Overconfidence can provide all of us with most discomfiting lessons. Indeed, smugness is an emotion that can be very expensive to investors in both the short and long-term. I bring this up because the Nintai Charitable Trust’s portfolio has achieved satisfactory returns over the past 12 months after a rather lackadaisical three-year performance. Much like our school teacher, we don’t think we should break out the champagne just yet.

The first quarter saw some dramatic movement leaving the markets trading at some its highest levels ever. What bear market? The Standard & Poor's 500TR was up by 2.0% and the Morningstar Total U.S. Equity Index was up 1.1%. The Nintai Charitable Trust Portfolio was up 6.3% net all fees. Several stocks have driven outperformance YTD. Dolby Labs (DLB) was up 32%, Fastenal (FAST) was up 17%, SEI Investments (SEIC) was up 14% and Terra Nitrogen (TNH) was up 16%. Several companies produced some drag during quarter including Ansys (ANSS) down 5%, Mastercard (MA) 3%, and Novo Nordisk (NVO) down 3%.

The following is the breakdown of annualized returns by one-year, three-year, five-years, ten-year periods and since inception.

As Dr. Paul Price pointed out in a recent article, the markets hit their low on February 11th, 2016. Since then, the market has acted like a sling shot with the SPY ETF up 11.5% since the low. I will be quite candid in saying that I have absolutely no idea of where the markets are headed. What I did know was there were some striking opportunities to pick up some wonderful companies on the Nintai Charitable Trust watch list. These included the following purchases made during the quarter.

BUY ARM Holdings (01/11/16: Average Share Price ARMH: $41.08)

ARM designs microprocessors, physical IP and related technology and software, and sells development tools to enhance the performance and energy-efficiency of high-volume embedded applications. ARM’s technology and patents are at the heart of processers used in nearly every mobile device. Its IP is assured through an interlocking set of patents that assure a competitive moat for an extended period of time. We think the worldwide growth of mobile devices and interconnectivity provides the company with a very long runway for profitable growth.

ARMH has generated an average ROE of 14%, FCF/Revenue of 36%, and net margins of 24% over the past five years. Management has generated a return on capital of 26% over the same period. The company currently has $113M in cash on the balance sheet with no short or long-term debt. ARMH generates roughly $500M in free cash annually and yields 0.9%.

BUY Checkpoint Software (01/08/16: Average Share Price CHKP: $77.21)

Check Point has been known as the leader in unified threat management (UTM) for the past 20 years. It has spent the last several years retooling its offerings to meet the SaaS model as well as new competitors. Its moat is considerable as it is extraordinarily difficult to swap out UTM security for a new vendor.

CHKP has generated an average ROE of 19%, FCF/Revenue of 59%, and net margins of 44% over the past five years. Management has generated a return on capital of 39% over the same period. The company currently has $258M in cash on the balance sheet with no short or long-term debt. CHKP generates roughly $930M in free cash annually and does not pay a dividend.

BUY SEI Investments (01/28/16: Average Share Price SEIC: $36.38)

SEI is one of the leaders in investment processing, investment management, and investment operations solutions. SEI provides these services for private banks, financial advisors, institutional managers, investment managers, and individuals and families

SEIC has generated an average ROE of 24%, FCF/Revenue of 23%, and net margins of 24% over the past five years. Management has generated a return on capital of 28% over the same period. The company currently has $680M in cash on the balance sheet with no short or long-term debt. SEIC generates roughly $318M in free cash annually and yields 1.1%.

BUY Visa (01/06/16: Average Share Price V: $72.88)

Much like our sister holding Mastercard (MA), Visa runs one of a duopoly-based closed network credit and debit card network. They currently have roughly 50% of all credit card transactions and 75% of all debit card transactions (along with extraordinary operational numbers). A wide moat indeed. We think the movement to credit based economies will provide Visa with a fantastic long-term growth story.

