- John Thurman

In last week’s article we discussed the role of risk and uncertainty in value investing. More particularly, we focused on the how we make the distinction between the two during our valuation process. In the article we discussed there were two critical questions to ask about risk and uncertainty.

1. How do we assign and quantify a proper amount of risk to these situations and;

2. How do we mitigate that risk through price and value?

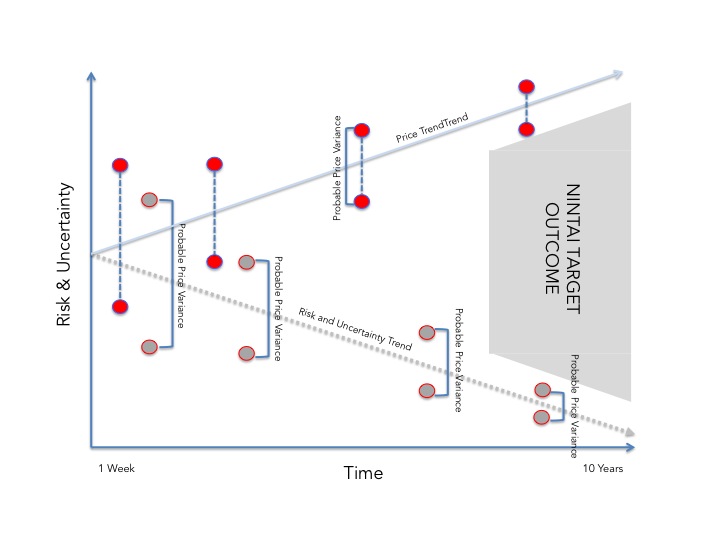

In this article I wanted to discuss the second question. At Nintai we see this as a core value in our investment strategy. Time and price must be our allies as we are simply not smart enough to calculate the short-term volatility of the markets and individual stock prices. We use a graphic to demonstrate our thinking when we explain this to our investors.

There is of course one key variable missing from this diagram – value. Meaning that if you overpay the price trend line isn’t guaranteed to move upwards. Graham clearly understood this when he wrote:

“A loss of value which either is realized through actual sale, or is caused by a significant deterioration in the company’s position – or, more frequently perhaps, is the result of the payment of an excessive price in relation to the intrinsic worth of the security.”

Overpaying means the price trend may be flat to negative regardless of time. In our models the starting price on the left axis can move up or down. Dependent on the slopes of trend lines we might take a closer look at a potential investment.

One of the dangers of a nifty graphic like this is that investors believe we can create a relatively accurate risk/reward model for each potential investment. Let me be very clear: we cannot do this in any way, shape or form. When working with a graphic we believe there are three (3) key caveats investors – and the Nintai team – must constantly bear in mind.

We Have No Idea About Future Risk and Uncertainty…….

The simple fact is we really don't know what future risk and uncertainty will be for our investments. John Maynard Keyne’s once wrote “there is little likelihood of our discovering a method of recognizing particular probabilities, without any assistance whatever from intuition or direct judgment. A proposition is not probable because we think it so (my emphasis)”. Just because we think we can predict the future return of an investment – even as a series of probabilities – doesn't mean it will turn out anything like we plan or desire. That doesn't mean we stop investing. It simply means we do what we can with the tools we have to mitigate risk and uncertainty and set our expectations appropriately.

…….So We Will Most Certainly Underestimate Risk & Uncertainty

Wall Street has always felt it has a better understanding of risk and uncertainty than it really does. Theories such as Efficient Market Hypothesis (EMH), Sharpe Ratios, Beta, Capital Asset Pricing Models (CAPM), and Modern Portfolio Theory (MPT) make investment risk management resemble a measurable science. The reality is quite different. During the 2008 global crisis there were an estimated 15-20 ten-sigma events (meaning according to Gaussian distribution there is an extraordinarily small chance of one – let alone 15-20 events – happening[1]). So what happened? How did everyone get it so wrong? The simple fact is we simply underestimated the risk. Accordingly we also mispriced the risk which led to truly disastrous investment and policy decisions. At Nintai we realize we will always underestimate both risk and uncertainty. Hence our focus on time and price as mitigators of our errors.

Bad Valuations and Pricing Can Overwhelm Time

During times of nearly daily market highs we find that we must fight against what Howard Marks refers to as FOMO (Fear Of Missing Out) risk. It’s extraordinarily difficult to sit on the sidelines and watch stocks to continue to rise. At Nintai we find ourselves facing this situation as we write. During these times we try to focus on finding great companies that meet our investment criteria, take a deep breath, and wait for the right price. We do this because we know – and this with some certainty! – it is nearly impossible to overcome paying too much for a company’s shares. Almost no time horizon can mitigate risk when an investor overpays. Just ask individuals who purchased Cisco in January, 2000. Price is the spring - which when wound up tight (meaning price and value are compressed) - can help provide the extraordinary long returns we all want in the portfolio.

Conclusions

The future is unknowable. But that doesn't prevent us from purchasing company shares at a discount to fair value, with a competitive moat, high profitability, and rock solid financials. We invest in companies like these for the long term. Time and price can be the foundation not only for reduction of risk but also long-term investment returns. We believe our investment partners have been rewarded handsomely when Nintai measures a potential investment with risk, uncertainty, price, and time in mind. In today’s market we think it’s even more important to evaluate stocks within this framework.

[1] In 2008 there was even a 23 sigma event in the commercial real estate credit default swap market. As one writer put it “it is roughly equivalent to your to your odds of being hit by lightening at 3:02PM tomorrow while you are sitting in your office chair on the 43rd floor of an office building – through the glass”.

RSS Feed

RSS Feed