- Eugene Fama

“The results of this study are not good news for investors who purchase actively managed mutual funds. No investment style generates positive abnormal returns over the 1965-1998 sample period. The sample includes 4,686 funds covering 26,564 fund-years."

- James L. Davis

Being an active investment manager in 2019 can make you feel like the salesperson trying to sell rotary phones in 1999. Each year the evidence piles up that active fund management cannot compete with passive (or index) investing over the long haul. One of the great tools to follow the performance gap between the two investment styles is the S&P Dow Jones Indices Annual SPIVA US Year-End Scorecard. In its sixteenth year of publication, the report is unique in that it compares apples to apples, takes into account survivorship bias, and reports equal and asset-weighted returns.

I think the report adds significantly to both individual investors’ as well as institutional investors’ knowledge. For individual investors, the data show how difficult it is to create an actively managed portfolio that can outperform an index-based approach over the long term. This is demonstrated clearly with outstanding data, great graphics, and down-to-earth descriptions of complex issues. For the institutional investor, the data break through some of the perceived notions and hardened views on why and how we (money managers) feel we will always be the exception to the rule. When I talk to my fellow institutional investors, I rarely hear about the fact that many haven’t beaten their respective index in 3, 5, 10, 15, and sometimes even 20 years. This industry has far too many underperforming managers making far too much money.

The 2018 annual report was published on March 11 2019[1] and it – as usual – has little good news for active managers. For the ninth consecutive year, the majority (65%) of large-cap funds underperformed the S&P 500. Small-cap equity managers also found 2018’s gains and draw-downs difficult to manage with a large majority (68%) lagging the S&P SmallCap 600. Diving deeper into market segmentation, small-cap value and small-cap core had an abysmal 2018 with 83% and 88% underperforming their respective categories. In both the large-cap and small-cap categories, the idea that market turbulence creates a “stock picker’s market” was simply washed away with shockingly widespread underperformance. In fact, compared with results from 2017, there was a 27% and 46% percentage point increase in the proportion of funds lagging the S&P 500 Growth and S&P SmallCap 600 Growth indices. Internationally things were no better. 96% (46 of 48!) of the S&P Global BMI’s 48 country markets declined. International and emerging market funds also struggled tremendously, with 77% of international funds lagging the S&P 700. The majority of emerging market managers failed to beat the S&P/IFCI Composite. As an example, even though the S&P Developed Ex-U.S. SmallCap index dropped over 18%, two-thirds (66%) of international small-cap funds failed to outperform their benchmark. With such results in “stock-pickers’ markets”, index funds have never looked better.

However, the report shows that not all was a washout in 2018. U.S. large-cap value broke its losing streak with roughly 54% of the managers in the category beating the S&P 500 Value. In a strange (and seemingly inexplicable) finding, 84% of actively managed mid-cap growth funds beat the S&P MidCap 400 Growth index for the second year in a row. Another strange result was from bond fund market. 83% of government long funds and 91% of investment-grade long funds outperformed over the one-year horizon in 2018. In a true case of inversion and the fact that past results are no guarantee of future returns, over 90% of both categories lagged over the three-year period.

That seems to be about as good as the news gets in this year’s report. Funds continued their long-term underperformance with every category having over 80% of active managers underperforming their benchmark in both 10 and 15-year time periods. The issue of survival continues to be a major issue. 57% of domestic equity funds, 49% of international equity funds, and 52% of all fixed income funds were merged or liquidated over the 15-year horizon. These numbers point out - with unusual clarity - the importance of correcting for survivorship bias.

What This All Means

The past 10 years have been very difficult stretch for active investment managers – whether they be value or growth, small or large-cap, foreign versus domestic. One of the mantras has been that long-term bull markets make everyone (and especially index funds) look like geniuses. We are told that once market volatility returns and stock prices began to wobble, then active managers will really begin to show their worth. The 2018 S&P Dow Jones Indices Annual SPIVA US Year-End Scorecard (along with other reports over the past 18-24 months) has knocked this theory into a cocked hat.

