- Charlie Munger

“The risk of paying too high a price for good-quality stocks - while a real one - is not the chief hazard confronting the average buyer of securities. Observation over many years has taught us that the chief losses to investors come from the purchase of low-quality securities at times of favorable business conditions.

- Benjamin Graham

Since the 2009 bottom of the 2007 - 2009 market crash, we’ve had an over decade-long market expansion which has provided investors with the longest bull market in recent history. For those at the end of their investing career, this has been a huge tailwind allowing for far more generous performance any would have thought possible. During these types of market runs, the old adage of “a rising tide raises all boats” certainly rings true. Just look at these returns for 2019: Dow Jones up 21.7% YTD, NASDAQ up 28.2% YTD, S&P 500 TR up 26.1%, Russell 2000 up 18.9%. Every sector is up double digits in 2019 with the exception of Energy Capped (up 5.1% YTD). All other sectors range from a low of Healthcare (up 15.8% YTD) to a high of Technology (up 38.5% YTD). With such returns every investor is a hero of their own financial story.

I thought I’d take a different tack in this article to explain why Nintai Investments sees the past five years less through rose-tinted glasses and more through lenses that always see risk around the corner. Since opening our new investment services business in 2018, we’ve both underperformed (in the first year) and are now outperforming when measured since inception. We’ve really come into our own over the past quarter as the markets recognized the value of high-quality companies with strong returns on capital, equity and pristine financials. Our returns over the last 3 months have been 10.77% compared to the S&P 500’s 6.71%. (Note: past performance is no assurance of future returns). Our returns have been 15.72% (including fees) since inception versus the S&P 500’s 13.87%. This isn’t to boast about our performance (though we - and our investment partners - are pleased) but rather to point out that we believe Nintai’s approach of purchasing extremely high quality businesses at fair prices and holding them for extended periods can outperform both bull and bear markets (again: past performance is absolutely no assurance of future returns). As we look around and see record highs all around us, at Nintai we continue to clear the deck for foul weather and prepare for the inevitable (significant) market correction. With that in mind, I thought I’d discuss Nintai’s approach and the relatively simple process we employ in meeting our strategic goals.

Better Quality, Cheaper Prices

At Nintai we believe in a fundamental investment concept. If we invest in a bucket of companies with significant advantages in quality (higher returns on capital, equity, assets, free cash flow margins, no debt, etc.) combined with valuations (a blend of cheaper attributes including estimated intrinsic value from our DCF models and cheaper PE ratios), over the long-term we can expect to outperform the broader markets.

The concept of purchasing higher quality companies or looking to purchase shares at a discount to estimated intrinsic value isn’t anything new to the value investment community. I have found it is rarer to combine the two as a foundation for your investment strategy. When I utilize Morningstar’s portfolio manager research tools to find funds with a high match rate to Nintai’s holdings, I’ve found only 2 (two!) with a greater than 25% overlap with our portfolios. With numbers like this, you can see it’s rather rare to find the concept carried out on a regular basis. What’s equally rare (as far as I can see) is articulating the idea that the highest quality companies purchased at good prices can provide significant downside protection during a bear market. In general, I’ve found that companies and management that generate great returns on capital and have little or no debt are businesses that thrive in bull or bear markets and in expanding or recessionary economic times. Combined with holding significant cash, I feel comfortable that when the inevitable market tumble comes along, I’ve reduced the risk of capital impairment as best as I can in today’s markets.

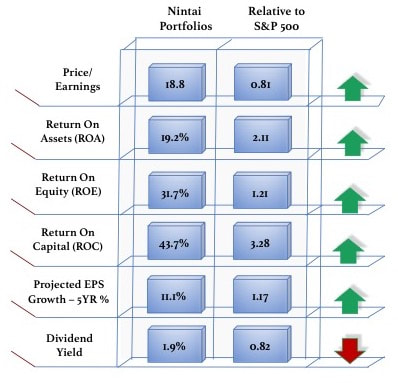

Nintai’s Abacus reports give a quick graphic overview in how we are doing in meeting the goals of a portfolio consisting of outstanding quality at value prices. Later on, I will walk readers through the summary report and take a look at how we are doing in meeting Nintai’s investment strategy.

It All Starts by Finding Corporate Excellence

Any research we do at Nintai starts with locating companies with outstanding business characteristics. We locate these in multiple ways – GuruFocus’ All-in-One Screener, conversations with thought leaders, meetings with corporate executives, etc. Once we’ve found a company that meets our criteria we will begin the in-depth process of really understanding the company’s strategy, products, markets, competitors, etc. If we’ve done our job we can run a summary “Quality” report on Nintai Abacus and make sure the portfolio is meeting our strategy.

Let’s use a blend of our investment partner portfolios to demonstrate what I mean by a “Quality” summary report. In November 2019 on average, the Nintai Investment portfolios shared the following attributes: return on capital (42.8%), return on equity (31.7%), and return on assets (19.2%). This compares to the same numbers for the S&P500 (source: Morningstar’s “Portfolio X-Ray” reporting function): return on capital (3.28[1]), return on equity (1.21), and return on assets (2.11). These numbers show that – in general – Nintai’s portfolios have created a basket of holdings far more profitable than the S&P 500. Additionally, the debt-to-equity ratio of the S&P 500 (as of August 2019) stood at 0.89 (source: Haver Analytics and Standard & Poor’s) versus 0.023 for the Nintai portfolios.

Why are all the numbers important? First, a basic tenet at Nintai Investments is to prevent permanent impairment of our investment partners’ hard earned capital. We’ve found over time that companies with little or no debt[2] and who are also highly profitable (both from a free cash flow perspective as well as capital returns) minimize that risk. Second, we’ve found that management teams who act prudently with their investors’ capital are great stewards to partner with over a decade or two. Last, companies with these characteristics are generally outstanding businesses with outstanding fundamentals and deep competitive moats. All three of these play a vital role in preventing a blow up in the portfolio that can lead to truly horrendous losses. At Nintai, everything begins by investing in outstanding quality.

