- e.e. cummings

Recently someone sent me a copy of my 2016 presentation at the Gurufocus conference and had some questions about my comments on Valeant. I believe the phrase used was that “I wouldn’t touch it with a ten-foot barge pole”. As I pointed out at the time, Valeant’s model of purchasing rights to drugs – some patented, some not – and dramatically rising prices wasn’t a long-term market strategy. Partnered with taking on $30B in debt for drug products that weren’t worth nearly that, and you had a ticking time bomb. I stated at the time there were some great quality businesses hidden in the story. The company seems to agree, with management announcing it was changing its name to one of these gems - Bausch Health.

I bring it up as I own another asset-light in-licensing biopharma in several of my clients’ portfolios – Biosyent (TSI: RX or OTC: BIOYF). I purchased shares in the company in late 2017 and expect to be a long-term owner in the company. Similar to Valeant, Biosyent seeks out products that have underperformed (through lack of marketing dollars, lack of product fit, etc.) and in-license them to fully support an integrated sales and promotional strategy.

There are obvious differences between Biosyent’s business strategy and that employed by the former Valeant. The most significant differences are outlined in Biosyent’s three

criteria when looking for in-licensing or acquisition opportunities.

- Be a unique product with a specific market niche.

- Provide either a therapeutic or technology advantage for patients and healthcare professionals (HCPs).

- Have strong market support with defendable intellectual property rights.

Compare these criteria with Valeant’s purchase of Sprout Pharmaceuticals in 2015. Sprout had recently received a controversial approval from the FDA to market Addyi, its female version of Viagra. The drug had initially been rejected after poor clinical trial data and finally received approval after a series of shaky clinical reviews with documented side effects when combined with alcohol or other drugs. With this, Addyi had already violated Biosyent’s second criterion. After purchasing Sprout for over $1B, the company assured Wall Street it would quickly recoup its purchase price by doubling the initial drug price from $400/dose to $800/dose. It also estimated drug sales would top $1B in its first year of sales. This number was lowered to $300-$400M later in the year then lowered to $100M. Actual sales came in $27M – a miss by over 99%. These numbers demonstrated Valeant violated Biosyent’s first and third criterion. In the end, Valeant was forced to write off roughly $940M of the Sprout acquisition as bad debt.

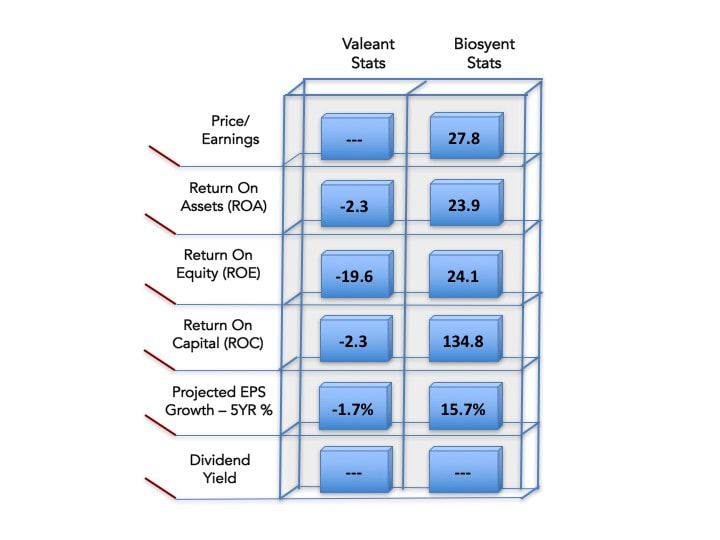

It shouldn’t come as any surprise that a comparison of key measures I look for in an investment were (and still are) vastly different between Valeant and Biosyent in 2016.

The ability to shy away from those “can’t lose” opportunities where management are “shifting paradigms” can be excruciatingly difficult. When all the heroes at the local cocktail circuits are talking about “creating synergies” standing pat doesn’t make you a great conversationalist. To paraphrase mr. cummings, the hardest journey in life is sometimes just fighting to be you – a value-driven investor. In that attempt, I believe value investors should keep several themes in mind. (Note: not all value investors - such as Mr. Buffett’s cigar-butt method - agree with these. I’m just more comfortable with is approach. Even my own friend and co-worker John Dorfman thinks me mad as a hatter sometimes).

Addition is Generally Better than Subtraction

As most people in private equity will tell you, investing in a company and providing increased capital to grow the business is far different (and potentially easier) than purchasing a failing one, slashing costs, and trying to right the ship. My nature in general is to avoid situations like the latter simply because my brain isn’t wired like that. Biosyent’s model – by its very nature – makes greater sense to me and I believe offers a better model for employees, patients, and shareholders. Biosyent management is focused on growing the top and bottom line with a laser-like focus on margins and returns on equity and capital. Growth for growth’s (and Wall Street’s) sake is not a generally successful long-term strategy.

Capital Allocation is Critical

Biosyent’s focus on defensible products with clear IP rights, and a well-researched market base makes capital allocation a helluva lot easier than buying a pig in a poke and trying to confer thoroughbred status on the poor creature (how’s that for a mixed metaphor?). The example of Valeant’s acquisition of Sprout is an outstanding example of poor allocation of capital. Biosyent’s management measures its success on its ability to identify a potential target, purchase it at a fair value, and execute a commercial strategy that generates high internal rates of return on their acquisition. You really can’t ask much more from management.

To Thy Own Self Be True

Biosyent has never deceived itself into thinking they are transforming the biopharmaceutical industry. Rather they see themselves as simply arbitraging away a difference between missed opportunities and market needs. They provide outstanding products to patients with diverse needs in smaller niche markets. They have not gone on record as destroying the pharmaceutical model, ridiculing research and development, or gaming the system on pricing. I’ve often used a quote from my first boss who said people get in real trouble when they begin to believe the lies. At the end of the day Biosyent is a biopharmaceutical company providing patients with medicines that improve – and sometimes – save lives. Nothing more, nothing less.

Conclusions

Ai its core, capitalism is (or should be) about capital seeking the best possible return on its investment. Great management will achieve great returns on that capital over a long period of time. The difference between Valeant and Biosyent couldn’t be more stark. Finding management similar to Biosyent’s is a rare event. Given time they will do the heavy lifting in your portfolio’s returns. By not straying into the public domain and being roundly abused by the latest TV carnival barker, individual investors can win that battle e.e. cummings warned against. In the end, the victory will be all the sweeter knowing your returns are uniquely your own.

Disclosure: Biosyent is held in several individual accounts managed by the author.

RSS Feed

RSS Feed