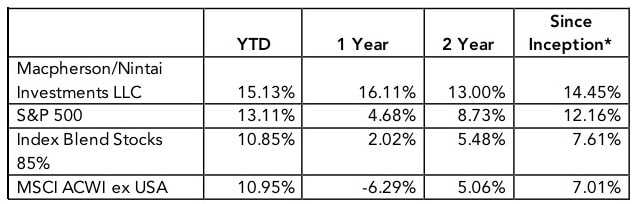

If the premise that volatility and draw-downs create the perfect opportunities for active fund managers is false, then where does this leave us? How do institutional and individual investors go about creating a portfolio that can successfully compete against their respective benchmarks? First, I should say I have a vested interest in this debate. As an active investment manager, I believe my short and long-term records show it is possible to beat the markets over time. Utilizing data from my time at Dorfman Value Investments and my new firm Nintai Investments LLC, a composite of my individual account returns looks like this:

*Macpherson DVI/Nintai Investments LLC Inception Date: September 2016

Macpherson DVI/Nintai Investments LLC returns reflect a blended management fee of 0.75% for Macpherson Nintai LLC and 1.5% for Dorfman Value Investments

***Previous performance is no guarantee of future returns***

Certainly a 2 ½ year time frame doesn’t offer a long-term perspective of my investment skills or abilities. Yet I think combined with my record from Nintai Partners (from 2002 - 2015), my outperformance of both the S&P500, the MSCI ACWI ex US, and an Index Blend show I have produced more than adequate returns for my investors over the years.

Second, I believe there are some core tenets that apply to active management that can assist managers to beat their respective benchmarks. These can be found in reports like the S&P Dow Jones Indices Annual SPIVA US Year-End Scorecard and other performance studies. There are three that I think are vital to achieving long-term outperformance.

Underperformance is Often Tied to Survivability

Whenever you are reading a fund prospectus or listening to a presentation by a fund family, ask them a very simple question: How many of their funds have been closed or merged away over the last decade? Have the returns of those funds been included separately in their total return numbers – or included? For instance, many fund companies will take Fund X - which had a terrible performance record over the last decade – and merge into Fund Y with a much better return and voilà! The company no longer has a good return (Fund Y) and a bad return (Fund X), but now a single good return (Fund Y only) and the disappearance of bad data (sayonara Fund X). Even better is reading the corporate PR announcing such a merger. You will hear management discussing “remarkable synergies”, “outstanding fund leadership”, and “exciting new opportunities”. Always remember: if management can try to fool their shareholders so easily, it isn’t long before they begin fooling themselves.

Turnover - Whether Portfolio or Managers - is Generally Bad

Nearly all turnover in the investment management business is an acknowledgment of an alternative outcome from the original plan. Some examples might be the investment thesis is broken/impaired, they partnered with the wrong management team, or they overpaid for the asset. I can’t think of many investment processes that are successful in the long-term that include high turnover as part of their strategy. Even in today’s investment world – where data is plentiful, easy to locate and even easier to utilize – turnover requires an enormous amount of effort to find investment opportunities, fully research the potential investment’s management, market, competition, product development, financials, etc. The US tax system penalizes investors for high turnover and the investment community preys on investors with every sort of fee that can be devised by mankind related to turnover. Finally, turnover robs an investor of the eighth wonder of the world – compounding. Every actively managed portfolio fight against these market characteristics on a regular basis.

Utilize a Tool Fund Managers Generally Can’t: Cash

If you look at almost any actively managed fund you will find cash is 5% of assets or less. As an investment manager you will often here the old adage “I don’t pay you to hold cash”. As an investment manager myself, I make it clear to my investment partners/clients that cash can range anywhere

from 5 - 30% of total assets under management. In fact, I believe my investors do pay me to hold cash sometimes simply to not overpay for new assets or to sell assets when they are grossly overvalued. As of March 2019, I hold between roughly 15 - 30% cash in my individually managed portfolios. Individual investors have the luxury of holding as much cash as the case deems appropriate.

Conclusions

The performance gap between actively managed portfolios and index-based investing continues to widen with time. It’s now 9 years since a majority of actively managed funds have outperformed index funds. The last several years show the gap growing, not shrinking. One of the last pillars in defense of actively-based investing (“we active managers will outperform when volatility rises and markets begin to oscillate”) has cracked and tottered in the last 6 months while markets swooned and returns dropped dramatically. For all the talk about how indexing has gotten too large and unwieldy, it’s important to realize that over two-thirds of invested dollars are still in actively managed funds. Until the large fund companies learn some new tricks, reports like the latest S&P Dow Jones Indices Annual SPIVA US Year-End Scorecard will continue to deliver grim news, and that’s not what any actively managed portfolio investor wants to hear.

As always I look forward to your thoughts and comments.

Disclosure: None

---------------------------------------------

[1] The actual report can be found here: https://bit.ly/2XZ8VVO. I highly recommend all investors read this report. The numbers provide real clarity on the chances of beating a generic index. Data like these – with years of outstanding insights – can provide investment managers and individual investors untainted information on the chances of outperforming their respective index. Such information can bring hard but necessary reality to investors of all stripes.

RSS Feed

RSS Feed