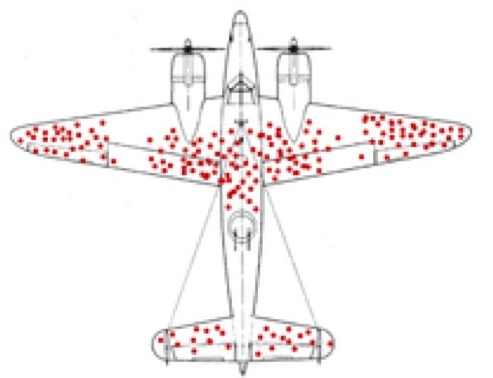

The study ascertained damage was centered on the mid-fuselage, outer wing tips, and the rear stabilizers. Since the damage patterns were so pronounced, the Air Force team’s recommendation was to reinforce these areas.

Wald took one look at this and told the team their work was deeply flawed. By studying the planes that came back the researchers were seeing where the planes could withstand damage. The more interesting facts should be about the planes that didn't make it back. By analyzing where all the bullets holes and damage were (on the wing tips, mid-fuselage, and rear stabilizers) on the planes that made it back, he proposed strengthening the areas where there were no bullet holes (mid-wing and rear fuselage). Through his report thousands of bomber crew members were saved through the course of the war. Wald’s work is often used in survivorship bias studies - meaning we focus too much on survivors when we should be looking more closely at those that don’t make it.

In my article, I used Wald’s research as a prelude to looking at survivorship bias in mutual funds. Investors many times get hooked on - like air force leadership - the winners in mutual funds, rather than the losers (or those who “don’t make it home” in Wald’s words). In the article I discussed inverting and understanding how many mutual funds survived and beat the S&P 500 index over time. The data demonstrate the incredibly poor performance investment managers displayed for the years 2007 - 2011. I wrote:

“Roughly 9 out 10 funds underperformed before they were either merged away or simply closed. A loss that would have staggered Wald himself. It’s hard to imagine that trained professionals - with a wealth of technology, analytics, and treasure behind them - couldn't exceed the batting average of an AA baseball team third stringer. In fact it’s hard to imagine that throwing darts at a list of stocks and bonds couldn't have produced better results. For the investors who received such terrible returns from their investment managers, all they received was a letter quietly delivered to their mailbox informing them of the merger of their fund with an entirely new – and no doubt exciting and outperforming – investment opportunity.”

I thought it might useful to take a look to see if anything had changed in the last decade and whether the findings in “Mutual Fund Survivorship” still hold up. Morningstar recently published its latest Active/Passive Barometer report which can provide answers[1].

Every month, Morningstar takes a look at both performance and survivability of active versus passive funds by fund category (e.g. large value, large growth, mid growth, etc.). They also report performance by management fee organized by decile. In August’s report Morningstar discussed their latest findings.

- Testing the theory that active funds can outperform passive funds during times of volatility, Morningstar measured all 20 fund categories performance (active and passive) for the first 6 months of 2020 including the period of the Corona virus market correction. Only 51% of active funds both outperformed and survived (or “made it home”) versus their passive cousin. Domestic funds actually did worse with just 48% outperforming.

- Active bond funds did worse than active stock funds with only 40% surviving and beating their respective index.

- Not surprisingly (in alignment with the “Mutual Fund Survivorship” article), long term performance was terrible. Only 24% were able to survive and beat their respective index over the 10 year period ending in 2020. Foreign stock, real estate, and bond funds (turning around their short term performance) were the best performers while US Large Cap were the worst performing.

- Another (non)-surprise was the fact that the cheapest funds had double the chance of surviving and beating their index versus the most expensive 34% to 16% respectively.

Taking a deeper dive into the data shows that sometimes the findings aren’t as simple as they appear. For instance, why is it that nearly every growth fund decreased performance by nearly 15% from 2019 – 2020? Yes, we know growth went out of fashion, but why? Here are some other complexities investors should consider as they think about survivability and performance.

Survivability is a Complex Problem with a Hybrid Solution

Having a fund merged away or closed is rarely due to a single issue. Many times it’s a combination of events. These include high costs versus both indexes as well as funds within their category (e.g. small growth), underperformance against both the S&P and other funds in their category, and a dwindling asset base. The answer to meeting these issues isn’t always easy. One and three are inextricably linked. If the fund lowers fees, then it might not maintain a level of profitability necessary to keep the fund going. But growing the asset base might require this if fund finds itself in a war against index pricing. The issue of performance is far trickier. The very choice of active management means the odds of beating the index has decreased versus an index fund (part of that of course is fees. Back to where we began!). The ability to pick stocks or bonds more successfully than an index fund – long term – is a very rare accomplishment.

Survivability and Performance Isn’t Just About Active versus Passive

With the data as they are, it’s easy to say that passive beats active. But that’s not the case every time. In both survivability and performance passive generally beats performance. It’s important to remember that outperformance can vary dramatically by fund category (small cap, mid cap, etc.), methodology (growth, value, or blended), geography (domestic versus international), equity versus bond, or even by industry (real estate). It’s far too easy to simply write off a fund because it’s actively managed. It’s vital investors spend time reviewing short- and long-term performance, fees, and the fund’s strategy. Some funds might outperform the market by 30% for one year but underperform by 15% over a five year period.

As Usual, Fees Greatly Affect Survivability and Performance

One thing that hasn’t changed and continues to be one of the top issues affecting performance and survivability is fees. The funds with the highest fees (both passive and active) had a survivability rate of only 27% of those with the lowest management fees. Those management teams that are both actively managing and charging the highest fees survived only 16% of the time period versus 47% of the passively managed funds with the lowest fees. Bottom line? If you think your active management team has any chance of long term success, at least make sure they have the lowest fee structures. Bottom line? Jack Bogle 1 - High fee actively managed funds – 0.

Conclusions

Since I published “Mutual Fund Survivorship” five years ago, not much has changed. We know active management generally is more expensive than passive and has a lower rate of survival. We also know the funds with the lowest management fees have better performance and longer survival than those with the highest fees. Actively managed funds with the highest fees have a pretty poor chance of “making it home”. As an active manager with a record of longer-term outperformance (remember: past performance is no guarantee of future returns!) we feel extraordinarily lucky to have investment partners who fully support our methods and strategy. Our goal of course is to provide them with long-term outperformance while maintaining a reasonable risk/reward profile. So far - with a generous amount of luck and some skill - we’ve been blessedly successful in these efforts. If we stick to our investment strategy, don’t wander too far from our circle of competence/comfort, and charge a reasonable fee, we can provide a real service to our partners. So far we seem to be on the right course.

As always we look forward to hearing from our readers. Tom can be reached at [email protected].

[1] “Morningstar’s Active/Passive Barometer”, August 2020, Ben Johnson CFA

RSS Feed

RSS Feed