- Joey Adams

“Not many like being an investor in down markets. Even fewer like it in bear markets. The latter is almost always made up of grinding weeks filled with lower lows, sometimes punctuated by a false rally, then returning to the gut-wrenching agony as markets continue their march downward. Anybody who lives through a bear market finds it hard to forget those memories. Anybody whose survived one – and was caught using leverage – never, ever forgets those memories.”

- Sally Hughes

As an investment manager, my job is to continually weigh risk and uncertainty and develop the best approach to maximizing my investment partner’s returns. That may entail either capturing the most an upside market or minimizing losses in a downside market as best I can. As we approach the end of summer in 2019, we are caught in the midst of a tremendous tug-of-war. On one side we have proponents of an ongoing market expansion. We currently have record low unemployment, slow – with somewhat steady economic growth in the 2 - 3% range, low interest rates, and plentiful capital to fund further expansion in the national economy. On the other side we have a plethora of economists and pundits warning on an impending recession. These individuals cite slowing manufacturing, decreasing transport rates, an inverted yield curve, escalating trade wars, and multiple global economies sliding into their own respective recessions. As an individual investor (or even an institutional one at that!) one can become overwhelmed by the mixed messages presented by the markets. It come sometimes lead to poorly conceived strategies, emotional responses, and negative outcomes. When markets begin to swoon - as they have in Q42018 and later in 2019 - it’s critical to have some core values to guide you in your decision making. These values must be grounded in solid investment theory.

Bear Markets are Only Bull Markets Inverted

As a value investor, dealing with bear markets usually comes after a period of overvalued bull markets. One should never lose sight of that. Every decision in both rising and declining markets must be based on value. Cleaving away emotional biases, market noise, and an escalating market-based panic/euphoria will be vital to keeping your head and making sound business decisions. After all, investing really is all about business. So when you think about bear markets - and all the emotions and fears that come with them - remember: down markets are really only the inversion of up markets. You didn’t panic when that home-building stock went up 300% since 2015. So why get so nervous now?

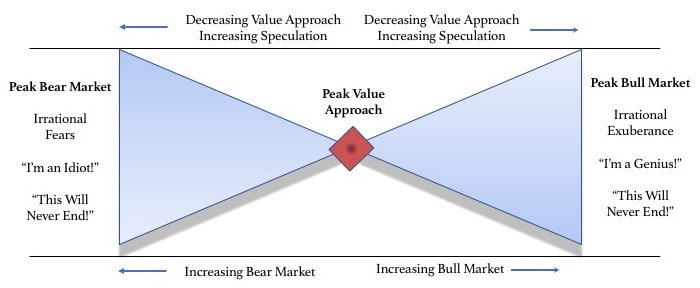

One of the things I’ve noticed over the years is that investors often act similarly in peak bull and bear markets. Investors begin to lose focus on the value approach and begin to see things in a more emotional or speculative approach. As seen in the graphic below, it is much like a bowtie in which bull and bear market behavior are simply mirror images. The same but simply inverted. If that’s the case – which I believe to be true – then theoretically value investors should fear bear markets as little as they fear bull markets. In fact, truly great value investors have a love/hate relationship with bull markets (nothing to buy until bull markets lead to bear markets which means opportunity) and they love bear markets (back up the truck!).

Ways to Mitigate Risk in Bear Markets

If we think of bear markets simply as an inversion of bull markets, how do mitigate risk as the markets turn? I thought I’d outline four major ways to mitigate this risk and discuss them in the context of our “bowtie model” I previously discussed.

Choice 1: Seek Neutrality By Taking Profits and Holding Cash

At Nintai, we see this as the closest method to sticking with our value investing approach. It prepares us to deal with both bull and bear markets. Remember our description: bull markets allow us to take profits and the bear markets allow us to make profits. At the height of a bull market, it is likely valuations will be stretched and likely to see some holdings reaching nose-bleed valuation levels. When this happens, be sure to happily sell some of your holdings (take profits) to that giddy person who irrationally thinks prices will always go up. In exchange for that, have cash available when the inevitable blow up happens and that poor giddy investor is now panic stricken and happy to sell you shares in great companies that are remarkably cheap compared to their intrinsic value (make profits). Use the inversion of market thinking to apply your core value investing approach.

Choice 2: Take Profits and Invest in Bonds

While this choice may have been the conservative one for the last generation of value investors, at Nintai we think this is more speculative than Choice 1 simply because of the structure and characteristics of the bond market in today’s world. With the explosion in lower credit quality and negative-yielding debt (I discuss this in greater detail in “Where Are The Prisoners: Debt and the Russell 2000”, found here, and “The Changing Face of Debt”, found here), simply using bonds as a parking place for cash is no longer a completely safe bet (US Treasuries might be the closest but even these face tremendous market pressures today). At Nintai, we don’t have the bandwidth to dig into individual debt instruments or bonds, and we think its likely most other individual value investors don’t either.

Choice 3: Go Net Short

Many hedge funds (hence the “hedge” in their name) will position their portfolios to be say 60% long and 70% short (using leverage) to be net short in their investment approach. This simply means they have positions that will hopefully increase in price (long) and positions where they hope the price goes down (short). When you sum the long positions versus the short positions, the fund will have more shorts then longs and hence be “net short”. We think this falls much further down the speculation part of our bow tie. One reason is that short positions have an unlimited amount of potential loss. This greatly changes the risk/reward dynamic placing far more risk into the equation. Second, we have found individuals need to have an extraordinary amount of knowledge about the company and its markets to bet on that venture’s failure. Unfortunately you see this type of investment approach happen more often at the end of bull markets. At Nintai, we’re not fans.