V has generated an average ROE of 16%, FCF/Revenue of 40%, and net margins of 38% over the past five years. Management has generated a return on capital of 42% over the same period. The company currently has $3.5B in cash on the balance sheet with no short or long-term debt. V generates roughly $6.2B in cash annually and yields 0.7%.

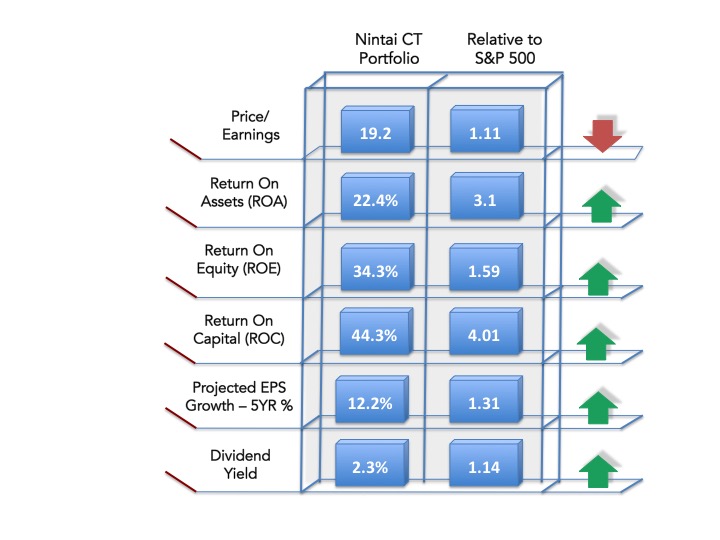

All of these changes have pushed the portfolio P/E to an abnormally high of 19.2 that exceeds the S&P 500 by roughly 11%. Other measures (as seen in our standard Abacus view) show on aggregate the portfolio has significantly higher returns on capital, equity, and assets. In addition, projected earnings growth is estimated to exceed the S&P 500 by roughly 31% and yields roughly 14% than the index. We believe these numbers will allow the portfolio to outperform the S&P 500 over the long term.

At the beginning of 2016, the Nintai Charitable Trust had roughly 7% of all AUM in cash. By the end of the first quarter this number had dropped to roughly 3%. The market swoon that began last summer and reached its nadir in February 2016 allowed the Trust to acquire shares in four (4) outstanding companies at a significant discount to my estimated intrinsic value. Over the past 12 months turnover in the portfolio reached nearly 75% on an annual basis. We expect a more normal environment of sloth and indolence to prevail with turnover expected to drop to a far more normal 5-10% over the next few years.

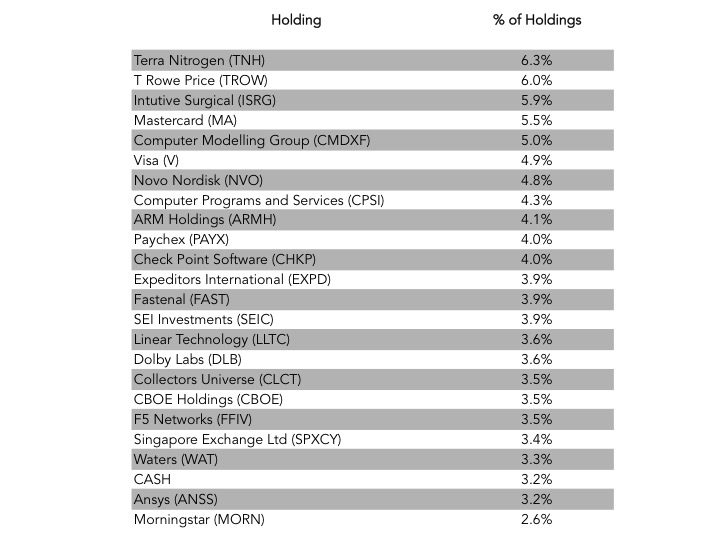

Nintai Charitable Trust Holdings, March 31st, 2016

RSS Feed

RSS Feed