Getting these numbers to accurately reflect returns has been quite an adventure. As many of you know, I left Dorfman Value Investments and opened my own investment firm - Nintai Investments LLC - on October 1 2018. The numbers in this report reflect a composite of fees from both Dorfman Value Investments and Nintai Investments LLC. The Hayashi Foundation charges a set 0.25% management frees and calculations were made on the yen/dollar conversion as of December 31 2018.

While I was pleased with the both the individual portfolio’s and Hayashi Trust’s relative performance for the year (beating the S&P 500 by roughly 5.5% for 2018), absolute returns were disappointing across the board. Even with cash at nearly 25% of total AUM for the most of the quarter (and year), the composite portfolio lost -14.1% in the 4th quarter. This is extremely disappointing. 2018 4th quarter’s underperformance was caused by a widespread drop in multiple portfolio holdings. I deliberately invest in companies with pristine balance sheets, deep economic moats, and growing free cash flow to offset losses to the downside. With double-digit drops in 17 of the 21 portfolio holdings during Q4, I added to positions aggressively over the second half of 2018.

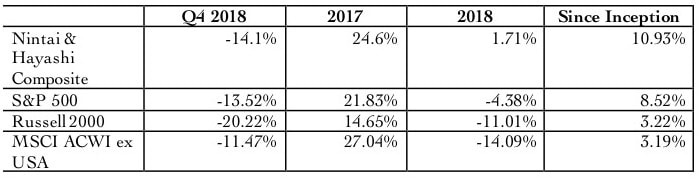

For the year, the Nintai Investment’s (and previous DVI) portfolios plus Hayashi Foundation outperformed the S&P500 1.71% (net of fees) to -4.38%. Last year, my significant cash position was a drag on returns. In 2018, the case was altered. Here are the Nintai Investment and Hayashi Trust account returns for periods ended December 31, 2018.

There weren’t many areas to hide from the losses in 2018. The only two major sectors to show positive returns were utilities (+0.5%) and healthcare (+4.7%). Others showed medium losses such as consumer discretionary (-0.5%), information technology (-1.6%) and real estate (-5.6%). Others showed substantial losses including consumer staples (-11.2%), financials (-14.7%), industrials (-15.0%), communication services (-16.4%), materials (-16.4%), and energy (-20.5%)

2018 was the year the bull market ended in a series of spectacular drops and rises rarely seen in the past decade. The Trump Administration’s announcements to impose tariffs on China, negotiations on a new NAFTA treaty, criticism of the Federal Reserve Board on its rate policy all added to a profound sense of uncertainty in both the economy and the markets. At Nintai Investments LLC and the Hayashi Trust, for most of the year I found the risk/reward of market highs combined with these aforementioned macroeconomic issues quite poor for value investing. Our large cash position allowed me the opportunity to take advantage of mispricing late in the 4th quarter of 2018.

Last year I discussed with my investors my role as an allocator of capital seeking to maximize returns while simultaneously minimizing risk. As a value investor, the opportune moment of low risk and achieving potentially high long-term returns is a rare moment in time. Mispriced value – combined with the high quality I look for in portfolio holdings – might come along every 6-8 years. I’ve written previously these opportunities at mispriced value can happen in one of two ways (or both). First, the markets suffer a collapse of confidence and the general indices head towards (or enter) bear market territory. The second is when a great company misses Wall Street’s expectations and the stock price drops below my estimated intrinsic value. The latter part of 2018 has seen both of these. As I write at year end, many major indices are close – or already in – bear market territory.

Additionally, 12 of the 26 holdings in the individual portfolios and Hayashi Trust dropped at least 10% since purchase. In nearly every case, I added substantially to my existing position.

The Losers

Going hand in hand with holding cash during a downturn, the ability to not permanently impair capital is the second-best way to assure adequate long-term returns. Each of the companies listed as losers this year saw me double or triple my positions over the course of the year. I am confident that none of these companies will come remotely close to creating a permanent loss to my investments.

Loser: Computer Modelling Group (CMDXF)

Computer Modelling Group is a Canadian software company that specializes in integrated analysis and optimization, black oil and unconventional simulation, reservoir and production system modelling for the petroleum industry.

The decision to purchase CMDXF has been proven to be a net negative in nearly every possible way. Oil prices continue to drop, licensing fees continue to drop, and revenue continues to slightly contract. The upside? Free cash flow grew slightly in 2018 and the company continues its generous dividend policy with a C$0.10 dividend creating a yield of 6.90%. That said, we have been steadily adding to the CMDXF portfolio with 5 additional purchases in Q42018.

I continue to be impressed with Computer Modelling Group’s management and am impressed with the Board’s decision to hire Ryan Schneider, formally COO, as the new CEO. I believe Ryan understands the necessary steps required to get CMDXF back onto a growth trajectory. Oil reserves are increasingly in areas where extraction costs are nearly cost prohibitive. The ability to calculate potential reserves without drilling will become increasingly important. Computer Modelling Group’s platform and strength of their IP leads me to be confident demand will remain strong over the next decade.

