- John Maynatd Keynes

“Since other investors may be smart, well-informed and highly computerized, you must find an edge they don’t have. You must think of something they haven’t thought of, see things they miss or bring insight they don’t possess. You have to react differently and behave differently. In short, being right may be a necessary condition for investment success, but it won’t be sufficient. You must be more right than others…which by definition means your thinking has to be different.”

- Howard Marks

When I began investing nearly 30 years ago, it was pretty much accepted that the efficient market hypothesis (EMH) was the gospel of successful investing. If you went to any Barnes & Noble’s or Borders book store (how quaint!) or took a class in college on investing, you were likely to get the simple message that stated asset prices reflect all available information all the time. The implication being that it is impossible to outperform the market consistently on a risk-adjusted basis since market prices should only react to new information. Any outperformance could be explained away by luck, circumstance, or a random standard deviation event that could be washed out with time. Warren Buffett’s classic response to this theory was his “The Superinvestors of Graham-and-Doddsville” published in Columbia Business in May, 1984 . This article, along with additional research, has called into question the validity of the EMH school and its major claims.

Over time it has become apparent to many that long-term outperformance of the general markets is possible – regardless of claims by EMH proponents. Individuals have beaten a wide range of bogies – ranging from the domestic S&P500 to the overseas MSCI ACWI ex USA, large cap to small cap, growth versus value. Certainly Mr. Buffett’s classic article appears to have taken some the certainty of EMH and knocked it into a cocked hat.

As I’ve spent time reading, researching, and interviewing great value investors, I’ve found the vast majority have a tendency to see things differently. Whether it be Charlie Munger’s “invert….always invert” or Ben Graham’s classic “margin of safety”, every successful value investment manager has a tendency to have their own unique thought/evaluation process or valuation methodology.

In a recent article (“The Best Investment Advice I Ever Got”, December 31 2018) I discussed getting advice from a Board member that really made me think about my approach to value investing as well as capital allocation. Beyond the learnings I discussed in that article, one major concept was really driven home and that is the only way to overachieve (or underachieve as well!) the general markets is to think differently. For me, I’ve found that means approaching investing in several unique ways. The first is to think about quality and not quantity. I sleep better and am more comfortable investing in companies with outstanding quality measures. I’m simply to indolent and my circles of competence too small to try to understand how to turn a failing company around. The second is to think about how to approach allocating my time. There’s only so much of it, so I’d prefer to use my time in the most exciting and interesting investment opportunities as well as utilizing it in areas where I can be most effective. Sitting around and trying to find companies that are likely to fail and then betting against them I find both depressing from a moral standpoint and frankly I’m not very good at it. Last, is spending time thinking about how I think. By learning to approach things from a different angle, bringing additional data to the conversation, and creating models that generate different (and increasingly intriguing) questions, I find my outcomes are generally better in terms of performance and the role as a capital allocator far more interesting.

Similar to my last multi-volume articles of fundamental business analysis, I thought I’d spend some time working through the process of thinking differently – what it means, what are some processes, and what are some working examples. In this – the first of three – I thought I’d start by taking a look at one of the main drivers of how I think differently from more traditional value investors – focusing on quality over quantity.

Thinking About Quality….Not Quantity

In one of Warren Buffett’s many notable analogies, one of the more interesting to me has been the idea that an investor has a punch card with only 20 available punches (or investment opportunities). He describes the concept in the following manner: “I could improve your ultimate financial welfare by giving you a ticket with only twenty slots in it so that you had twenty punches - representing all the investments that you got to make in a lifetime. And once you'd punched through the card, you couldn't make any more investments at all. Under those rules, you'd really think carefully about what you did, and you'd be forced to load up on what you'd really thought about. So you'd do so much better."

Frankly, I don’t know many - if any - investment managers who have lived by such a strict regimen. One of the real advantages an individual investor has over professional managers is you can begin such a process as Buffett’s punch cards at any time over your investing career. Whether you are just starting out or have been at it for 25 years, honing your portfolio down to just 20 stocks can be a great exercise. No matter how you define quality – high returns on capital or equity, deep competitive moats, zero debt, etc. – as you hone your portfolio down, it will inevitably be very different than any major index.

