Scott Simmons

As value investors you hear a lot about circle of competence. Warren Buffett speaks about not going beyond the limits of this circle. Tom Watson - IBM’s founder - said, “I’m no genius, but I’m smart in spots, and I stay around those spots”. At the Nintai Charitable Trust we certainly don’t count ourselves among the hallowed halls of genius, so we try to stick around our spots as well. But this really only tells half the story of our investment philosophy. We use a separate – but interlocking – circle we call the Circle of Comfort. This is a series of measures we use that allows us to sleep well at night. They mostly have to do with the quality of the business we invest in – balance sheet strength, management team, returns on equity/capital, etc. Let’s assume we didn’t sleep for one night, but rather we pulled a Rip Van Winkle and slept 15 years. My guess is our investment would be in the same business line but would be worth a great deal more than when we went to sleep.

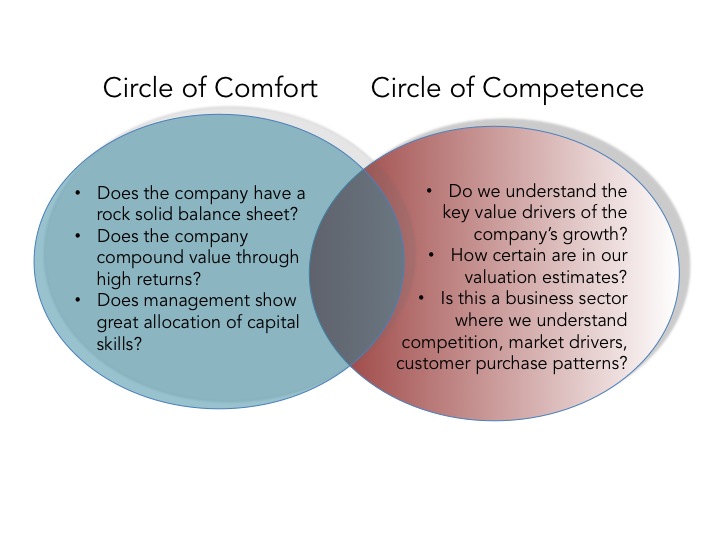

The Dual Circles

As shown in the graphic below we see our best opportunities in the overlap of our Circles of Comfort and Competence. This means we look for companies with the financial ability to withstand a tremendous series of shocks along with a business where we can identify and quantify where these might come from (such as regulatory changes to new competitive offerings). There aren’t that many companies that meet our criteria. Our screen (using Gurufocus’ All-In-One Screener) has a tendency to show roughly 140 companies the fit into our Circle of Comfort. From there we further whittle down the list by companies that reside in our Circle of Competence.

As we mentioned, our “comfort” screen on Gurufocus brings up about 140 companies. You can recreate this screen by entering in the following criteria:

- Cash to Debt: >100

- Debt to Equity: 0

- ROA 10 YR Median: >15%

- ROE 10 YR Median: >15%

- ROC 10 YR Median: >15%

An example of such a holding is Intuitive Surgical (ISRG). Relative to our Circle of Comfort, the company has 10 year averages of 30% ROC, 91% ROE, and 17% ROA. The company has no debt and $1.6B cash/short term instruments on the balance sheet. ISRG converts roughly 30% of revenue into free cash (generating $691M in free cash last year) and maintained 26% net margins over the past 5 years. In the past 3 years the company has reduced outstanding shares from 41.1M to 37.9M. Overall we are quite comfortable the company could handle any series of catastrophic events including product litigation, public policy changes, and/or a deep recession.

In regards to our circle of competence, we are quite comfortable in estimating market growth, adoption rates, and customer satisfaction within the robotic surgery space. With a pool of roughly 75 current ISRG clients we know and communicate with, we can maintain a deep understanding of key issues surrounding their product. Serving on several healthcare Boards also adds to our understanding of the space.

Conclusions

There are two models that guide my thinking at the Nintai Charitable Trust. The first is sleeping well at night by assuring I stay within my Circle of Comfort. This means finding compounding machines with rock solid balance sheets. Second is making sure I have deep knowledge of the industry in which the investment does business. This includes market drivers, competition, and public policy/regulatory issues. Through these I remain within my Circle of Competence. These models create a framework that assures I don't wander off into unsafe, unknown and unknowable investment traps. If that allows our Trust directors to sleep well at night and provide adequate returns we couldn't ask for any more.

RSS Feed

RSS Feed