Looking at these returns, it wouldn’t be unreasonable to ask, “Have we lost our touch?” Is Nintai’s methodology somehow flawed? Indeed, after watching the performance of the last three years, our (and perhaps our investment partners’) confidence has been shaken. You wouldn’t be human if you weren’t.

But there are some logical explanations for the underperformance. To be clear, we are not making excuses. The last three years’ returns are awful. There’s no other way to describe them. That said, two themes have driven Nintai’s returns since 2021 – return sequencing and market cap performance.

Return Sequences

Traditionally, the definition for return sequences is “the danger that the timing of withdrawals from a retirement account will hurt the overall rate of return available to the investor.” In plain English, timing matters greatly when moving from a net investor to a net withdrawer of one’s investment portfolio. For instance, if someone invests during a bull market but starts withdrawing during a bear market, the chances they will run out of money sooner than later is relatively high. Conversely, those who invest in a bear market but start withdrawing in a bull market will likely do just fine.

We have seen a form of return sequencing with the Nintai portfolios. While the returns for the portfolio were excellent in the first four years, the total assets under management (AUM) were relatively small. Conversely, though the portfolio has only had two down years over the past seven years (though only invested for four months, the portfolio outperformed in 2017 as well), those two years were after the portfolio had significantly increased its AUM. In other words, we outperformed at precisely the wrong time. Over the past three years, generating outsized returns would have been far more profitable than the first four years. This is driven by the size of our assets under management at certain times—a classic example of return sequencing.

What can be done to offset the effects of return sequencing? The short answer is not much. The more robust answer is allowing time with a steady amount of assets under management to reduce its impact. The reason for the outsized impact of return sequencing in the Nintai portfolios is based on both a.) a short reporting time and b.) a massive increase in funds under management in that short period. Or, as the classic adage goes, only time will tell. Our investment approach and long-term time horizon will determine the difference between the pre-growth and the post-2021 returns.

Portfolio Holding Market Caps: Mid-Cap and Getting Smaller

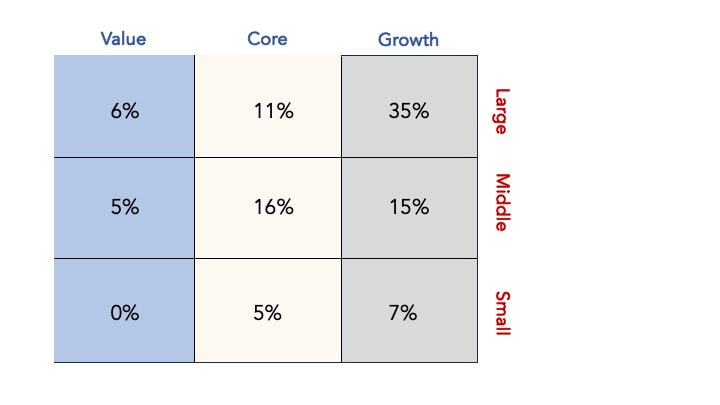

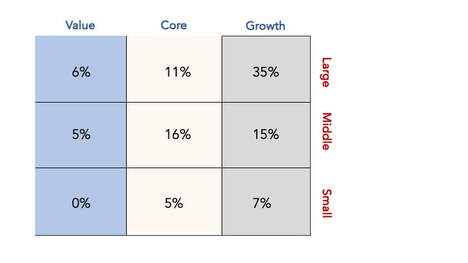

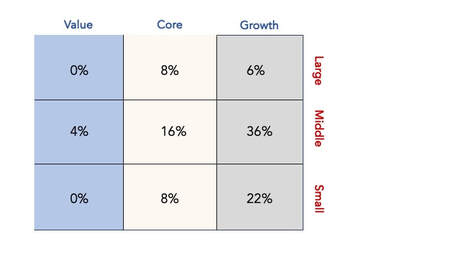

As I mentioned, the Nintai portfolios have gotten smaller in market cap since their inception in 2017. In its first full year (2018), the portfolio comprised 52% large-cap, 36% mid-cap, and 12% small-cap stocks.

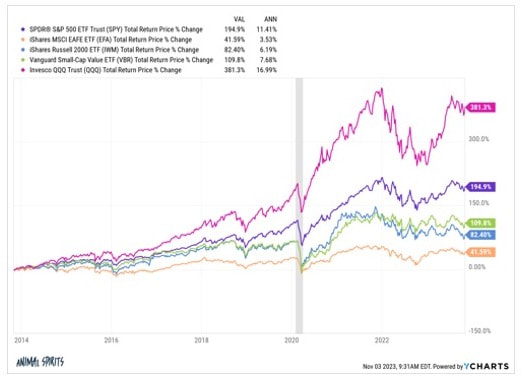

As I mentioned at the beginning of this document, our interest lies in better understanding the dichotomy of our early returns versus our later returns. The two issues of return sequencing based on AUM size and the movement to small and mid-cap stocks explain some differences in returns versus the S&P 500 Index. I want to be clear that these are not excuses for the portfolio underperforming that proxy (but conversely outperforming its closest one - the Russell Mid-Cap Growth index). They are interesting facts to understand better why the underperformance has occurred. Indeed, our investment in New Oriental Education (EDU) had a more significant impact than the concepts discussed here. At Nintai, we think it’s vital that we explore both the winning and losing trends in our portfolio performance. I’ve pointed out many times that to outperform in the long term, it is a necessary fact you must underperform for some shorter periods. It’s unpleasant, but it's essential to learn from these down periods to minimize their breadth and depth in the future.

As always, we thank you for your continued support of Nintai Investments. Please let us know if you have any questions or comments.

RSS Feed

RSS Feed