Choice 4: Bet on Volatility

As we reach peak bull markets and you sometimes have significant drawdowns like we did in Q42018, investors can see dramatic increases in the CBOE VIX index. This index (which can be traded on by using the VXX ETF) measures investor emotions by tracking S&P500. As described Investopedia: “The VIX is a real-time market index that represents the market's expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors' sentiments.” Let’s face it. If you had to look up the underlying a definition of some of this description, then you are at the very far end of the bowtie. In fact, you may be on the way to developing your own version of neck ware. At Nintai, we think on investment approach that - by its very definition is based on investor emotions - is the most rank form of speculation.

It Always Comes Back to Value

In the opening of my book “Seeking Wisdom: Thoughts on Value Investing” I discussed why it’s equally (if not more) important to think about how you invest than what are you invest in your portfolio. As talk of an impending recession gets louder, I think this statement becomes even more important. How you think about investing in a bear market is more important than what you invest in during that market. If I had one piece of advice, it would be that the concept of value (buying an asset at a significant discount to your estimated intrinsic value) become

critical as you prepare for a downturn. At Nintai, our number one concern is preventing the permanent loss of our investment partners’ capital. That risk is far greater in a recessionary economy and/or bear market than during an economic expansion where the tide raises all boats. During down markets, to make sure we stay focused on value we adopt several processes.

Our Arena is the Public Markets (or Stay Inside the Box)

As value investors, our arena is the domestic and international stock markets that trade securities. For the sake of my thinking, I limit my environment to these markets and these markets alone. It doesn’t include the larger investor community, the financial press, the commodity trading pits, investment blogs, or any other noisy and messy environment outside the NYSE, NASDAQ, the LSE, or the Paris bourse. The majority of my time is spent gathering data about companies that I own shares in. That vast cacophony of noise about interest rates, iron ore prices, the latest Presidential tweet, or what message the market is sending reading the latest inverted quadrangle ratio? It really means very little. All those magazines you read with the must own 30 stocks of 2020 or why the latest and greatest stock analyst only wears blue suits on triple witching day? Nope. Means nothing. And the fact that your neighbor made 6,000% on that closed-end fund that only invests in penny real estate stocks in Borneo? Nope. Nothing. Do yourself a favor. Draw a box on a piece of paper. Inside place the names of the stocks you own and the exchange they trade on. When something comes up on TV or in a meeting and you think it might be of interest in your investing, just check to see if it has anything to do with inside the box. If it doesn’t, it’s outside the box. And you know what that means.

Invert the Average Investor’s Reactions

As I discussed previously, investor reaction to bull and bear markets is remarkably similar. In both cases, individuals find themselves separated from data-driven, value-based decision making. Rather, emotions such as greed (bull) and fear (bear) drive investment decision that for many are costly in the long-term. We suggest you stay dead center in your own particular bowtie – use value as the core for all decision making. Whether taking profits (bull markets) and making money (bear markets) don’t let emotions rule the day. At the old Nintai Partners, we actually had an investor who put on a bow tie every time the market had dropped by more than 10%. He said that when he began getting emotional about significant drawdowns in his portfolio, he would finger the center of the tie and remind himself – “stay in the center, not the edges”. I can’t say I recommend this approach, but whatever way you can stay focused, use it.

Value Should Drive You to Neutrality

In an earlier discussion, I stated that bear markets are almost inevitably preceded by bull markets. These are usually accompanied by some form of asset bubble such as credit/real estate in 2007 or stock/industry group leading a New Economy like technology in 1999. During these bubbles, it’s likely that much of your portfolio will be pushing the upper-range of your estimated intrinsic value. Many times you will see holdings reaching 130 – 140% of your estimate. If you are a disciplined value investor, you will be taking profits by either trimming positions or selling them outright. This conversion should drive cash as a percent of total holdings to what might be perceived as shocking levels. You will reach these levels because finding replacements for these holdings will be few and far between. Now you may be saying right now “Tom is an idiot. I know to buy low and sell high”. You may say that to yourself, but if you carry that out you will be the rare bird indeed. Peruse nearly any mutual fund material today and it is likely they still remain at less than 5% cash. With an average turnover of 75% - 100% annually, that means many funds may be selling - but they buying an awful lot of stocks at inflated prices. As an individual investor, you have the blessing of maintaining cash at any level you like. Let the bull market drive you into neutrality. Let value force you into cash by taking profits and not overpaying for replacements.

Conclusions

One of the major themes in the questions I receive has centered on how Nintai thinks about down markets and how Nintai Partners did so well in the last bear market. This is the first article in a series that will discuss how value investors might try to prepare for an oncoming bear market. This first looked - at a very high level - at how the value process is actually similar in both bull and bear markets. It’s also about the importance of thinking about the “how” and not the “what” when it comes to value investing in down markets.

Speaking of the “how”, by their very nature it would seem that value investors have a leg up when it comes to preparing for the inevitable market crash. But that’s not necessarily the case. If you look at some the great value investors of the last several decades and their performance in the 2007 – 2009 market crash, it’s shocking to see that many of them underperformed the markets. In my next article, I will discuss how easy it is (even for value gurus) to wander away from core value principles. I will use the 2007 – 2009 crash as an example and discuss what happened in some specific cases. I will include several instances of Nintai’s forgetting about the “how” and focusing only on the “what”.

RSS Feed

RSS Feed