1. How do we assign and quantify a proper amount of risk to these situations and;

2. How do we mitigate that risk through price and value?

In this week's article, I thought it might be helpful to take a deeper dive as to how Nintai views the first question. Before we begin the process of answering these two questions, it would be wise to review the difference between risk and uncertainty. As quoted in my previous article, Nate Silver's The Signal and the Noise description is highly applicable to our situation today:

"Risk, as first articulated by the economist Frank H. Knight in 1921, is something that you can put a price on. Say that you’ll win a poker hand unless your opponent draws to an inside straight: the chances of that happening are exactly 1 chance in 11. This is risk. It is not pleasant when you take a “bad beat” in poker, but at least you know the odds of it and can account for it ahead of time. In the long run, you’ll make a profit from your opponents making desperate draws with insufficient odds. Uncertainty, on the other hand, is risk that is hard to measure. You might have some vague awareness of the demons lurking out there. You might even be acutely concerned about them. But you have no real idea how many of them there are or when they might strike. Your back-of-the-envelope estimate might be off by a factor of 100 or by a factor of 1,000; there is no good way to know. This is uncertainty. Risk greases the wheels of a free-market economy; uncertainty grinds them to a halt (my emphasis)."

We think this last sentence is particularly appropriate for today’s markets. We believe that both risk and uncertainty are going to impact the stock prices going forward. But if this is true then how do we prepare our portfolio against an impending storm?

Separating the Wheat and the Chaff

One of the most important distinctions one can make when beginning to understand a portfolio company’s downside potential is separating risk from uncertainty. At Nintai we do this with the following questions:

- Is the issue quantifiable? In this case can we say that a reduction in China’s growth from 8% to 5% would decrease our company’s revenue by X%?

- Is the linkage clear? In this instance we need to see a direct and measurable impact between the issue and our company. For instance, does the Greek default directly impact our corporate investment through debt restructuring, direct investments, and/or plants and operations?

- Can we quantify the parts? Each issue we see in our potential investment needs to be broken into component parts. These parts are then quantified and added to the mix. For issues such as the Chinese market meltdown there some parts of the issue that simply can't be made distinct (such as Xiao's commitment to market reform).

Risk and Uncertainty: Which Matters Most?

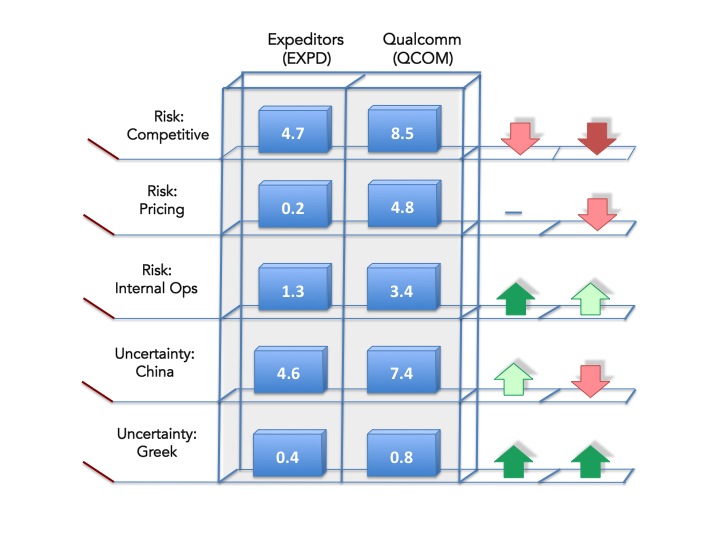

This is all well and good until it comes time to evaluate our uncertainties. Are they more or less important than our defined risks? What impact would/should they have on our potential investment’s value? There really isn't an exact answer to these questions. We’ve programmed Nintai’s Abacus evaluation tool to break out risk from uncertainty and weight uncertainties at roughly 125% of risk. We believe not being able to quantify or get a firm grip on an issue should make us less – rather than more – confident in our valuations. Seen below is a screenshot looking at Expeditors International (EXPD) and Qualcomm (QCOM) measuring several risk and uncertainty measures. (Note: these numbers are for raw evaluation only. They do not take into account the uncertainty percentage increases).

Only Half the Equation

Next week, we will discuss the key mitigators of risk and uncertainty: price and time. Without that context in the valuation process, these two categories are two islands standing alone and can play only a limited role. As we wrote in our previous article:

“When considering risk and uncertainty we propose that price and value are the great equalizers. Howard Marks (Trades, Portfolio) once wrote, “No asset class or investment has the birthright of a high [or low] return. It’s only attractive if it’s priced right”. Stocks with an enormous amount of uncertainty can be considered a reasonable investment opportunity if the price is sufficiently below intrinsic value. Conversely a company with very little uncertainty can be extraordinarily risky if purchased significantly above fair value. When thinking about these two factors, it is essential investors always place them in the context of value and price.

RSS Feed

RSS Feed