- Neville Schuman

My fellow value investor John Dorfman and I were speaking earlier this month about outperforming and underperforming the market. I’ve written a couple of times about value investing and underperformance (you can find the articles here and here). At both the Nintai Charitable Trust and Dorfman Value Investments, the last five years have been difficult, as the broader indices have outpaced their respective returns.

In an article last year (“Underperformance and Value Investing”, April 10th, 2015) I discussed that vexing question of how long is too long for your investment manager to underperform. In that article I wrote:

“Studies have shown the famous Super Investors of Graham and Doddsville underperformed the markets roughly one-third of their investing career. What’s particularly difficult to understand is that it takes times of underperformance to achieve long-term outperformance. This is for several reasons. First, if a value strategy beat the general markets every year, then it is likely far more investors would follow this path. It’s the underperformance that drives most of these investors from the value model. Simply put, most people don't have the temperament to hold on through the down times. Second, companies purchased by value investors are likely undervalued and perceived in a negative light. The markets will eventually recognize their value but we – and here’s the kicker – just don't know when. This can lead to significant periods of underperformance. Last, there are periods (such as seen in the past few years) where investors focus on lower quality, higher-risk stocks that generate high returns. Why buy a company that makes farm tools when you can purchase a cloud-based green network that has doubled in the past 12 weeks?”

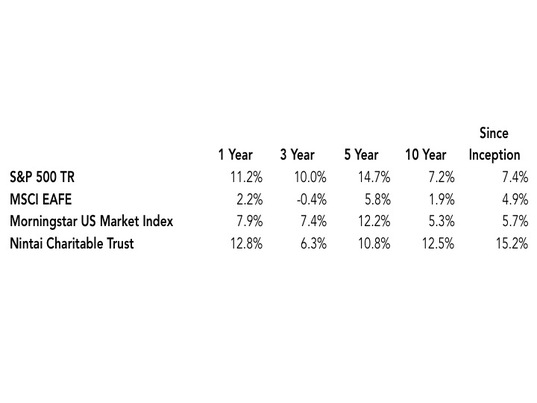

Since I wrote that, the Nintai Charitable Trust portfolio has been fortunate in outperforming the general markets. But our three (3) and five (5)-year performance numbers are difficult to explain to our investors. As seen in the table below, mid-term (meaning three to five years) performance has significantly lagged the S&P 500TR.

As disappointing as the Nintai’s three and five year returns have been, there are some mitigating data that offset the negatives. Three characteristics are seen in the portfolio that partially explains its underperformance – beta, valuation, and leverage. On all three counts the Nintai portfolio has been lower (less volatility, cheaper valuation, and less leverage) than the general markets.

Volatility

Over the past three years, the Nintai Charitable Trust’s beta has averaged 0.83. This means the portfolio has been 17% less volatile than the general markets. Combined with the fact 13% of the portfolio is currently in cash, volatility is considerably less than either the S&P500 or the Morningstar US Market Index. Volatility in itself isn’t necessarily a bad thing – large swings in prices provide value investors with buying opportunities. But market volatility frequently suggests market uncertainty. Companies in the Nintai Charitable Trust portfolio are generally more stable (from stronger financials and wider competitive moats) and better understood than other stocks.

Valuation

Over the past 5 years the Nintai Charitable Trust portfolio has traded – on average – between 5 to 15% below our estimated intrinsic value. As of September 30th, it is trading at a 9% discount. During the last 5 years the portfolio has captured roughly 2/3 of the S&P 500 gains. Looked at in a different light, the Nintai Charitable Trust Portfolio’s P/E has gone from 22 in 2011 to a P/E of 20 in 2016. The S&P 500 TR’s P/E has gone from 15 in 2011 to 25 as of September 30th, 2016. Much of the S&P 500’s gains came from P/E expansion (paying more for future earnings) making the index appreciably more expensive each year. Conversely, the Nintai Charitable Trust portfolio has decreased in expense (paying less for future earnings) and hence lagged the S&P 500 returns. Much like a spring contracting, the Nintai portfolio should (and that’s the operative word!) bounce back over time.

Leverage

Generally long bull markets assist in raising all boats. This includes companies that might not look so good when fundamentals shift – increased interest rates, consumer spending decreases, or limited access to the credit markets. The Nintai Charitable Trust (as well my holdings in Dorfman Value) tend to have extremely strong financials – little/no debt, generous free cash flow as a percentage of revenue, and high returns on equity, assets, and capital. Over the past three years we have seen the opposite of these stocks take flight – high debt, lower returns, and lower/no free cash flow. We think this is setting investors up for considerable losses if the credit markets tighten and/or an economic slow down happens. As Nintai’s former lead Board member once said, “it’s hard to go bankrupt when you don’t owe anybody money”. We couldn’t agree more. While not capturing the full upside of this bull market, we feel comfortable we are better protected on the down side.

Conclusions

It’s never easy as an investment manager to underperform the markets. An intense amount of self-imposed (along with investor) pressure begins to press for changes in the portfolio or the holding selection process. Charlie Munger said it best when he stated this isn’t supposed to be easy. The past 5 years has made his point all too clear. By keeping an eye on valuations, competitive moats, and financial strength our portfolio should experience lower volatility and greater protection on the downside. If that makes my role as capital allocator for investor funds more difficult, I can live with that. Our investors deserve nothing less.

RSS Feed

RSS Feed