed. We think the movement to credit based economies will provide Visa with a fantastic long-term growth story.

Visa has generated an average ROE of 16%, FCF/Revenue of 40%, and net margins of 38% over the past five years. Management has generated a return on capital of 42% over the same period. The company currently has $3.5 billion in cash on the balance sheet with no short or long-term debt. Visa generates roughly $6.2 billion in cash annually and yields 0.7%.

16. Check Point Software Technology (NASDAQ:CHKP)

Check Point has been known as the leader in unified threat management for the past 20 years. It has spent the last several years retooling its offerings to meet the SaaS model as well as new competitors. Its moat is considerable as it is extraordinarily difficult to swap out UTM security for a new vendor.

Check Point has generated an average ROE of 19%, FCF/Revenue of 59%, and net margins of 44% over the past five years. Management has generated a return on capital of 39% over the same period. The company currently has $258 million in cash on the balance sheet with no short or long-term debt. Check Point generates roughly $930 million in cash annually and does not pay a dividend.

17. Waters (WAT)

Waters provides instruments used across the healthcare and food industries. They are utilized from biopharma R&D to quality control in food labeling. The company has been slow moving into adjacent markets (such as food labeling) where their high-end systems are vital to corporate safety and regulatory efforts. Management has used laser-like focus to not overextend or make acquisitions outside their core competency.

Waters has generated an average ROE of 33%, FCF/Revenue of 21%, and net margins of 23% over the past five years. Management has generated a return on capital of 51% over the same period. The company currently has $460 million in cash on the balance sheet, $1.5 billion in long-term debt, and $175 million in short term debt. Waters generates roughly $462 million in cash annually and does not pay a dividend.

18. Paychex (PAYX)

In another duopoly, Paychex (along with ADP) provides outsourced payroll services. While this area has been relatively stagnant over the past five years, Paychex has created cross-selling models that include PEO services, retirement plans, and other HR services. We expect these to drive growth as well as the return of normalized interest rates that provide significant “float” revenue.

Paychex has generated an average ROE of 36%, FCF/Revenue of 28%, and net margins of 25% over the past five years. Management has generated a return on capital of 38% over the same period. The company currently has $412 million in cash on the balance sheet with no short or long-term debt. Paychex generates roughly $800 million in cash annually and yields 3.4%.

19. Ansys (ANSS)

Ansys is the only complete systems provider in the engineering simulation software market. The company is generally considered the gold standard in its field with engineers around the world utilizing its installed base. We think the company’s ability to continue to take market share (in a very fragmented market) as well the tailwind of overall adoption rates will provide the company with a long-term future of moderate growth.

ANSS has generated an average ROE of 16%, FCF/Revenue of 35%, and net margins of 27% over the past five years. Management has generated a return on capital of 28% over the same period. The company currently has $776 million in cash on the balance sheet with no short or long-term debt. ANSS generates roughly $335 million in cash annually and does not pay a dividend.

20. Computer Programs and Systems (NASDAQ:CPSI)

Computer Programs and Systems provides enterprise-wide systems in order to automate data management of both financial and clinical data. The company is focused on rural and smaller hospitals where it has a lead against some of the larger EMR providers (such as Epic). The company recently announced the acquisition of Heartland that provides CPSI with a considerable stake in the long-term care market and increases market share to roughly one-quarter of the community hospital market.

CPSI has generated an average ROE of 48%, FCF/Revenue of 14%, and net margins of 15% over the past five years. Management has generated a return on capital of 27% over the same period. The company currently has $28 million in cash on the balance sheet with no short or long-term debt (Note: this will change with the acquisition of Heartland). CPSI generates roughly $38 million in cash annually and yields 5.2%.

21. Dolby Laboratories (DLB)

Most people know Dolby through their noise reduction headsets or the ubiquitous logo at the bottom of every movie credit. The company provides technology for both consumer and commercial markets. We think Dolby has done a good job as it continues to make preparations for the loss of a considerable amount of patents in 2017. The high growth days are over but the continued growth in the middle class provides ample growth opportunities for the company.

Dolby has generated an average ROE of 14%, FCF/Revenue of 25%, and net margins of 24% over the past five years. Management has generated a return on capital of 23% over the same period. The company currently has $531 million in cash on the balance sheet with no short or long-term debt. DLB generates roughly $114 million in cash annually and yields 1.4%.

22. Morningstar (MORN)

Morningstar provides two product lines – investment information and investment management. The same data that powers Morningstar.com's large data set also feeds into sites like Yahoo Finance (YHOO) and MSN Money (MSFT). Morningstar's customers also include institutional money managers, broker-dealers, and other investment advisors. We think the management Morningstar has a deep competitive moat with its fund rating services and its historical database. We expect high single digit growth over the next decade.

Morningstar has generated an average ROE of 16%, FCF/Revenue of 18%, and net margins of 15% over the past five years. Management has generated a return on capital of 38% over the same period. The company currently has $223 million in cash on the balance sheet with no short or long-term debt. Morningstar generates roughly $188 million in cash annually and yields 1.0%.

Conclusions

The Nintai Charitable Trust begins the year with roughly one-half of the portfolio added since last year’s report. We continue hold a considerable amount of cash (nearly 10% of AUM) even after the market decreases since the beginning of the year. Overall the portfolio presents one of the most profitable and highest return selection of companies we’ve ever owned. Is it guaranteed to outperform the great markets over the next one, three or five years? We have no idea and can make no promises to do so. But if we allow our managers to continue to achieve high returns on capital and let compounding work its magic, we are confident it can achieve adequate (for the Trust’s needs) returns in the long term.

RSS Feed

RSS Feed