As an example of this type of punch card focused, low turnover investing, I thought I’d take a look at some of the initial investments made in the early days at Nintai Partners’ internal investment portfolio (neither the company nor its investment portfolio exists anymore). With 20/20 hindsight, I’m surprised by the large percentage of holdings that remained in the portfolio for the entire lifetime of the firm. Of a total of 31 investments made from 2001-2002, roughly 55% were held until the firm closed in 2015.

Looking at the history of these holdings, roughly one-half of the investment portfolio (we generally held portfolios with 20-25 holdings) punch card had been punched within the first year or two of investing. In nearly everyone of these holdings, the investment was in a company that met our own “high-quality” definition: high returns on equity, assets, capital, little/no debt, significant competitive advantages (often a monopoly or duopoly), and managers who were outstanding capital allocators.

A Working Example

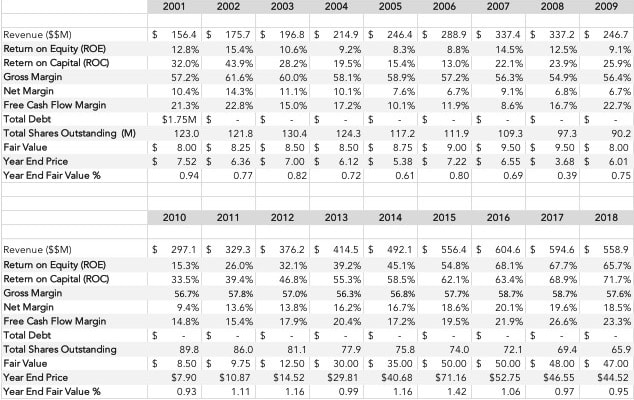

One of the companies that was an initial purchase in the Nintai Partners’ portfolio was Manhattan Associates (MANH). The company originally turned up in a research report we were generating for a supply management business. After the project was completed, we spent a great deal of time doing further research and made out first share purchase in July, 2001. We added to the position all the way though 2010 when the shares dropped significantly below our estimated intrinsic value. Seen below is a high-level summary analysis of the company and some key measures we looked at to assist in our investment decisions.

Revenue: With the exception of the Great Recession, MANH saw relatively steady growth from 2001 – 2015 growing revenue from $156M in 2001 to $556M in 2015.

Profitability: The company saw return on equity and return on capital expand from 12.8% and 32% in 2001 to 54.8% and 62.1% in 2015.

Fair Value: Nintai Partners’ estimated intrinsic value increased from $8.00 in 2001 to $50.00 in 2015. Share price increased from $7.52 in 2001 to $71.16 in 2015.

Shares Outstanding: While increasing ROC dramatically during the 2001-2015 time period, management purchased shares in large amounts decreasing outstanding shares from 123,000,000 in 2001 to 74,000,000 in 2015.

Balance Sheet Strength: The company had no debt starting in 2002 remaining debt free through 2015 and saw cash on the balance sheet increase from $104M in 2001 to $129M in 2015.

Free Cash Flow: Free cash flow increased from $33M in 2001 to $132M in 2015.

Conclusions

From 2001 until the closure of Nintai Partners in 2015, Manhattan Associates allowed Nintai’s management to steadily invest in a a high-quality company that simply got better over time. Management didn’t need to be looking for a portfolio replacement on an annual basis, they weren’t reading hundreds of annual reports, and they didn’t need to question whether there were better opportunities to allocate capital. Over the full time of Nintai’s investment, the company’s stock achieved an annual return of 21.7%

Once you find a company of extraordinary quality at a reasonable discount to your estimated intrinsic value, it makes sense to let management and time to do the heavy lifting when it comes to investment returns. Whether it be a jumbo cap (like Warren Buffet’s Coca Cola (KO) purchase or a much smaller company like Manhattan Associates, finding a high-quality company at a discount price – combined with the advantage of time – can make your long-term returns compelling.

In my next segment, I will discuss the concept of time and how it is greatly misunderstood in the investment process. Until then, I look forward to your thoughts and comments.

DISCLOSURE: Manhattan Associates is owned in several Nintai Investments LLC individual accounts.

RSS Feed

RSS Feed