Loser: Cognex (CGNX)

Cognex (CGNX) provides machine vision products that help automate manufacturing processes. The firm’s products include vision software, vision systems, vision sensors, and ID products. Vision sensors deliver simple, low-cost solutions for common vision applications, such as checking the size of parts. ID products read codes that have been applied to items during the manufacturing process. Cognex generates the largest proportion of its sales in the United States and Europe. Cognex is a gem of a business. In July 2015, CGNX completed the sale of its Surface Inspection Systems Division (SISD) to AMETEK for $156 million in cash. With the sale, Cognex is focusing their efforts on discrete manufacturing where they see the greatest growth potential (11-13%) in discrete vs. slower growth (5-7%) in surface inspection.

Cognex has an outstanding balance sheet and set of financials. It has no short or long-term debt, $405M in cash on the balance sheet, and generates $196M in free cash flow. The company’s 86.9% return on capital far outweighs its 14.04% WACC. Cognex converts 26% of revenue into free cash and generates mid-teens ROE. The stock trades at an 19% discount to my estimated intrinsic value and yields 0.48%.

Sine my initial purchase, I’ve made 3 additional purchases, and with its value as it is wil likely be buying more.

Loser: Biosyent (BIOYF)

Biosyent is a specialty pharmaceutical company focused on in-licensing or acquiring innovative pharmaceutical and healthcare products. The company markets these pharmaceutical products in Canada and in other international markets. Biosyent seeks out products that have underperformed (through lack of marketing dollars, lack of product fit, etc.) and in-license them to fully support an integrated sales and promotional strategy.

I wrote about Biosyent’s strategy in much greater detail in an article entitled, “Valeant and Biosyent: Opposites Don’t Attract”. In it, I discussed the difference between Valeant’s strategy of purchasing drugs with dubious track records, assuming huge amounts of debt, and raising drug prices by up to 4,000%. Compare this to Biosyent’s strategy of purchasing quality drugs that simply don’t have the marketing budget to get promoted or acquiring molecules in late stage development and you have two very different companies.

Biosyent has a strong balance sheet. It has no short or long-term debt, $17.3M in cash on the balance sheet, and generates $4.7M in free cash flow. The company’s 58% return on capital far outweighs its 6.4% WACC. Biosyent converts 28% of revenue into free cash and generates mid-30s ROE. The stock trades at an 15% discount to my estimated intrinsic value. As the stock price has dropped, we added significantly to our position with purchases in October and November 2018.

The Winners

Winner: Cash

For most of the year cash looked like it was going to be a drag on returns as it had been since 2011. The last three months of 2018 it completely redeemed itself. I’ve often mentioned that real value investors make their names in market downturns, not bull runs. This adage has served me well in the past and will likely continue into the future. At its peak, cash represented roughly 42% of my total portfolios.

Winner: iRadimed (IRMD)

iRadimed was up roughly 61% for the year. iRadimed engages in developing, manufacturing, marketing, and distributing magnetic resonance imaging (MRI) compatible products such as IV pumps and other electronic equipment.

iRadimed is one of those stocks that you purchase and then it immediately drops by 30%. At times like this, it is essential you know the business inside and out. If the business case is broken, you are faced with a difficult choice. If the business case remains valid, then it is time to make additional – and significant additions - to the position. In IRMD’s case, the latter represented the case and I took the opportunity over the next 6 months to nearly triple the size of the original purchase. The 35% run up during the latter part of 2017 and then 61% in 2018 was driven by excellent management execution, strategic capital allocation, and FDA approvals that brought the stock to record highs.

Winner: Novo Nordisk (NVO)

Novo Nordisk is a Danish healthcare company. It is engaged in the discovery, development, manufacturing and marketing of pharmaceutical products. The company’s business segments include, diabetes and obesity care, and biopharmaceuticals. As a pioneer in diabetes care, Novo Nordisk has been developing diabetes care products since early 20th century. It currently garners slight over one-quarter of the $45 billion branded diabetes treatment market. The next two decades will see enormous growth in the diabetes market. As obesity and age take their toll, the diagnosis and treatment of the disease with markedly increase until 2037.

As a leader in modern insulin analogs, NVO leads in long-term (Levemir) and short-term (Novolog) as well as oral-to-injection transition (Victoza). The company just a significant boost in clinical trial data showing its ultra-long insulin is more effective, has greater dosing variables, and less risk of hypoglycemia. All of these led to solid 2018 gains.

Conclusions

2018 was one of the more interesting years I’ve had in my investing career. The end of a bull run is never a pretty picture unless you have loads of cash you are looking to put to work and can find those price to valuation disconnects that get every value investor’s heat pumping. I’m proud of the work of the many researchers who helped me identify, rep art, and make assessments on companies barely in my circle of competence. I am grateful for clients who have had the confidence that their investment manager needs the freedom to wait for the right moment. But I am most grateful for friends, family, and co-workers who helped me through the course of the year as I dealt with professional changes and medical treatments that saved my life. I wish everyone a happy and prosperous New Year.

RSS Feed

RSS Feed