- Robin Powell

In my article last month, I discussed how three things greatly impacted long-term investor returns. These were high versus low fees, active versus passive investing models, and complicated versus simple strategies. The next few articles are going to discuss each of these in greater detail and discuss why and how they impact returns to such a significant degree.

In today’s article, I will discuss the impact of high fees on investment returns (and inverting to show the positives of low-fee options). The good news is that fees have decreased dramatically over the last 30 years. According to the Investment Company Institute, over the past 26 years, average expense ratios of equity and bond mutual funds have declined substantially. The average expense ratio for equity mutual funds declined 58 percent from 1996 to 2022, and the average bond mutual fund expense ratio decreased 56 percent over the same period. The downside is that far too many investors still invest in products with far too high rates driven by high management fees and costs of extraordinary turnover rates. For instance, 9% of total US fund investors still invest in funds that charge a 12-b1 fee. These are fees paid out of the mutual fund or ETF assets to cover the costs of distribution – marketing and selling mutual fund shares – and sometimes to cover the costs of providing shareholder services. 12b-1 fees get their name from the SEC rule that authorizes a fund to charge them. They are considered noxious because they go toward costs, like marketing and distribution, that ultimately benefit the fund's managers, not its investors.

What Constitutes High versus Low Fees?

Investing in mutual funds can provide an extremely wide range of management fees. It’s hard to sometimes ascertain why some fund companies charge 0.74% for investment grade bond funds while another might charge 1.52%. It’s harder to understand with the amount of outstanding funds charging very little, why many investors will remain with a fund that both underperforms and overcharges. But I will get into that later.

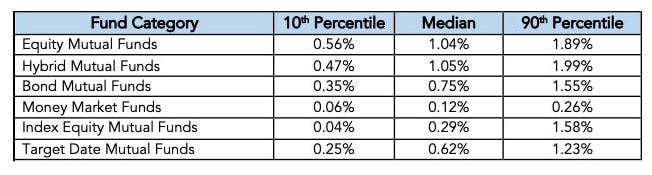

Generally, fund fees are divided into deciles (mean 1/10th or 10%) with the top 10% representing the lowest-charging funds and the 90th decile representing those charging the highest rates. A breakdown of major fund categories shows the difference between the highest and lowest fees charged.

A few things jump out at once. First, the difference between the 10th and 90th percentiles is dramatic. In particular, the difference in the index fund class is stunning. How an investment house can get away with charging a high actively-managed-like rate for following an index is hard to understand. The fact that an investor would put money into such a fund is even harder (if not near impossible) to understand. Second, it’s difficult to understand why bond funds should charge such rates (particularly in the 90th percentile) for managing bonds. The fees have a far greater impact on bond funds than equity funds due to the nature of each’s returns (meaning bond funds generally return less than equity funds over time).

The Impact of High Fees Over Low Fees

Funds with higher fees have several major consequences for an investor. The first, and most immediate and profound, is the reduction in total return. Every penny that is charged as part of a management fee or 12-b1 fee, comes directly from the investor’s returns. Fred Schwed once asked where all the customers’ yachts were, and if one had to take a stab at the question, it’s likely they went the way of management fees.

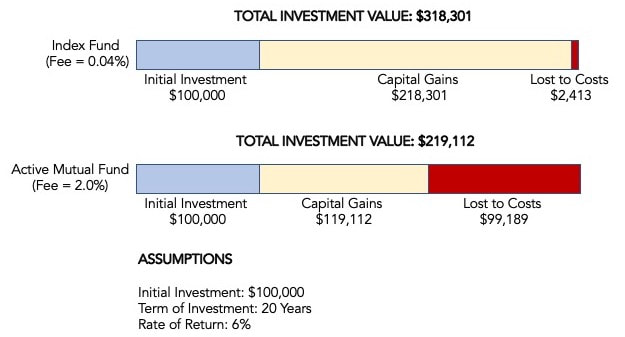

For a concrete example, let’s imagine Bill and Meghan Smith investing $100,000 in a low-cost index fund with a super-low management fee of 0.04%. Over twenty years, they earn a 6% return. After expenses, they are left with $318,301. They’ve paid a total of $2,413 to their investment company. That means they’ve kept the vast amount of their returns (here, the customer can buy a big yacht!). On the other hand, Bill and Meghan’s neighbors Rob and Cindy Owens, invested the same $100,000 in a high-fee active fund that charges 2.0% annually. After earning the exact same 6% in returns over the same twenty years, they find that after expenses, they only have $219,112, or nearly $100,000 less, than their dear friends. Here’s how it looks graphically.

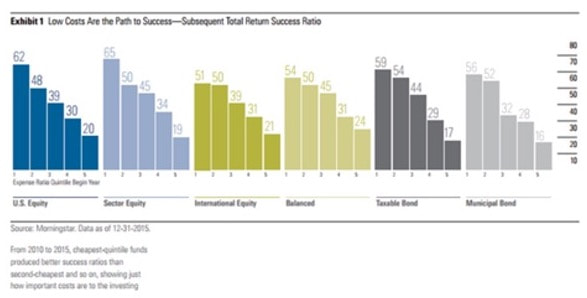

This underperformance caused by high fees impacts nearly every aspect of the investment universe. Morningstar frequently evaluates the impact of fees on investor returns and shows that the vast majority of investors see a significant portion of their returns eaten up by expenses. The underperformance becomes even more glaring when divided into quintiles of least expensive to most expensive. Here’s a graphic from Morningstar’s “Mind the Gap” annual review of investor returns versus fund returns. You can see from the data that the most expensive funds create enormous gaps in performance in nearly every major category, whether in equities, fixed income or allocation strategies.

Research has proven that higher fees generate two very specific results. First, higher fees generally don’t produce higher returns. In fact, the exact opposite is true. The same research has shown that the number one predictor of investment returns is the level of fees charged by management. The higher the fees, the greater the prediction of underperformance. Once again, Morningstar's research has proven this to be the case. Research in 2016 (and confirmed over the years) showed that funds with the highest fees generally produced the worst results. Here’s the data.

It’s hard to overstate the impact of high fees on investor returns. What seems like a small difference of half a percentage point can make the difference of a quarter of a million dollars over a twenty-year investment horizon. With so many outstanding options available to investors, such as low-cost index funds or even lower-cost actively managed funds, there aren’t many compelling reasons to overpay for investment services. If that doesn’t make for a compelling case, it should be pointed out that nearly all evidence points toward the fact that the higher the fee, the lower the performance. Next month’s article will examine the difference between active and passive investing and why the former is nearly always a losing bet.

As always, I look forward to your thoughts and comments.

DISCLOSURE: Nintai Investments has no positions in any stocks mentioned and has no plans to buy any new positions in the stocks mentioned within the next 72 hours.

RSS Feed

RSS Feed