The first he showed it to thought the word 'Hatter' tautologous, because followed by the words 'makes hats,' which show he was a hatter. It was struck out. The next observed that the word 'makes' might as well be omitted, because his customers would not care who made the hats. If good and to their mind, they would buy, by whomsoever made. He struck it out. A third said he thought the words 'for ready money' were useless as it was not the custom of the place to sell on credit. Every one who purchased expected to pay. They were parted with, and the inscription now stood, 'John Thompson sells hats.' 'Sells hats,' says his next friend! Why nobody will expect you to give them away, what then is the use of that word? It was stricken out, and 'hats' followed it, the rather as there was one painted on the board. So the inscription was reduced ultimately to 'John Thompson' with the figure of a hat subjoined."

- Benjamin Franklin to Thomas Jefferson on editing the Declaration of Independence

“When Wall Streeters tout EBITDA as a valuation guide, button your wallet.”

- Warren Buffett (Trades, Portfolio)

Many enthusiasts of Occam’s Razor [1] would tell you the simplest solution is most frequently the best solution. Franklin’s milliner was a victim of such thinking in his new business. At the Nintai Charitable Trust, we sometimes think solutions can be found simpler and more plausible after cutting through seemingly insignificant data or arguments. However, we’ve found there have been instances in the financial markets where Sir Occam’s approach – where less is more – is probably not the best approach and serves our investors poorly. An example of this is the use of EBITDA in calculating a corporation’s value and as a tool to assess an investment opportunity.

EBITDA: A (mercifully) brief history

The history of using EBITDA really caught the public attention during the wave of leveraged buyouts and M&A wave in the period from the mid-1980s to the height of the technology bubble in the late-1990s. EBIDTA stands for Earnings Before Interest, Depreciation, and Amortization. The final “duh” (DA) of EBITDA are the platypi of corporate finance. Both depreciation and amortization are non-cash expenses, meaning no cash is exchanged. They are also expenses based solely on subjective estimates by managers and auditors. On the auditing continuum they can be judged by experience, industry standards all the way to other end of the spectrum to what we rank amateurs might call “fraudulent intent.” Since the 1980s, the use of EBITDA has become far more widespread with talking heads on CNBC announcing such-and-such a company is trading 12 times EBITDA. But what exactly does that tell us about the company’s value? Is it a tool value investors should have in their quiver?

EBITDA: Financial alchemy in the modern world

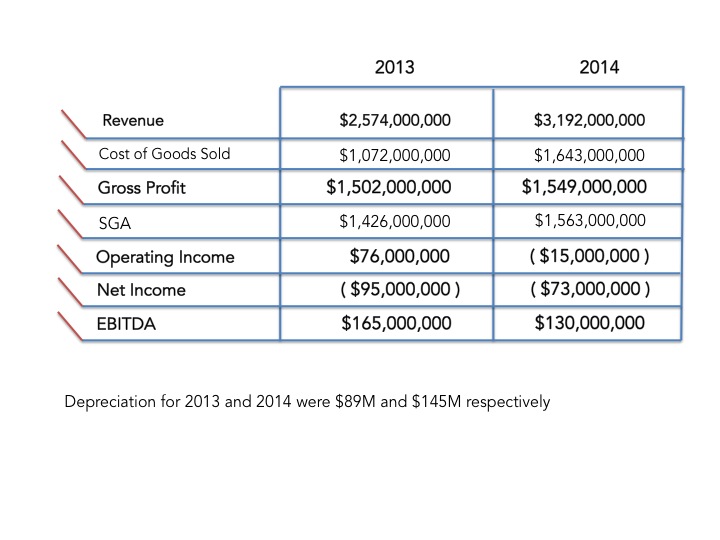

EBITDA has become such a normalized measure in today’s financial world, even companies without high asset and high capital needs are utilizing it on a regular basis for their earnings releases. A prime example of this has been Groupon (NASDAQ:GRPN) – the company that “drives more business though price and discovery.” In 2013 and 2014, the company showed losses of $95 million and $73 million by GAAP standards (see below). By announcing their numbers as EBITDA, the company miraculously turned these years into highly profitable periods earning $165 million and $130 million. We think the usage of EBITDA in these cases is particularly eggregious.[2] Beyond giving the company an entirely false financial façade, it calls in to question the judgment of both the company’s executives and board of directors.

For the Nintai Charitable Trust, EBITDA matters for several reasons. First, we enjoy valuing and investing in companies using a certain percentage of what we refer to as reality. For example, interest matters. Anybody who has seen what leverage can do (and debt is by its very definition leverage) knows that interest is a very real expense. Just ask any investor who saw their investments implode when what looked like free borrowing suddenly was cut off and their company was left in a situation not unlike a large bloated fish 50 feet from the water on an ebbing tide.

Equally important, EBIDTA can tell you a great deal about corporate management. Do these individuals really believe depreciation and interest can be taken “off-budget” as they say in Washington? Does a technology company really believe EBITDA is the best financial representation of their company? I would argue that anybody in the investment world – with the exception of the late Bruce “Bid ‘Em Up” Wasserstein – should and would look closely at any company making its business case with EBIDTA numbers.

Finally, I would argue that EBITDA has zero role in the calculation of value. We think Cody Boyte summed it up well when he said, “EBITDA does not take into account any capital expenditures, working capital requirements, current debt payments, taxes, or other fixed costs which analysts and buyers should not ignore. The cash needed to finance these obligations is a reality if the business wishes to grow, defend its position, and maintain its operating profitability (my emphasis)”. Perhaps Charlie Munger (Trades, Portfolio) put it most succinctly and pungently when he said, “I think that, every time you see the word EBITDA, you should substitute the word ‘bullshit’ earnings.”

Conclusions

As value investors, we are dependent upon the accurate and timely reporting of financial returns by corporate management. A considerable aspect of this is reporting financial data that is consistent with GAAP standards and gives both investors and the markets a reasonable reflection of a corporation’s financial status. EBIDTA has become a Wall Street proxy for cash flow or as a replacement for GAAP earnings. In doing this, both management and analysts are doing a grave disservice to investors. Much as Franklin’s milliner, investors should be equally disgruntled and leery by management that disposes of numbers in a similar fashion from their financials.

The Nintai Charitable Trust has no positions (long or short) in the companies discussed in this article.

[1] Occam's razor (Latin: Lex Parsimoniae or 'law of parsimony') is a problem-solving principle devised by William of Ockham (c. 1287–1347), who was an English Franciscan friar and scholastic philosopher and theologian. The thesis posits that among competing hypotheses, the one with the fewest assumptions should be selected.

[2] As was GroupOn claiming marketing was a capital expense thus increasing their EBIDTA returns. This is an example of why Warren Buffett (Trades, Portfolio) said, “References to EBITDA make us shudder”. Other examples include Waste Management’s (NYSE:WM) indestructible garbage trucks and WorldCom’s capitalization of nearly everything that wasn’t bolted down (and more).

RSS Feed

RSS Feed