Finding Value in a Value Investment Strategy

Finding outstanding, profitable, and prudent companies is of course only half the battle. Buying them at a discount to my estimated intrinsic value is the second piece of equally important halves. In finding value, we use two different and distinct methods. The first is company specific. We utilize a discounted free cash flow model to ascertain the value of each individual holding (or potential holding). As this information is proprietary, I will simply say the aggregate price-to-value ratio for the Nintai portfolios is currently 0.91. This is to say our portfolios currently trade at a 9% discount to our estimated intrinsic value. Values range from 137% (overvalued) of our estimated value to 72% (undervalued). As a portfolio of individual stocks, we see some investment opportunities in several holdings trading at significant discounts to their estimated intrinsic values.

The second approach we take to value is comparing the total portfolio to the S&P 500. This gives us an idea as to how the portfolio’s value is to the general markets. While we put a great deal of effort into the DCF model, we think looking at the broader markets is equally valuable. There are two numbers we look for in these market reviews. The first is how our portfolios’ price-to-earnings ratio look against the S&P 500’s ratio. This tells us how expensive the portfolios are against the broader markets. The second is analyzing the portfolios’ 5-year earnings growth projections against the S&P 500. This gives us a look at whether we are paying more or less for future growth versus the general markets.

The S&P 500’s price-to-earnings ratio - as of November 2019 - (source: www.multpl.com) stood at 22.95. The Nintai portfolios’ average price-to-earnings ratio was 18.8 at the same time - an 18.1% discount to the S&P 500 PE ratio. This tells us the Nintai portfolios are currently trading at a significantly cheaper rate than the S&P 500. Great news. In addition, the Nintai portfolios have a 5-year estimated earnings growth rate of 11.1%. This is roughly 17% greater than the estimated S&P 500 rate. We now know the portfolios are cheaper than the S&P 500 as well as estimated to grow earnings significantly faster. What’s not to like about those statistics?

Putting It All Together

While it’s nice to have these numbers at our fingertips, they aren’t really that helpful to our investment partners. We created the Abacus reporting system to graphically demonstrate the quality and value components of each portfolio. This allows investors to use a single graphic to measure how their portfolio stacks up against the S&P 500. Seen below is a summary portfolio report of all the Nintai portfolios wrapped up in a single page report.

- Does the portfolio meet our quality criteria in general and against the S&P 500 specifically and;

- How does the portfolio compare in value against the S&P 500?

A number we look at carefully is the combination of the S&P 500 P/E relative number as well as the S&P 500 projected EPS growth relative number. Here we combine the fact that the portfolio is 18% cheaper than the S&P 500 and is estimated to grow 17% faster giving us a 35% “combined value rate (CVR)”. We are satisfied with a CVR over 25%. We have nearly always outperformed over the next 3 - 5 years if the number exceeds that amount. Equally important is adding up the S&P 500 relative number for ROC, ROE, and ROA. Here we look for a sum called the “combined quality value (CQV)” greater than 5. The current portfolio CQV is 6.6.

Why This Matters

A lot of readers will point out that looking for quality at good prices is just common sense. I completely agree. Yet its extraordinary to me that so few investment managers practice such an investment strategy. All too often I see far too active trading (even when a manager might own great companies), or a lack of concern about debt and credit quality. If you own a basket of outstanding companies with a long runway for growth, at Nintai we feel this tackles several issues.

Watch Out Below

As mentioned earlier, one clear advantage of focusing on value and quality is the protection it provides on the downside. I wrote several years ago about how the highest quality stocks in our portfolios had performed the best during the 2007 - 2009 market crash. I firmly believe we will see similar movement when (and remember it’s not if – but when) the next crash happens. After an 11 year old bull market, I think the downside protection is worth even more. As a fiduciary steward, there is nothing more important than focusing on preventing the permanent impairment of my investment partner’s capital. I firmly believe a focus on quality and value is one of the more powerful tools in my arsenal to prevent such losses.

Let Management Do the Heavy Lifting

It’s been demonstrated many, many times that just a few items can severely damage investment returns over the long term. Under the broad category of “costs”, lie both transactional fees and taxes. One of the real benefits investing in a high quality stock at good value is the ability to hold it for the long term - meaning decades sometimes. This cuts down on transactional costs as well as any short or long-term capital gains. Why not let management allocate capital and do all the hard work when it comes value creation?

Finding Quality is a Difficult Task

While it may seem like a simple concept, finding quality at a value price is actually a rare and difficult thing to find in today’s market. Utilizing just Nintai’s quality measures (and not worrying about value pricing) leaves our team with less than 200 companies in the US and European markets. In addition, the company has to be in an industry, geography, business strategy, etc. that leads us to think we might be able to obtain a small knowledge-based competitive advantage against other investors. When we find a gem that meets all this criteria, at Nintai we are loathe to let them go.

Conclusions

As the latest bull market gets long in the tooth (and it’s narwhal long!), at Nintai we increasingly focus on the downside risk of the markets. We’ve found over time that two approaches serve us well in the latter stages of a bull market and for the duration of a bear market – hold significant cash and focus on quality. The (relatively) simple process of identifying outstanding companies with high returns and rock solid financials and purchasing those at fair value-based prices can cut down on risk dramatically. At Nintai, we highly recommend investors take a long hard look at their portfolios and look for companies and management that they can partner with over the decade or two. It’s hard to find ways to argue with Munger and Graham simultaneously. With a record like theirs, why even try?

RSS Feed

RSS Feed