- John Houseman for Smith Barney

If you are old enough you can remember those commercials in the early eighties with John Houseman sitting in front of a burning fire in some gentleman’s club telling viewers that Smith Barney makes money the old fashioned way - they earn it. I was never quite sure what they meant by that, but it certainly was a great line delivered by a great actor.

At Nintai we like to think we make many the old fashioned was as well - by simply outperforming the markets. This too is also a great line, though we have no John Houseman to deliver it. Rather than a great marketing line, the only way we know of backing up our claim is through performance. During my time at Nintai Partners - and subsequently at Nintai Investments - there have been two salient facts that have driven our outperformance (of course past performance is no assurance of future returns).

First, the value of cash becomes outsized in that its value does not drop and its ability to purchase downtrodden stocks becomes vital. Having dry powder to take advantage of mispricing in the markets becomes essential for long-term outperformance. Second, during genuine market corrections (drops by at least 20%), correlative values (meaning the difference in returns between value and growth, small and large, etc.) generally merge to roughly 1. This means everybody does equally poorly. If value stocks drop by 20%, then growth stocks drop by roughly 20%. Having the ability to remain calm and sticking to your core valuations - and buying when stock prices hit the required margin of safety - are two emotional and intellectual prerequisites to being a great value investor. In my next two articles I want to discuss these two factors – the strength of the cold hard cash and the drop to mutual correlative values in market corrections. In the final analysis, most of the value we add at Nintai Investments does not come in bull market, but rather our defensive nature and positioning when bear markets come about over time.

In part 1, I thought I’d use three individual Nintai Investments to discuss the value (and cost) of holding large cash positions over the past year. Over the past several years,

I‘ve written extensively about the underlying power of cash. I have described its strength in the terms of what the armed services refers to optionality. This means that

cash gives you the ability to play defensively and offensively when certain assets reach an adequate margin of safety.

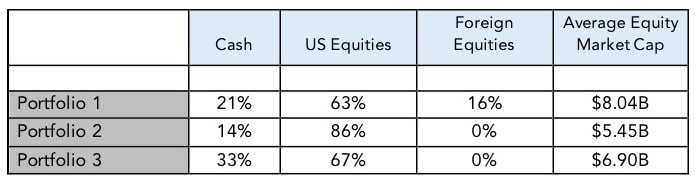

Below, you will see 3 Nintai Investment individualized accounts breaking out cash as a percent of AUM, US equities and foreign equities as a percent of AUM, and the average portfolio equity market cap. The 3 portfolios’ cash positions range from 14% of total AUM to 33%. I should point out that Nintai Investments generally holds cash – not bonds – as we believe bond prices are as distorted as equity prices.

I’ve often said that I made my record at Nintai Partners Fund by losing only 18% in 2008 and making 71% in 2009. Every other year was actually not that different thanthe general markets between 2002 - 2015. Indeed, some of these years (particularly 2013, 2014, and 2015 I really underperformed).

What To Learn from Severe Drawdowns

When markets drop 2-3% every day for 2 straight weeks, even the most sanguine investor can get sweaty palms and feel the first pangs of fear in the gut. But I’ve never been involved in severe drawdowns when there hasn’t been – beforehand - a run up of truly magnificent proportions. Whether it was the technology bubble in 1999 - 2000, the real estate/CDO/MBS bubble in 2006 – 2007, or the ten year bull market from 2009 - 2020, prices have generally reached nose-bleed levels before the inevitable sucking sound of the drawdown. During the end of those run ups, successful value investors will be arguing with other market participants that 30 - 40% cash positions aren’t that unreasonable.

By the end of December, I found my investment partner portfolios were ranging from 15 - 30% cash. Any buys I might be adding to accounts were additions to existing positions. Nearly every report update had a section on cash - explaining why percentages were so high and its impact on returns. While slightly outperforming the markets, it was touch and go as the large cash positions were taking a toll on the continuous upward pressure of the bull market.

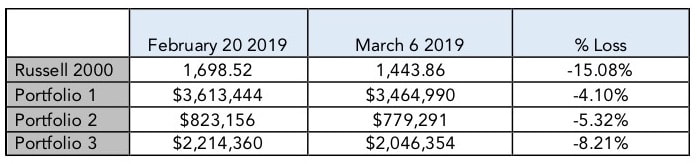

Then came the last two weeks at the end of February 2020 to the beginning of March 2020. During this time, the markets went on a roller coaster ride down 1,000 points one day and up 800 the next. However, the over trajectory was down - with the S&P 500 losing 14% over the roughly 2 week period. As I discussed earlier, the large cash positions helped each portfolio outperform the general markets.

What Can Be Learned?

Most professional money managers don’t have the luxury of holding large percentages of their assets under management in cash. Many feel they must be “all in” when it comes to their clients funds as inaction represents lack of effort.

Cash Acts Like a Portfolio Anchor

At Nintai we feel very different than most players on Wall Street. Our actions – in this case represented by the holding of cash – represents wisdom in not overpaying for an asset and awaiting the right opportunity to come along to deploy capital. In these cases, cash acts as an anchor against permanently impairing capital in down markets. After a stock has dropped by 55% in 30 days, it’s pretty hard to see a recovery over the short - or even long - term, while cash hasn’t dropped an iota in the same scenario.

Cash Has Immediate Use

One of the most powerful aspects of cash is the fact is you never have to think to act when action is necessary. If one owns bonds, then you have to calculate the bid/ask or the current price per share if you own them in a fund and calculate if you want to take the loss or pay the tax to cash out and use the proceeds in purchasing another asset. Not so with cash. You can purchase the asset in seconds and not give a thought to price conversions, long or short term capital gains, or whether the price is equal to the amount of shares you are looking to purchase. Cash has immediate purchasing power – which is a huge advantage in crazily volatile markets.

Cash Can Go From Defensive to Offensive Instantly

Nothing beats cash when it comes to optionality. If you think a stock has reached its bottom, or even has just passed its point of an adequate margin of safety, then cash goes from an immediate defensive tool to an offensive tool. It no longer protects to the downside but rather covers the opportunity of the upside. There is simply no tool in the financial markets that can provide such a change in strategy so quickly.

Conclusions

In this time of financial volatility - when not every investor is asking “how much many will I make today” but rather cowering in their home unwilling to open their statements or go on the computer to check their balances - the ability to have an anchor to windward that protects against the downside and offers instant opportunity to take advantage of new opportunities is a powerful tool. The ability to sleep better at night because you know you’ve made provisions against the downside is vastly underrated as an investment position. If you have positions that are 20 - 30% above your estimated intrinsic value, don’t hesitate to pay the taxes, lock in the profit, and have some cash ready to purchase some potential long term bargains as the markets fluctuate as severely as they have in the past few weeks. My guess is you won’t regret it and you might it find yourself more relaxed and salivating at some potential stock you’ve had your eye on for several years but was never in your price range.

As always, I look forward to your thoughts and comments.

RSS Feed

RSS Feed